Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

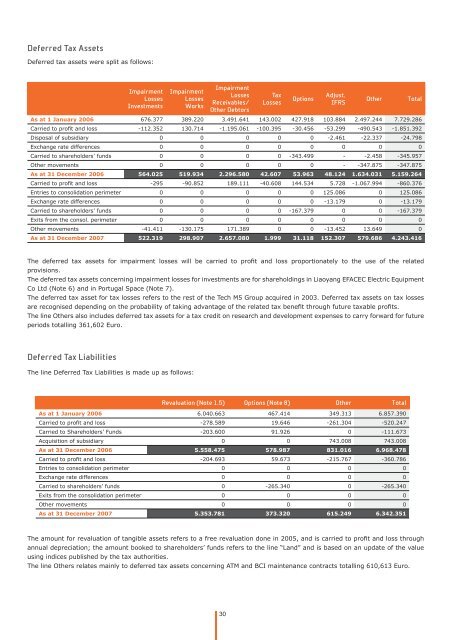

Deferred Tax Assets<br />

Deferred tax assets were split as follows:<br />

Impairment<br />

Losses<br />

Investments<br />

Impairment<br />

Losses<br />

Works<br />

Impairment<br />

Losses<br />

Receivables/<br />

O<strong>the</strong>r Deb<strong>to</strong>rs<br />

30<br />

Tax<br />

Losses<br />

Options<br />

Adjust.<br />

IFRS<br />

O<strong>the</strong>r Total<br />

As at 1 January 2006 676.377 389.220 3.491.641 143.002 427.918 103.884 2.497.244 7.729.286<br />

Carried <strong>to</strong> profi t and loss -112.352 130.714 -1.195.061 -100.395 -30.456 -53.299 -490.543 -1.851.392<br />

Disposal of subsidiary 0 0 0 0 0 -2.461 -22.337 -24.798<br />

Exchange rate differences 0 0 0 0 0 0 0 0<br />

Carried <strong>to</strong> shareholders’ funds 0 0 0 0 -343.499 - -2.458 -345.957<br />

O<strong>the</strong>r movements 0 0 0 0 0 - -347.875 -347.875<br />

As at 31 December 2006 564.025 519.934 2.296.580 42.607 53.963 48.124 1.634.031 5.159.264<br />

Carried <strong>to</strong> profi t and loss -295 -90.852 189.111 -40.608 144.534 5.728 -1.067.994 -860.376<br />

Entries <strong>to</strong> consolidation perimeter 0 0 0 0 0 125.086 0 125.086<br />

Exchange rate differences 0 0 0 0 0 -13.179 0 -13.179<br />

Carried <strong>to</strong> shareholders’ funds 0 0 0 0 -167.379 0 0 -167.379<br />

Exits from <strong>the</strong> consol. perimeter 0 0 0 0 0 0 0 0<br />

O<strong>the</strong>r movements -41.411 -130.175 171.389 0 0 -13.452 13.649 0<br />

As at 31 December 2007 522.319 298.907 2.657.080 1.999 31.118 152.307 579.686 4.243.416<br />

The deferred tax assets for impairment losses will be carried <strong>to</strong> profi t and loss proportionately <strong>to</strong> <strong>the</strong> use of <strong>the</strong> related<br />

provisions.<br />

The deferred tax assets concerning impairment losses for investments are for shareholdings in Liaoyang EFACEC Electric Equipment<br />

Co Ltd (Note 6) and in Portugal Space (Note 7).<br />

The deferred tax asset for tax losses refers <strong>to</strong> <strong>the</strong> rest of <strong>the</strong> Tech M5 Group acquired in 2003. Deferred tax assets on tax losses<br />

are recognised depending on <strong>the</strong> probability of taking advantage of <strong>the</strong> related tax benefi t through future taxable profi ts.<br />

The line O<strong>the</strong>rs also includes deferred tax assets for a tax credit on research and development expenses <strong>to</strong> carry forward for future<br />

periods <strong>to</strong>talling 361,602 Euro.<br />

Deferred Tax Liabilities<br />

The line Deferred Tax Liabilities is made up as follows:<br />

Revaluation (Note 1.5) Options (Note 8) O<strong>the</strong>r Total<br />

As at 1 January 2006 6.040.663 467.414 349.313 6.857.390<br />

Carried <strong>to</strong> profi t and loss -278.589 19.646 -261.304 -520.247<br />

Carried <strong>to</strong> Shareholders’ Funds -203.600 91.926 0 -111.673<br />

Acquisition of subsidiary 0 0 743.008 743.008<br />

As at 31 December 2006 5.558.475 578.987 831.016 6.968.478<br />

Carried <strong>to</strong> profi t and loss -204.693 59.673 -215.767 -360.786<br />

Entries <strong>to</strong> consolidation perimeter 0 0 0 0<br />

Exchange rate differences 0 0 0 0<br />

Carried <strong>to</strong> shareholders’ funds 0 -265.340 0 -265.340<br />

Exits from <strong>the</strong> consolidation perimeter 0 0 0 0<br />

O<strong>the</strong>r movements 0 0 0 0<br />

As at 31 December 2007 5.353.781 373.320 615.249 6.342.351<br />

The amount for revaluation of tangible assets refers <strong>to</strong> a free revaluation done in 2005, and is carried <strong>to</strong> profi t and loss through<br />

annual depreciation; <strong>the</strong> amount booked <strong>to</strong> shareholders’ funds refers <strong>to</strong> <strong>the</strong> line “Land” and is based on an update of <strong>the</strong> value<br />

using indices published by <strong>the</strong> tax authorities.<br />

The line O<strong>the</strong>rs relates mainly <strong>to</strong> deferred tax assets concerning ATM and BCI maintenance contracts <strong>to</strong>talling 610,613 Euro.