Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Statistically, as of that date, this rate meant an annual gross cost of 3,206 thousand Euro.<br />

If <strong>the</strong>re were a worsening of <strong>the</strong> overall average rate of 0.5%, <strong>the</strong> annual interest cost would be 3,961<br />

thousand Euro. If on <strong>the</strong> o<strong>the</strong>r hand <strong>the</strong>re were a drop in overall average interest rates of 0.5%, <strong>the</strong><br />

annual interest rate cost would be 3,215 thousand Euro. The gross impact would be +/- 373 thousand<br />

Euro.<br />

<strong>Efacec</strong> Capital Group manages <strong>the</strong> interest rate risk through derivatives contracted on its medium and long term fi nancing, thus<br />

enabling <strong>the</strong> impact of interest changes <strong>to</strong> be mitigated (Note 5).<br />

Denomination of Loans<br />

The accounting value of Group loans is entirely denominated in Euro.<br />

Unused Credit Lines<br />

The Group also has <strong>the</strong> following credit lines that have not yet been used:<br />

2007 2006<br />

At variable rates<br />

Due within one year 15.155.000 12.128.000<br />

Due after 1 year 12.500.000 0<br />

27.655.000 12.128.000<br />

Those credit lines falling due within one year are au<strong>to</strong>matically renewed for <strong>the</strong> consolidation of <strong>the</strong> fi nancial liabilities of <strong>the</strong><br />

Group.<br />

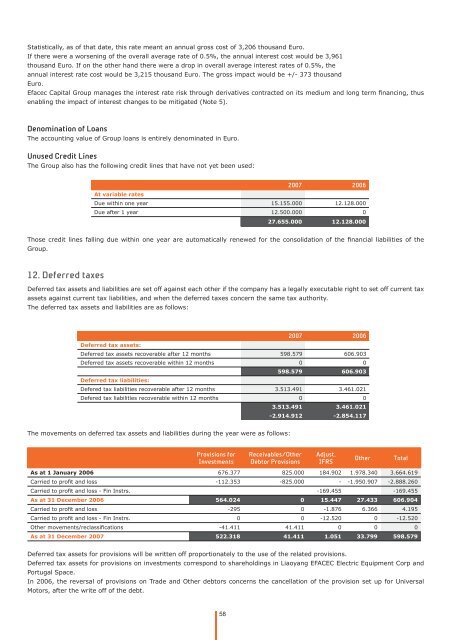

12. Deferred taxes<br />

Deferred tax assets and liabilities are set off against each o<strong>the</strong>r if <strong>the</strong> company has a legally executable right <strong>to</strong> set off current tax<br />

assets against current tax liabilities, and when <strong>the</strong> deferred taxes concern <strong>the</strong> same tax authority.<br />

The deferred tax assets and liabilities are as follows:<br />

2007 2006<br />

Deferred tax assets:<br />

Deferred tax assets recoverable after 12 months 598.579 606.903<br />

Deferred tax assets recoverable within 12 months 0 0<br />

Deferred tax liabilities:<br />

598.579 606.903<br />

Defered tax liabilities recoverable after 12 months 3.513.491 3.461.021<br />

Defered tax liabilities recoverable within 12 months 0 0<br />

3.513.491 3.461.021<br />

-2.914.912 -2.854.117<br />

The movements on deferred tax assets and liabilities during <strong>the</strong> year were as follows:<br />

Provisions for<br />

Investments<br />

58<br />

Receivables/O<strong>the</strong>r<br />

Deb<strong>to</strong>r Provisions<br />

Adjust.<br />

IFRS<br />

O<strong>the</strong>r Total<br />

As at 1 January 2006 676.377 825.000 184.902 1.978.340 3.664.619<br />

Carried <strong>to</strong> profi t and loss -112.353 -825.000 - -1.950.907 -2.888.260<br />

Carried <strong>to</strong> profi t and loss - Fin Instrs. -169.455 -169.455<br />

As at 31 December 2006 564.024 0 15.447 27.433 606.904<br />

Carried <strong>to</strong> profi t and loss -295 0 -1.876 6.366 4.195<br />

Carried <strong>to</strong> profi t and loss - Fin Instrs. 0 0 -12.520 0 -12.520<br />

O<strong>the</strong>r movements/reclassifi cations -41.411 41.411 0 0 0<br />

As at 31 December 2007 522.318 41.411 1.051 33.799 598.579<br />

Deferred tax assets for provisions will be written off proportionately <strong>to</strong> <strong>the</strong> use of <strong>the</strong> related provisions.<br />

Deferred tax assets for provisions on investments correspond <strong>to</strong> shareholdings in Liaoyang EFACEC Electric Equipment Corp and<br />

Portugal Space.<br />

In 2006, <strong>the</strong> reversal of provisions on Trade and O<strong>the</strong>r deb<strong>to</strong>rs concerns <strong>the</strong> cancellation of <strong>the</strong> provision set up for Universal<br />

Mo<strong>to</strong>rs, after <strong>the</strong> write off of <strong>the</strong> debt.