Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

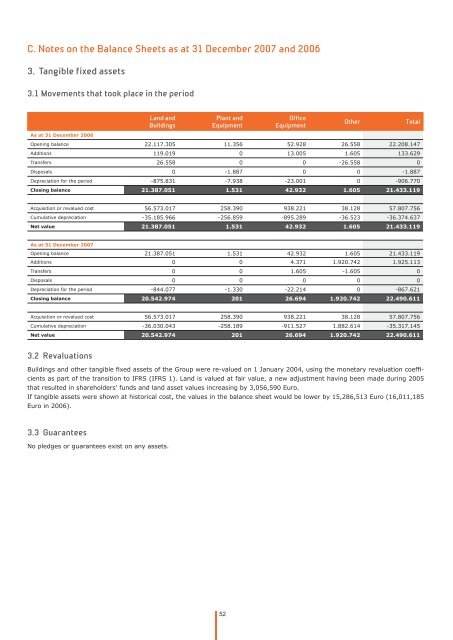

C. <strong>Notes</strong> on <strong>the</strong> Balance Sheets as at 31 December 2007 and 2006<br />

3. Tangible fixed assets<br />

3.1 Movements that <strong>to</strong>ok place in <strong>the</strong> period<br />

As at 31 December 2006<br />

Land and<br />

Buildings<br />

Plant and<br />

Equipment<br />

52<br />

Office<br />

Equipment<br />

O<strong>the</strong>r Total<br />

Opening balance 22.117.305 11.356 52.928 26.558 22.208.147<br />

Additions 119.019 0 13.005 1.605 133.629<br />

Transfers 26.558 0 0 -26.558 0<br />

Disposals 0 -1.887 0 0 -1.887<br />

Depreciation for <strong>the</strong> period -875.831 -7.938 -23.001 0 -906.770<br />

Closing balance 21.387.051 1.531 42.932 1.605 21.433.119<br />

Acquisition or revalued cost 56.573.017 258.390 938.221 38.128 57.807.756<br />

Cumulative depreciation -35.185.966 -256.859 -895.289 -36.523 -36.374.637<br />

Net value 21.387.051 1.531 42.932 1.605 21.433.119<br />

As at 31 December 2007<br />

Opening balance 21.387.051 1.531 42.932 1.605 21.433.119<br />

Additions 0 0 4.371 1.920.742 1.925.113<br />

Transfers 0 0 1.605 -1.605 0<br />

Disposals 0 0 0 0 0<br />

Depreciation for <strong>the</strong> period -844.077 -1.330 -22.214 0 -867.621<br />

Closing balance 20.542.974<br />

767<br />

201 26.694 1.920.742 22.490.611<br />

Acquisition or revalued cost 56.573.017 258.390 938.221 38.128 57.807.756<br />

Cumulative depreciation -36.030.043 -258.189 -911.527 1.882.614 -35.317.145<br />

Net value 20.542.974 201 26.694 1.920.742 22.490.611<br />

3.2 Revaluations<br />

Buildings and o<strong>the</strong>r tangible fi xed assets of <strong>the</strong> Group were re-valued on 1 January 2004, using <strong>the</strong> monetary revaluation coeffi -<br />

cients as part of <strong>the</strong> transition <strong>to</strong> IFRS (IFRS 1). Land is valued at fair value, a new adjustment having been made during 2005<br />

that resulted in shareholders’ funds and land asset values increasing by 3,056,590 Euro.<br />

If tangible assets were shown at his<strong>to</strong>rical cost, <strong>the</strong> values in <strong>the</strong> balance sheet would be lower by 15,286,513 Euro (16,011,185<br />

Euro in 2006).<br />

3.3 Guarantees<br />

No pledges or guarantees exist on any assets.