Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

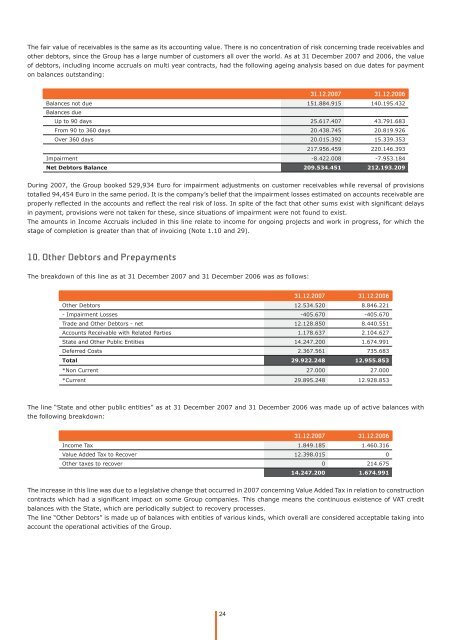

The fair value of receivables is <strong>the</strong> same as its accounting value. There is no concentration of risk concerning trade receivables and<br />

o<strong>the</strong>r deb<strong>to</strong>rs, since <strong>the</strong> Group has a large number of cus<strong>to</strong>mers all over <strong>the</strong> world. As at 31 December 2007 and 2006, <strong>the</strong> value<br />

of deb<strong>to</strong>rs, including income accruals on multi year contracts, had <strong>the</strong> following ageing analysis based on due dates for payment<br />

on balances outstanding:<br />

31.12.2007 31.12.2006<br />

Balances not due<br />

Balances due<br />

151.884.915 140.195.432<br />

Up <strong>to</strong> 90 days 25.617.407 43.791.683<br />

From 90 <strong>to</strong> 360 days 20.438.745 20.819.926<br />

Over 360 days 20.015.392 15.339.353<br />

217.956.459 220.146.393<br />

Impairment -8.422.008 -7.953.184<br />

Net Deb<strong>to</strong>rs Balance 209.534.451 212.193.209<br />

During 2007, <strong>the</strong> Group booked 529,934 Euro for impairment adjustments on cus<strong>to</strong>mer receivables while reversal of provisions<br />

<strong>to</strong>talled 94,454 Euro in <strong>the</strong> same period. It is <strong>the</strong> company’s belief that <strong>the</strong> impairment losses estimated on accounts receivable are<br />

properly refl ected in <strong>the</strong> accounts and refl ect <strong>the</strong> real risk of loss. In spite of <strong>the</strong> fact that o<strong>the</strong>r sums exist with signifi cant delays<br />

in payment, provisions were not taken for <strong>the</strong>se, since situations of impairment were not found <strong>to</strong> exist.<br />

The amounts in Income Accruals included in this line relate <strong>to</strong> income for ongoing projects and work in progress, for which <strong>the</strong><br />

stage of completion is greater than that of invoicing (Note 1.10 and 29).<br />

10. O<strong>the</strong>r Deb<strong>to</strong>rs and Prepayments<br />

The breakdown of this line as at 31 December 2007 and 31 December 2006 was as follows:<br />

31.12.2007 31.12.2006<br />

O<strong>the</strong>r Deb<strong>to</strong>rs 12.534.520 8.846.221<br />

- Impairment Losses -405.670 -405.670<br />

Trade and O<strong>the</strong>r Deb<strong>to</strong>rs - net 12.128.850 8.440.551<br />

Accounts Receivable with Related Parties 1.178.637 2.104.627<br />

State and O<strong>the</strong>r Public Entities 14.247.200 1.674.991<br />

Deferred Costs 2.367.561 735.683<br />

Total 29.922.248 12.955.853<br />

*Non Current 27.000 27.000<br />

*Current 29.895.248 12.928.853<br />

The line “State and o<strong>the</strong>r public entities” as at 31 December 2007 and 31 December 2006 was made up of active balances with<br />

<strong>the</strong> following breakdown:<br />

31.12.2007 31.12.2006<br />

Income Tax 1.849.185 1.460.316<br />

Value Added Tax <strong>to</strong> Recover 12.398.015 0<br />

O<strong>the</strong>r taxes <strong>to</strong> recover 0 214.675<br />

24<br />

14.247.200 1.674.991<br />

The increase in this line was due <strong>to</strong> a legislative change that occurred in 2007 concerning Value Added Tax in relation <strong>to</strong> construction<br />

contracts which had a signifi cant impact on some Group companies. This change means <strong>the</strong> continuous existence of VAT credit<br />

balances with <strong>the</strong> State, which are periodically subject <strong>to</strong> recovery processes.<br />

The line “O<strong>the</strong>r Deb<strong>to</strong>rs” is made up of balances with entities of various kinds, which overall are considered acceptable taking in<strong>to</strong><br />

account <strong>the</strong> operational activities of <strong>the</strong> Group.