Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Notes to the Financial Statements - Efacec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

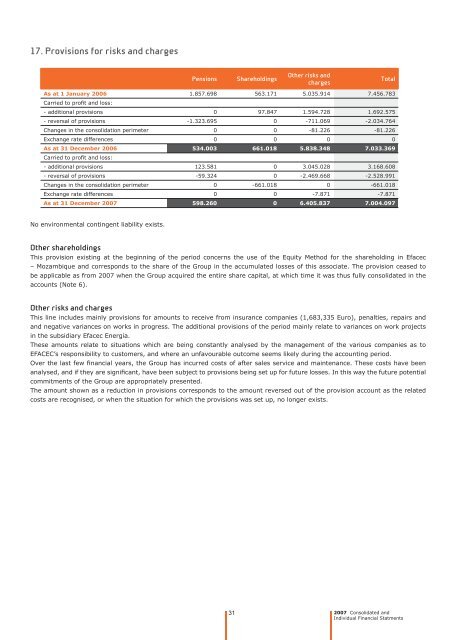

17. Provisions for risks and charges<br />

Pensions Shareholdings<br />

31<br />

O<strong>the</strong>r risks and<br />

charges<br />

As at 1 January 2006<br />

Carried <strong>to</strong> profi t and loss:<br />

1.857.698 563.171 5.035.914 7.456.783<br />

- additional provisions 0 97.847 1.594.728 1.692.575<br />

- reversal of provisions -1.323.695 0 -711.069 -2.034.764<br />

Changes in <strong>the</strong> consolidation perimeter 0 0 -81.226 -81.226<br />

Exchange rate differences 0 0 0 0<br />

As at 31 December 2006 534.003 661.018 5.838.348 7.033.369<br />

Carried <strong>to</strong> profi t and loss:<br />

- additional provisions 123.581 0 3.045.028 3.168.608<br />

- reversal of provisions -59.324 0 -2.469.668 -2.528.991<br />

Changes in <strong>the</strong> consolidation perimeter 0 -661.018 0 -661.018<br />

Exchange rate differences 0 0 -7.871 -7.871<br />

As at 31 December 2007 598.260 0 6.405.837 7.004.097<br />

No environmental contingent liability exists.<br />

O<strong>the</strong>r shareholdings<br />

This provision existing at <strong>the</strong> beginning of <strong>the</strong> period concerns <strong>the</strong> use of <strong>the</strong> Equity Method for <strong>the</strong> shareholding in <strong>Efacec</strong><br />

– Mozambique and corresponds <strong>to</strong> <strong>the</strong> share of <strong>the</strong> Group in <strong>the</strong> accumulated losses of this associate. The provision ceased <strong>to</strong><br />

be applicable as from 2007 when <strong>the</strong> Group acquired <strong>the</strong> entire share capital, at which time it was thus fully consolidated in <strong>the</strong><br />

accounts (Note 6).<br />

O<strong>the</strong>r risks and charges<br />

This line includes mainly provisions for amounts <strong>to</strong> receive from insurance companies (1,683,335 Euro), penalties, repairs and<br />

and negative variances on works in progress. The additional provisions of <strong>the</strong> period mainly relate <strong>to</strong> variances on work projects<br />

in <strong>the</strong> subsidiary <strong>Efacec</strong> Energia.<br />

These amounts relate <strong>to</strong> situations which are being constantly analysed by <strong>the</strong> management of <strong>the</strong> various companies as <strong>to</strong><br />

EFACEC’s responsibility <strong>to</strong> cus<strong>to</strong>mers, and where an unfavourable outcome seems likely during <strong>the</strong> accounting period.<br />

Over <strong>the</strong> last few fi nancial years, <strong>the</strong> Group has incurred costs of after sales service and maintenance. These costs have been<br />

analysed, and if <strong>the</strong>y are signifi cant, have been subject <strong>to</strong> provisions being set up for future losses. In this way <strong>the</strong> future potential<br />

commitments of <strong>the</strong> Group are appropriately presented.<br />

The amount shown as a reduction in provisions corresponds <strong>to</strong> <strong>the</strong> amount reversed out of <strong>the</strong> provision account as <strong>the</strong> related<br />

costs are recognised, or when <strong>the</strong> situation for which <strong>the</strong> provisions was set up, no longer exists.<br />

Total<br />

2007 Consolidated and<br />

Individual <strong>Financial</strong> Statments