Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

56<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

The <strong>Pharmaceuticals</strong> <strong>Sector</strong> produces most of the<br />

active ingredients needed for manufacturing the drugs<br />

in its portfolio.<br />

In the Plastics <strong>Sector</strong>, the situation differs between<br />

Specialties and Vinyls. The vinyl activities are largely<br />

integrated in terms of chlorine but not for the ethylene<br />

needed for producing PVC. Fluctuations in the price of<br />

ethylene affect the margins of this activity to a greater<br />

or lesser extent depending on the market situation<br />

and the possibility of passing on these fl uctuations in<br />

PVC sales prices. Specialties (Specialty Polymers and<br />

Inergy Automotive Systems), with their technology<br />

content and high added value, are less sensitive to<br />

raw materials prices. Fluorinated polymers enjoy a<br />

high degree of upstream integration, high performance<br />

polymers less so.<br />

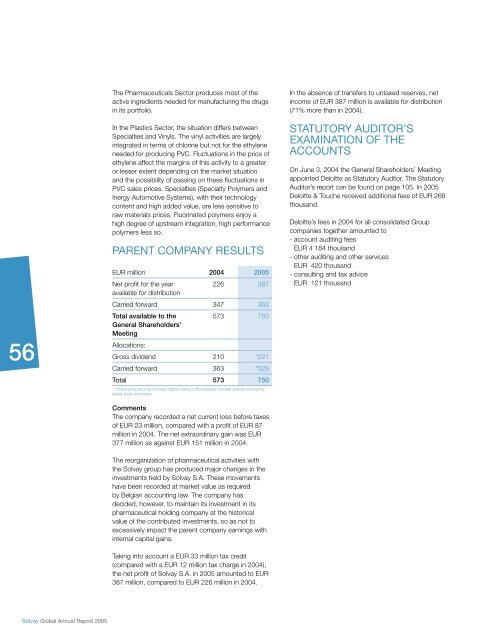

PARENT COMPANY RESULTS<br />

EUR million 2004 2005<br />

Net profi t for the year<br />

available for distribution<br />

226 387<br />

Carried forward 347 363<br />

Total available to the<br />

General Shareholders’<br />

Meeting<br />

573 750<br />

Allocations:<br />

Gross dividend 210 *221<br />

Carried forward 363 *529<br />

Total 573 750<br />

* These amounts may increase slightly owing to the exercise of share options covered by<br />

earlier share purchases.<br />

Comments<br />

The company recorded a net current loss before taxes<br />

of EUR 23 million, compared with a profi t of EUR 87<br />

million in 2004. The net extraordinary gain was EUR<br />

377 million as against EUR 151 million in 2004.<br />

The reorganization of pharmaceutical activities with<br />

the <strong>Solvay</strong> group has produced major changes in the<br />

investments held by <strong>Solvay</strong> S.A. These movements<br />

have been recorded at market value as required<br />

by Belgian accounting law. The company has<br />

decided, however, to maintain its investment in its<br />

pharmaceutical holding company at the historical<br />

value of the contributed investments, so as not to<br />

excessively impact the parent company earnings with<br />

internal capital gains.<br />

Taking into account a EUR 33 million tax credit<br />

(compared with a EUR 12 million tax charge in 2004),<br />

the net profi t of <strong>Solvay</strong> S.A. in 2005 amounted to EUR<br />

387 million, compared to EUR 226 million in 2004.<br />

In the absence of transfers to untaxed reserves, net<br />

income of EUR 387 million is available for distribution<br />

(71% more than in 2004).<br />

STATUTORY AUDITOR’S<br />

EXAMINATION OF THE<br />

ACCOUNTS<br />

On June 3, 2004 the General Shareholders’ Meeting<br />

appointed Deloitte as Statutory Auditor. The Statutory<br />

Auditor’s report can be found on page 105. In 2005<br />

Deloitte & Touche received additional fees of EUR 268<br />

thousand.<br />

Deloitte’s fees in 2004 for all consolidated Group<br />

companies together amounted to<br />

- account auditing fees<br />

EUR 4 184 thousand<br />

- other auditing and other services<br />

EUR 420 thousand<br />

- consulting and tax advice<br />

EUR 121 thousand

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)