Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

and the estimated fi nancial consequences of US and European legal proceedings relating to the respecting of<br />

competition rules in the peroxides area prior to 2001.<br />

The remaining expenses relate mainly to redundancy schemes and the miscellaneous costs of site restructurings<br />

and closures in Europe, the United States and Asia.<br />

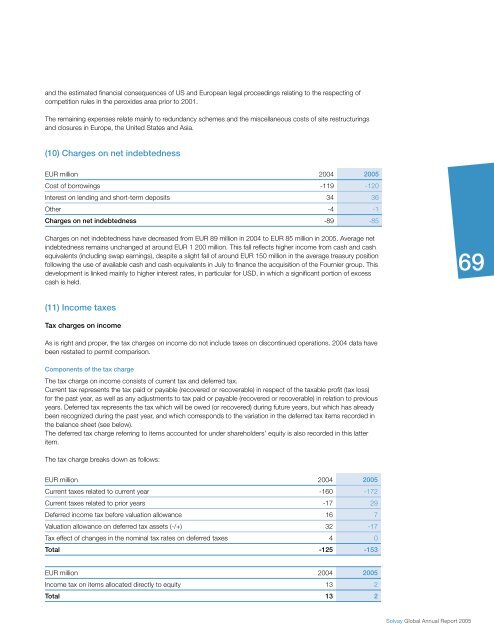

(10) Charges on net indebtedness<br />

EUR million 2004 2005<br />

Cost of borrowings -119 -120<br />

Interest on lending and short-term deposits 34 36<br />

Other -4 -1<br />

Charges on net indebtedness -89 -85<br />

Charges on net indebtedness have decreased from EUR 89 million in 2004 to EUR 85 million in 2005. Average net<br />

indebtedness remains unchanged at around EUR 1 200 million. This fall refl ects higher income from cash and cash<br />

equivalents (including swap earnings), despite a slight fall of around EUR 150 million in the average treasury position<br />

following the use of available cash and cash equivalents in July to fi nance the acquisition of the Fournier group. This<br />

development is linked mainly to higher interest rates, in particular for USD, in which a signifi cant portion of excess<br />

cash is held.<br />

(11) Income taxes<br />

Tax charges on income<br />

As is right and proper, the tax charges on income do not include taxes on discontinued operations. 2004 data have<br />

been restated to permit comparison.<br />

Components of the tax charge<br />

The tax charge on income consists of current tax and deferred tax.<br />

Current tax represents the tax paid or payable (recovered or recoverable) in respect of the taxable profi t (tax loss)<br />

for the past year, as well as any adjustments to tax paid or payable (recovered or recoverable) in relation to previous<br />

years. Deferred tax represents the tax which will be owed (or recovered) during future years, but which has already<br />

been recognized during the past year, and which corresponds to the variation in the deferred tax items recorded in<br />

the balance sheet (see below).<br />

The deferred tax charge referring to items accounted for under shareholders’ equity is also recorded in this latter<br />

item.<br />

The tax charge breaks down as follows:<br />

EUR million 2004 2005<br />

Current taxes related to current year -160 -172<br />

Current taxes related to prior years -17 29<br />

Deferred income tax before valuation allowance 16 7<br />

Valuation allowance on deferred tax assets (-/+) 32 -17<br />

Tax effect of changes in the nominal tax rates on deferred taxes 4 0<br />

Total -125 -153<br />

EUR million 2004 2005<br />

Income tax on items allocated directly to equity 13 2<br />

Total 13 2<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

69

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)