Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

74<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

The companies acquired are:<br />

Fournier Pharma<br />

On July 28, 2005 the <strong>Solvay</strong> group purchased 100% of the capital of Fournier Pharma, a company specializing in<br />

the treatment of cardiometabolic disorders, for a net cash outlay of EUR 1 183 million. Fournier Pharma consists<br />

of 31 legal entities, 14 of which are consolidated according to the materiality principle described under “2005<br />

consolidation scope”.<br />

The Fournier acquisition was initially accounted for on a provisional basis, as not all information was available at that<br />

time. Corrections were made at the year-end closing date.<br />

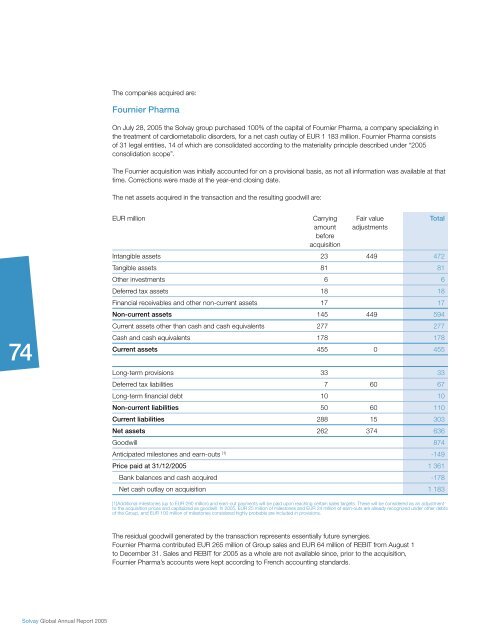

The net assets acquired in the transaction and the resulting goodwill are:<br />

EUR million Carrying<br />

amount<br />

before<br />

acquisition<br />

Fair value<br />

adjustments<br />

Intangible assets 23 449 472<br />

Tangible assets 81 81<br />

Other investments 6 6<br />

Deferred tax assets 18 18<br />

Financial receivables and other non-current assets 17 17<br />

Non-current assets 145 449 594<br />

Current assets other than cash and cash equivalents 277 277<br />

Cash and cash equivalents 178 178<br />

Current assets 455 0 455<br />

Long-term provisions 33 33<br />

Deferred tax liabilities 7 60 67<br />

Long-term fi nancial debt 10 10<br />

Non-current liabilities 50 60 110<br />

Current liabilities 288 15 303<br />

Net assets 262 374 636<br />

Goodwill 874<br />

Anticipated milestones and earn-outs (1) -149<br />

Price paid at 31/12/2005 1 361<br />

Bank balances and cash acquired -178<br />

Net cash outlay on acquisition 1 183<br />

[1]Additional milestones (up to EUR 290 million) and earn-out payments will be paid upon reaching certain sales targets. These will be considered as an adjustment<br />

to the acquisition prices and capitalized as goodwill. In 2005, EUR 25 million of milestones and EUR 24 million of earn-outs are already recognized under other debts<br />

of the Group, and EUR 100 million of milestones considered highly probable are included in provisions.<br />

The residual goodwill generated by the transaction represents essentially future synergies.<br />

Fournier Pharma contributed EUR 265 million of Group sales and EUR 64 million of REBIT from August 1<br />

to December 31. Sales and REBIT for 2005 as a whole are not available since, prior to the acquisition,<br />

Fournier Pharma’s accounts were kept according to French accounting standards.<br />

Total

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)