Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

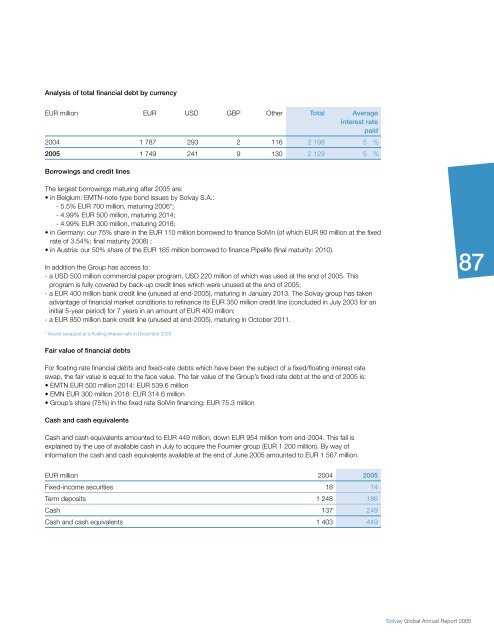

Analysis of total fi nancial debt by currency<br />

EUR million EUR USD GBP Other Total Average<br />

interest rate<br />

paid<br />

2004 1 787 293 2 116 2 198 5 %<br />

2005 1 749 241 9 130 2 129 5 %<br />

Borrowings and credit lines<br />

The largest borrowings maturing after 2005 are:<br />

• in Belgium: EMTN-note type bond issues by <strong>Solvay</strong> S.A.:<br />

- 5.5% EUR 700 million, maturing 2006*;<br />

- 4.99% EUR 500 million, maturing 2014;<br />

- 4.99% EUR 300 million, maturing 2018;<br />

• in Germany: our 75% share in the EUR 110 million borrowed to fi nance SolVin (of which EUR 90 million at the fi xed<br />

rate of 3.54%; fi nal maturity 2008) ;<br />

• in Austria: our 50% share of the EUR 165 million borrowed to fi nance Pipelife (fi nal maturity: 2010).<br />

In addition the Group has access to:<br />

- a USD 500 million commercial paper program, USD 220 million of which was used at the end of 2005. This<br />

program is fully covered by back-up credit lines which were unused at the end of 2005;<br />

- a EUR 400 million bank credit line (unused at end-2005), maturing in January 2013. The <strong>Solvay</strong> group has taken<br />

advantage of fi nancial market conditions to refi nance its EUR 350 million credit line (concluded in July 2003 for an<br />

initial 5-year period) for 7 years in an amount of EUR 400 million;<br />

- a EUR 850 million bank credit line (unused at end-2005), maturing in October 2011.<br />

* Issued swapped at a fl oating interest rate in December 2003<br />

Fair value of fi nancial debts<br />

For fl oating rate fi nancial debts and fi xed-rate debts which have been the subject of a fi xed/fl oating interest rate<br />

swap, the fair value is equal to the face value. The fair value of the Group’s fi xed rate debt at the end of 2005 is:<br />

• EMTN EUR 500 million 2014: EUR 539.6 million<br />

• EMN EUR 300 million 2018: EUR 314.6 million<br />

• Group’s share (75%) in the fi xed rate SolVin fi nancing: EUR 75.3 million<br />

Cash and cash equivalents<br />

Cash and cash equivalents amounted to EUR 449 million, down EUR 954 million from end-2004. This fall is<br />

explained by the use of available cash in July to acquire the Fournier group (EUR 1 200 million). By way of<br />

information the cash and cash equivalents available at the end of June 2005 amounted to EUR 1 567 million.<br />

EUR million 2004 2005<br />

Fixed-income securities 18 14<br />

Term deposits 1 248 186<br />

Cash 137 249<br />

Cash and cash equivalents 1 403 449<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

87

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)