Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

70<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

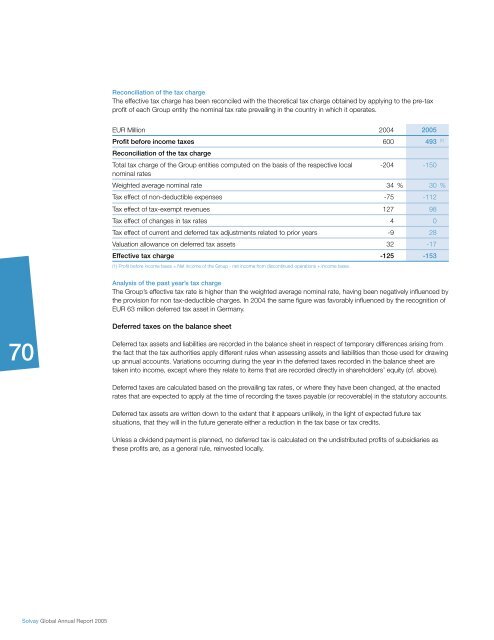

Reconciliation of the tax charge<br />

The effective tax charge has been reconciled with the theoretical tax charge obtained by applying to the pre-tax<br />

profi t of each Group entity the nominal tax rate prevailing in the country in which it operates.<br />

EUR Million 2004 2005<br />

Profi t before income taxes 600 493 (1)<br />

Reconciliation of the tax charge<br />

Total tax charge of the Group entities computed on the basis of the respective local<br />

nominal rates<br />

-204 -150<br />

Weighted average nominal rate 34 % 30 %<br />

Tax effect of non-deductible expenses -75 -112<br />

Tax effect of tax-exempt revenues 127 98<br />

Tax effect of changes in tax rates 4 0<br />

Tax effect of current and deferred tax adjustments related to prior years -9 28<br />

Valuation allowance on deferred tax assets 32 -17<br />

Effective tax charge -125 -153<br />

(1) Profi t before income taxes = Net income of the Group - net income from discontinued operations + income taxes.<br />

Analysis of the past year’s tax charge<br />

The Group’s effective tax rate is higher than the weighted average nominal rate, having been negatively infl uenced by<br />

the provision for non tax-deductible charges. In 2004 the same fi gure was favorably infl uenced by the recognition of<br />

EUR 63 million deferred tax asset in Germany.<br />

Deferred taxes on the balance sheet<br />

Deferred tax assets and liabilities are recorded in the balance sheet in respect of temporary differences arising from<br />

the fact that the tax authorities apply different rules when assessing assets and liabilities than those used for drawing<br />

up annual accounts. Variations occurring during the year in the deferred taxes recorded in the balance sheet are<br />

taken into income, except where they relate to items that are recorded directly in shareholders’ equity (cf. above).<br />

Deferred taxes are calculated based on the prevailing tax rates, or where they have been changed, at the enacted<br />

rates that are expected to apply at the time of recording the taxes payable (or recoverable) in the statutory accounts.<br />

Deferred tax assets are written down to the extent that it appears unlikely, in the light of expected future tax<br />

situations, that they will in the future generate either a reduction in the tax base or tax credits.<br />

Unless a dividend payment is planned, no deferred tax is calculated on the undistributed profi ts of subsidiaries as<br />

these profi ts are, as a general rule, reinvested locally.

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)