Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

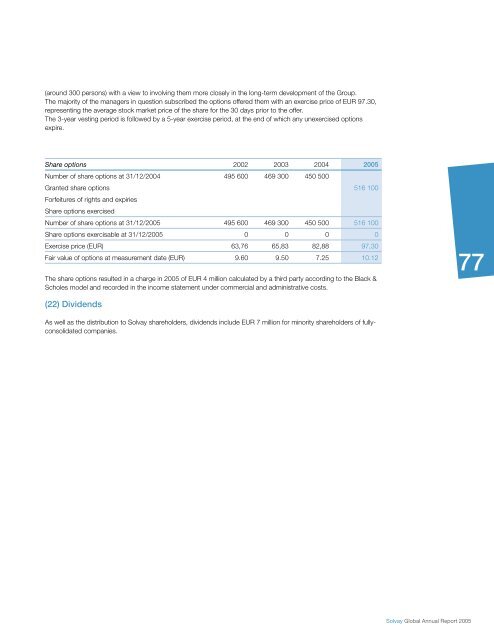

(around 300 persons) with a view to involving them more closely in the long-term development of the Group.<br />

The majority of the managers in question subscribed the options offered them with an exercise price of EUR 97.30,<br />

representing the average stock market price of the share for the 30 days prior to the offer.<br />

The 3-year vesting period is followed by a 5-year exercise period, at the end of which any unexercised options<br />

expire.<br />

Share options 2002 2003 2004 2005<br />

Number of share options at 31/12/2004 495 600 469 300 450 500<br />

Granted share options<br />

Forfeitures of rights and expiries<br />

Share options exercised<br />

516 100<br />

Number of share options at 31/12/2005 495 600 469 300 450 500 516 100<br />

Share options exercisable at 31/12/2005 0 0 0 0<br />

Exercise price (EUR) 63,76 65,83 82,88 97,30<br />

Fair value of options at measurement date (EUR) 9.60 9.50 7.25 10.12<br />

The share options resulted in a charge in 2005 of EUR 4 million calculated by a third party according to the Black &<br />

Scholes model and recorded in the income statement under commercial and administrative costs.<br />

(22) Dividends<br />

As well as the distribution to <strong>Solvay</strong> shareholders, dividends include EUR 7 million for minority shareholders of fullyconsolidated<br />

companies.<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

77

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)