Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

60<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

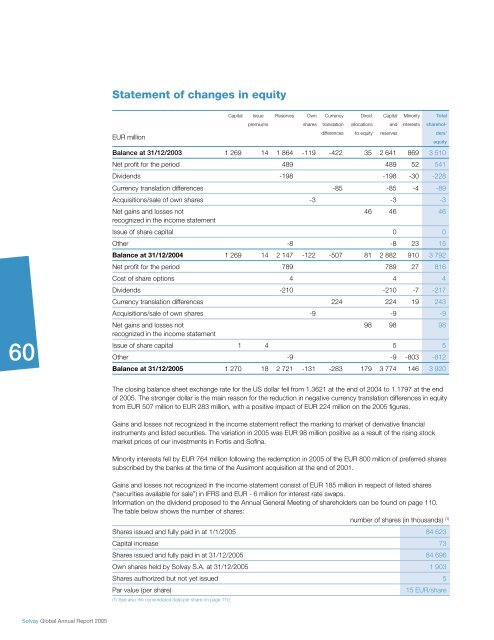

Statement of changes in equity<br />

EUR million<br />

Capital Issue<br />

premiums<br />

Reserves Own Currency<br />

shares translation<br />

differences<br />

Direct<br />

allocations<br />

to equity<br />

Capital<br />

and<br />

reserves<br />

Minority<br />

interests<br />

Total<br />

shareholders’<br />

equity<br />

Balance at 31/12/2003 1 269 14 1 864 -119 -422 35 2 641 869 3 510<br />

Net profi t for the period 489 489 52 541<br />

Dividends -198 -198 -30 -228<br />

Currency translation differences -85 -85 -4 -89<br />

Acquisitions/sale of own shares -3 -3 -3<br />

Net gains and losses not<br />

recognized in the income statement<br />

46 46 46<br />

Issue of share capital 0 0<br />

Other -8 -8 23 15<br />

Balance at 31/12/2004 1 269 14 2 147 -122 -507 81 2 882 910 3 792<br />

Net profi t for the period 789 789 27 816<br />

Cost of share options 4 4 4<br />

Dividends -210 -210 -7 -217<br />

Currency translation differences 224 224 19 243<br />

Acquisitions/sale of own shares -9 -9 -9<br />

Net gains and losses not<br />

recognized in the income statement<br />

98 98 98<br />

Issue of share capital 1 4 5 5<br />

Other -9 -9 -803 -812<br />

Balance at 31/12/2005 1 270 18 2 721 -131 -283 179 3 774 146 3 920<br />

The closing balance sheet exchange rate for the US dollar fell from 1.3621 at the end of 2004 to 1.1797 at the end<br />

of 2005. The stronger dollar is the main reason for the reduction in negative currency translation differences in equity<br />

from EUR 507 million to EUR 283 million, with a positive impact of EUR 224 million on the 2005 fi gures.<br />

Gains and losses not recognized in the income statement refl ect the marking to market of derivative fi nancial<br />

instruments and listed securities. The variation in 2005 was EUR 98 million positive as a result of the rising stock<br />

market prices of our investments in Fortis and Sofi na.<br />

Minority interests fell by EUR 764 million following the redemption in 2005 of the EUR 800 million of preferred shares<br />

subscribed by the banks at the time of the Ausimont acquisition at the end of 2001.<br />

Gains and losses not recognized in the income statement consist of EUR 185 million in respect of listed shares<br />

(“securities available for sale”) in IFRS and EUR - 6 million for interest rate swaps.<br />

Information on the dividend proposed to the Annual General Meeting of shareholders can be found on page 110.<br />

The table below shows the number of shares:<br />

number of shares (in thousands) (1)<br />

Shares issued and fully paid in at 1/1/2005 84 623<br />

Capital increase 73<br />

Shares issued and fully paid in at 31/12/2005 84 696<br />

Own shares held by <strong>Solvay</strong> S.A. at 31/12/2005 1 903<br />

Shares authorized but not yet issued 5<br />

Par value (per share) 15 EUR/share<br />

(1) See also the consolidated data per share on page 110.

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)