Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

76<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

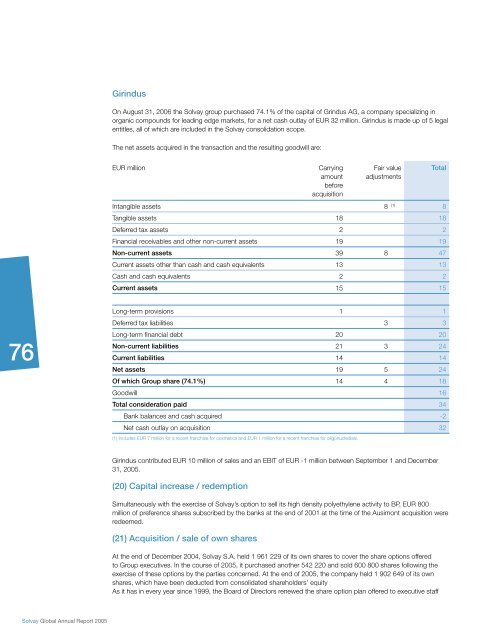

Girindus<br />

On August 31, 2006 the <strong>Solvay</strong> group purchased 74.1% of the capital of Grindus AG, a company specializing in<br />

organic compounds for leading edge markets, for a net cash outlay of EUR 32 million. Girindus is made up of 5 legal<br />

entitles, all of which are included in the <strong>Solvay</strong> consolidation scope.<br />

The net assets acquired in the transaction and the resulting goodwill are:<br />

EUR million Carrying<br />

amount<br />

before<br />

acquisition<br />

Fair value<br />

adjustments<br />

Intangible assets 8 (1) 8<br />

Tangible assets 18 18<br />

Deferred tax assets 2 2<br />

Financial receivables and other non-current assets 19 19<br />

Non-current assets 39 8 47<br />

Current assets other than cash and cash equivalents 13 13<br />

Cash and cash equivalents 2 2<br />

Current assets 15 15<br />

Long-term provisions 1 1<br />

Deferred tax liabilities 3 3<br />

Long-term fi nancial debt 20 20<br />

Non-current liabilities 21 3 24<br />

Current liabilities 14 14<br />

Net assets 19 5 24<br />

Of which Group share (74.1%) 14 4 18<br />

Goodwill 16<br />

Total consideration paid 34<br />

Bank balances and cash acquired -2<br />

Net cash outlay on acquisition 32<br />

(1) Includes EUR 7 million for a recent franchise for cosmetics and EUR 1 million for a recent franchise for oligonucledials.<br />

Girindus contributed EUR 10 million of sales and an EBIT of EUR -1 million between September 1 and December<br />

31, 2005.<br />

(20) Capital increase / redemption<br />

Simultaneously with the exercise of <strong>Solvay</strong>’s option to sell its high density polyethylene activity to BP, EUR 800<br />

million of preference shares subscribed by the banks at the end of 2001 at the time of the Ausimont acquisition were<br />

redeemed.<br />

(21) Acquisition / sale of own shares<br />

At the end of December 2004, <strong>Solvay</strong> S.A. held 1 961 229 of its own shares to cover the share options offered<br />

to Group executives. In the course of 2005, it purchased another 542 220 and sold 600 800 shares following the<br />

exercise of these options by the parties concerned. At the end of 2005, the company held 1 902 649 of its own<br />

shares, which have been deducted from consolidated shareholders’ equity<br />

As it has in every year since 1999, the Board of Directors renewed the share option plan offered to executive staff<br />

Total

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)