Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Neopharma<br />

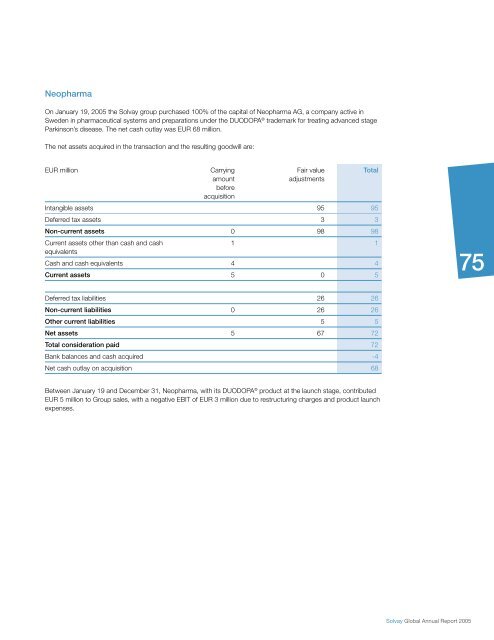

On January 19, 2005 the <strong>Solvay</strong> group purchased 100% of the capital of Neopharma AG, a company active in<br />

Sweden in pharmaceutical systems and preparations under the DUODOPA ® trademark for treating advanced stage<br />

Parkinson’s disease. The net cash outlay was EUR 68 million.<br />

The net assets acquired in the transaction and the resulting goodwill are:<br />

EUR million Carrying<br />

amount<br />

before<br />

acquisition<br />

Fair value<br />

adjustments<br />

Intangible assets 95 95<br />

Deferred tax assets 3 3<br />

Non-current assets 0 98 98<br />

Current assets other than cash and cash<br />

equivalents<br />

Total<br />

1 1<br />

Cash and cash equivalents 4 4<br />

Current assets 5 0 5<br />

Deferred tax liabilities 26 26<br />

Non-current liabilities 0 26 26<br />

Other current liabilities 5 5<br />

Net assets 5 67 72<br />

Total consideration paid 72<br />

Bank balances and cash acquired -4<br />

Net cash outlay on acquisition 68<br />

Between January 19 and December 31, Neopharma, with its DUODOPA ® product at the launch stage, contributed<br />

EUR 5 million to Group sales, with a negative EBIT of EUR 3 million due to restructuring charges and product launch<br />

expenses.<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

75

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)