Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

Pharmaceuticals Sector - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Post-employment benefi t plans are classifi ed into defi ned contribution and defi ned benefi t plans.<br />

- Defi ned contribution plans<br />

Defi ned contribution plans are those for which the company pays fi xed contributions into a separate entity or fund<br />

in accordance with the provisions of the plan. Once these contributions have been paid, the company has no<br />

further obligation. EUR 29 million of contributions to these plans were charged to income in 2005 (EUR 22 million<br />

in 2004).<br />

- Defi ned benefi t plans<br />

All plans which are not defi ned contribution plans are deemed to be defi ned benefi t plans. These plans can be<br />

either funded via outside pension funds or insurance companies (“funded plans”) or fi nanced within the group<br />

(“unfunded plans”). All main plans are assessed annually by independent actuaries. The amounts charged to<br />

income in respect of these plans are:<br />

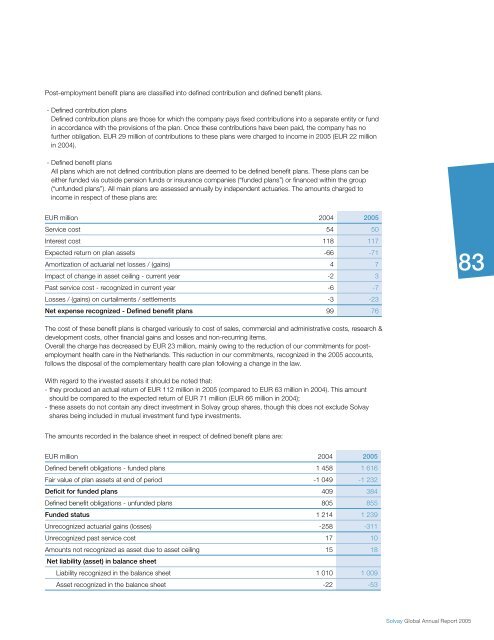

EUR million 2004 2005<br />

Service cost 54 50<br />

Interest cost 118 117<br />

Expected return on plan assets -66 -71<br />

Amortization of actuarial net losses / (gains) 4 7<br />

Impact of change in asset ceiling - current year -2 3<br />

Past service cost - recognized in current year -6 -7<br />

Losses / (gains) on curtailments / settlements -3 -23<br />

Net expense recognized - Defi ned benefi t plans 99 76<br />

The cost of these benefi t plans is charged variously to cost of sales, commercial and administrative costs, research &<br />

development costs, other fi nancial gains and losses and non-recurring items.<br />

Overall the charge has decreased by EUR 23 million, mainly owing to the reduction of our commitments for postemployment<br />

health care in the Netherlands. This reduction in our commitments, recognized in the 2005 accounts,<br />

follows the disposal of the complementary health care plan following a change in the law.<br />

With regard to the invested assets it should be noted that:<br />

- they produced an actual return of EUR 112 million in 2005 (compared to EUR 63 million in 2004). This amount<br />

should be compared to the expected return of EUR 71 million (EUR 66 million in 2004);<br />

- these assets do not contain any direct investment in <strong>Solvay</strong> group shares, though this does not exclude <strong>Solvay</strong><br />

shares being included in mutual investment fund type investments.<br />

The amounts recorded in the balance sheet in respect of defi ned benefi t plans are:<br />

EUR million 2004 2005<br />

Defi ned benefi t obligations - funded plans 1 458 1 616<br />

Fair value of plan assets at end of period -1 049 -1 232<br />

Defi cit for funded plans 409 384<br />

Defi ned benefi t obligations - unfunded plans 805 855<br />

Funded status 1 214 1 239<br />

Unrecognized actuarial gains (losses) -258 -311<br />

Unrecognized past service cost 17 10<br />

Amounts not recognized as asset due to asset ceiling 15 18<br />

Net liability (asset) in balance sheet<br />

Liability recognized in the balance sheet 1 010 1 009<br />

Asset recognized in the balance sheet -22 -53<br />

<strong>Solvay</strong> Global Annual Report 2005<br />

83

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)