annual report - FIAT SpA

annual report - FIAT SpA

annual report - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

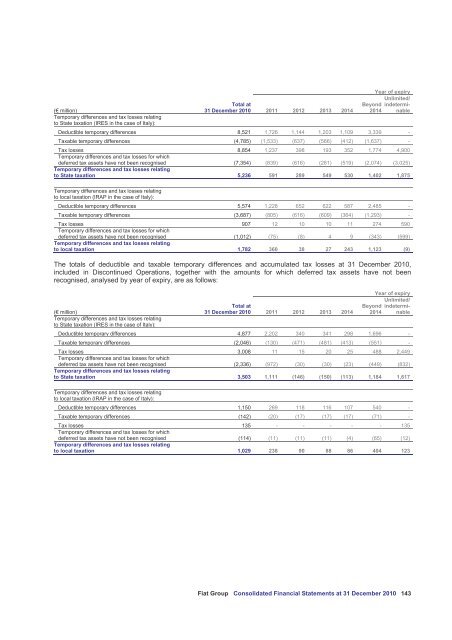

Total at<br />

Year of expiry<br />

Unlimited/<br />

Beyond indetermi-<br />

(€ million)<br />

Temporary differences and tax losses relating<br />

to State taxation (IRES in the case of Italy):<br />

31 December 2010 2011 2012 2013 2014 2014 nable<br />

Deductible temporary differences 8,521 1,726 1,144 1,203 1,109 3,339 -<br />

Taxable temporary differences (4,785) (1,533) (637) (566) (412) (1,637) -<br />

Tax losses<br />

Temporary differences and tax losses for which<br />

8,854 1,237 398 193 352 1,774 4,900<br />

deferred tax assets have not been recognised<br />

Temporary differences and tax losses relating<br />

(7,354) (839) (616) (281) (519) (2,074) (3,025)<br />

to State taxation 5,236 591 289 549 530 1,402 1,875<br />

Temporary differences and tax losses relating<br />

to local taxation (IRAP in the case of Italy):<br />

Deductible temporary differences 5,574 1,228 652 622 587 2,485 -<br />

Taxable temporary differences (3,687) (805) (616) (609) (364) (1,293) -<br />

Tax losses<br />

Temporary differences and tax losses for which<br />

907 12 10 10 11 274 590<br />

deferred tax assets have not been recognised<br />

Temporary differences and tax losses relating<br />

(1,012) (75) (8) 4 9 (343) (599)<br />

to local taxation 1,782 360 38 27 243 1,123 (9)<br />

The totals of deductible and taxable temporary differences and accumulated tax losses at 31 December 2010,<br />

included in Discontinued Operations, together with the amounts for which deferred tax assets have not been<br />

recognised, analysed by year of expiry, are as follows:<br />

Total at<br />

Year of expiry<br />

Unlimited/<br />

Beyond indetermi-<br />

(€ million)<br />

Temporary differences and tax losses relating<br />

to State taxation (IRES in the case of Italy):<br />

31 December 2010 2011 2012 2013 2014 2014 nable<br />

Deductible temporary differences 4,877 2,202 340 341 298 1,696 -<br />

Taxable temporary differences (2,046) (130) (471) (481) (413) (551) -<br />

Tax losses<br />

Temporary differences and tax losses for which<br />

3,008 11 15 20 25 488 2,449<br />

deferred tax assets have not been recognised<br />

Temporary differences and tax losses relating<br />

(2,336) (972) (30) (30) (23) (449) (832)<br />

to State taxation 3,503 1,111 (146) (150) (113) 1,184 1,617<br />

Temporary differences and tax losses relating<br />

to local taxation (IRAP in the case of Italy):<br />

Deductible temporary differences 1,150 269 118 116 107 540 -<br />

Taxable temporary differences (142) (20) (17) (17) (17) (71) -<br />

Tax losses<br />

Temporary differences and tax losses for which<br />

135 - - - - - 135<br />

deferred tax assets have not been recognised<br />

Temporary differences and tax losses relating<br />

(114) (11) (11) (11) (4) (65) (12)<br />

to local taxation 1,029 238 90 88 86 404 123<br />

Fiat Group Consolidated Financial Statements at 31 December 2010 143