annual report - FIAT SpA

annual report - FIAT SpA

annual report - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

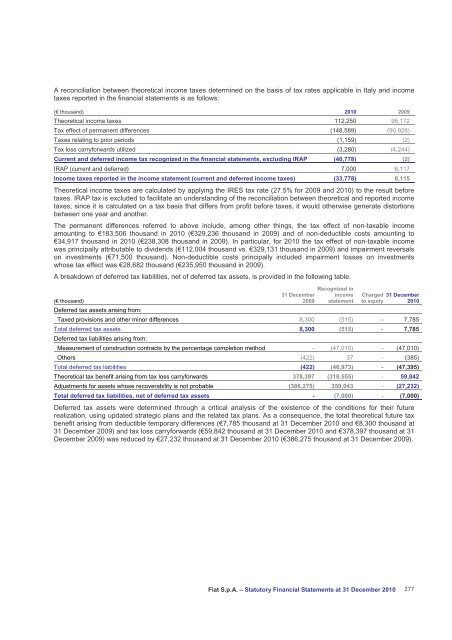

A reconciliation between theoretical income taxes determined on the basis of tax rates applicable in Italy and income<br />

taxes <strong>report</strong>ed in the financial statements is as follows:<br />

(€ thousand) 2010 2009<br />

Theoretical income taxes 112,250 95,172<br />

Tax effect of permanent differences (148,589) (90,928)<br />

Taxes relating to prior periods (1,159) (2)<br />

Tax loss carryforwards utilized (3,280) (4,244)<br />

Current and deferred income tax recognized in the financial statements, excluding IRAP (40,778) (2)<br />

IRAP (current and deferred) 7,000 6,117<br />

Income taxes <strong>report</strong>ed in the income statement (current and deferred income taxes) (33,778) 6,115<br />

Theoretical income taxes are calculated by applying the IRES tax rate (27.5% for 2009 and 2010) to the result before<br />

taxes. IRAP tax is excluded to facilitate an understanding of the reconciliation between theoretical and <strong>report</strong>ed income<br />

taxes; since it is calculated on a tax basis that differs from profit before taxes, it would otherwise generate distortions<br />

between one year and another.<br />

The permanent differences referred to above include, among other things, the tax effect of non-taxable income<br />

amounting to €183,506 thousand in 2010 (€329,236 thousand in 2009) and of non-deductible costs amounting to<br />

€34,917 thousand in 2010 (€238,308 thousand in 2009). In particular, for 2010 the tax effect of non-taxable income<br />

was principally attributable to dividends (€112,004 thousand vs. €329,131 thousand in 2009) and impairment reversals<br />

on investments (€71,500 thousand). Non-deductible costs principally included impairment losses on investments<br />

whose tax effect was €28,682 thousand (€235,950 thousand in 2009).<br />

A breakdown of deferred tax liabilities, net of deferred tax assets, is provided in the following table.<br />

31 December<br />

Recognized in<br />

income Charged 31 December<br />

(€ thousand)<br />

Deferred tax assets arising from:<br />

2009 statement to equity 2010<br />

Taxed provisions and other minor differences 8,300 (515) - 7,785<br />

Total deferred tax assets<br />

Deferred tax liabilities arising from:<br />

8,300 (515) - 7,785<br />

Measurement of construction contracts by the percentage completion method - (47,010) - (47,010)<br />

Others (422) 37 - (385)<br />

Total deferred tax liabilities (422) (46,973) - (47,395)<br />

Theoretical tax benefit arising from tax loss carryforwards 378,397 (318,555) - 59,842<br />

Adjustments for assets whose recoverability is not probable (386,275) 359,043 - (27,232)<br />

Total deferred tax liabilities, net of deferred tax assets - (7,000) - (7,000)<br />

Deferred tax assets were determined through a critical analysis of the existence of the conditions for their future<br />

realization, using updated strategic plans and the related tax plans. As a consequence, the total theoretical future tax<br />

benefit arising from deductible temporary differences (€7,785 thousand at 31 December 2010 and €8,300 thousand at<br />

31 December 2009) and tax loss carryforwards (€59,842 thousand at 31 December 2010 and €378,397 thousand at 31<br />

December 2009) was reduced by €27,232 thousand at 31 December 2010 (€386,275 thousand at 31 December 2009).<br />

Fiat S.p.A. – Statutory Financial Statements at 31 December 2010 277