annual report - FIAT SpA

annual report - FIAT SpA

annual report - FIAT SpA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

December 2009), activities to complete the ancillary work and cleanup, in addition to the contractual obligation for final<br />

approval of the work (Final Principal and/or Secondary Test Certificates) and to release the bank guarantees were still<br />

in progress, from an accounting perspective the project remained open at that date.<br />

Tax payables and other payables<br />

The main components of these items are as follows.<br />

At 31 December 2010, intercompany payables for consolidated VAT of €131,408 thousand (€124,348 thousand at 31<br />

December 2009) relate to the VAT credits of Italian subsidiaries transferred to Fiat S.p.A. as part of the consolidated<br />

VAT procedure.<br />

At 31 December 2010, payables to Group companies in connection with the IRES tax consolidation amounted to<br />

€211,576 thousand (€133,806 thousand at 31 December 2009) and represent the remuneration due for the tax losses<br />

contributed by the Italian subsidiaries to the domestic tax consolidation for 2010, the IRES tax credits of the Italian<br />

subsidiaries transferred to Fiat S.p.A. as part of the tax consolidation procedure for 2010 and payables relating to the<br />

domestic tax consolidation for 2009.<br />

Tax payables and other payables are all due within one year and their carrying amount is deemed to approximate their<br />

fair value.<br />

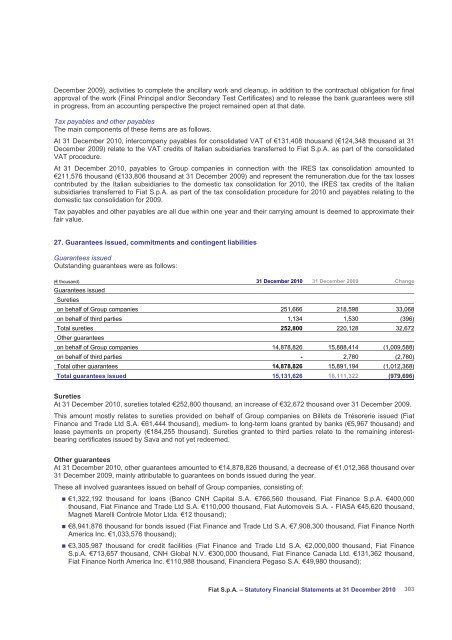

27. Guarantees issued, commitments and contingent liabilities<br />

Guarantees issued<br />

Outstanding guarantees were as follows:<br />

(€ thousand)<br />

Guarantees issued<br />

Sureties<br />

31 December 2010 31 December 2009 Change<br />

on behalf of Group companies 251,666 218,598 33,068<br />

on behalf of third parties 1,134 1,530 (396)<br />

Total sureties<br />

Other guarantees<br />

252,800 220,128 32,672<br />

on behalf of Group companies 14,878,826 15,888,414 (1,009,588)<br />

on behalf of third parties - 2,780 (2,780)<br />

Total other guarantees 14,878,826 15,891,194 (1,012,368)<br />

Total guarantees issued 15,131,626 16,111,322 (979,696)<br />

Sureties<br />

At 31 December 2010, sureties totaled €252,800 thousand, an increase of €32,672 thousand over 31 December 2009.<br />

This amount mostly relates to sureties provided on behalf of Group companies on Billets de Trésorerie issued (Fiat<br />

Finance and Trade Ltd S.A. €61,444 thousand), medium- to long-term loans granted by banks (€5,967 thousand) and<br />

lease payments on property (€184,255 thousand). Sureties granted to third parties relate to the remaining interestbearing<br />

certificates issued by Sava and not yet redeemed.<br />

Other guarantees<br />

At 31 December 2010, other guarantees amounted to €14,878,826 thousand, a decrease of €1,012,368 thousand over<br />

31 December 2009, mainly attributable to guarantees on bonds issued during the year.<br />

These all involved guarantees issued on behalf of Group companies, consisting of:<br />

� €1,322,192 thousand for loans (Banco CNH Capital S.A. €766,560 thousand, Fiat Finance S.p.A. €400,000<br />

thousand, Fiat Finance and Trade Ltd S.A. €110,000 thousand, Fiat Automoveis S.A. - FIASA €45,620 thousand,<br />

Magneti Marelli Controle Motor Ltda. €12 thousand);<br />

� €8,941,876 thousand for bonds issued (Fiat Finance and Trade Ltd S.A. €7,908,300 thousand, Fiat Finance North<br />

America Inc. €1,033,576 thousand);<br />

� €3,305,987 thousand for credit facilities (Fiat Finance and Trade Ltd S.A. €2,000,000 thousand, Fiat Finance<br />

S.p.A. €713,657 thousand, CNH Global N.V. €300,000 thousand, Fiat Finance Canada Ltd. €131,362 thousand,<br />

Fiat Finance North America Inc. €110,988 thousand, Financiera Pegaso S.A. €49,980 thousand);<br />

Fiat S.p.A. – Statutory Financial Statements at 31 December 2010 303