annual report - FIAT SpA

annual report - FIAT SpA

annual report - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

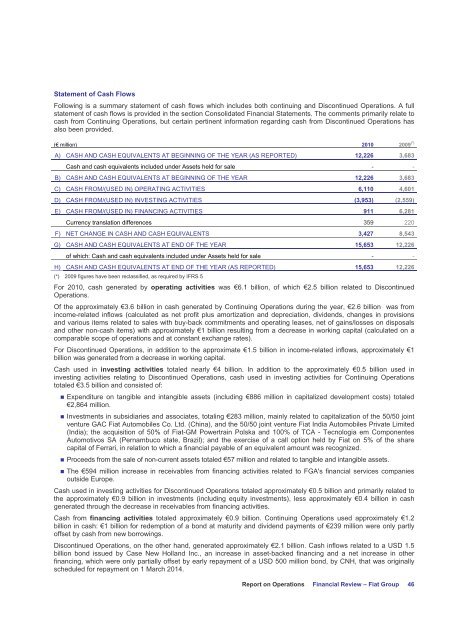

Statement of Cash Flows<br />

Following is a summary statement of cash flows which includes both continuing and Discontinued Operations. A full<br />

statement of cash flows is provided in the section Consolidated Financial Statements. The comments primarily relate to<br />

cash from Continuing Operations, but certain pertinent information regarding cash from Discontinued Operations has<br />

also been provided.<br />

(€ million) 2010 2009 (*)<br />

A) CASH AND CASH EQUIVALENTS AT BEGINNING OF THE YEAR (AS REPORTED) 12,226 3,683<br />

Cash and cash equivalents included under Assets held for sale - -<br />

B) CASH AND CASH EQUIVALENTS AT BEGINNING OF THE YEAR 12,226 3,683<br />

C) CASH FROM/(USED IN) OPERATING ACTIVITIES 6,110 4,601<br />

D) CASH FROM/(USED IN) INVESTING ACTIVITIES (3,953) (2,559)<br />

E) CASH FROM/(USED IN) FINANCING ACTIVITIES 911 6,281<br />

Currency translation differences 359 220<br />

F) NET CHANGE IN CASH AND CASH EQUIVALENTS 3,427 8,543<br />

G) CASH AND CASH EQUIVALENTS AT END OF THE YEAR 15,653 12,226<br />

of which: Cash and cash equivalents included under Assets held for sale - -<br />

H) CASH AND CASH EQUIVALENTS AT END OF THE YEAR (AS REPORTED) 15,653 12,226<br />

(*) 2009 figures have been reclassified, as required by IFRS 5<br />

For 2010, cash generated by operating activities was €6.1 billion, of which €2.5 billion related to Discontinued<br />

Operations.<br />

Of the approximately €3.6 billion in cash generated by Continuing Operations during the year, €2.6 billion was from<br />

income-related inflows (calculated as net profit plus amortization and depreciation, dividends, changes in provisions<br />

and various items related to sales with buy-back commitments and operating leases, net of gains/losses on disposals<br />

and other non-cash items) with approximately €1 billion resulting from a decrease in working capital (calculated on a<br />

comparable scope of operations and at constant exchange rates).<br />

For Discontinued Operations, in addition to the approximate €1.5 billion in income-related inflows, approximately €1<br />

billion was generated from a decrease in working capital.<br />

Cash used in investing activities totaled nearly €4 billion. In addition to the approximately €0.5 billion used in<br />

investing activities relating to Discontinued Operations, cash used in investing activities for Continuing Operations<br />

totaled €3.5 billion and consisted of:<br />

� Expenditure on tangible and intangible assets (including €886 million in capitalized development costs) totaled<br />

€2,864 million.<br />

� Investments in subsidiaries and associates, totaling €283 million, mainly related to capitalization of the 50/50 joint<br />

venture GAC Fiat Automobiles Co. Ltd. (China), and the 50/50 joint venture Fiat India Automobiles Private Limited<br />

(India); the acquisition of 50% of Fiat-GM Powertrain Polska and 100% of TCA - Tecnologia em Componentes<br />

Automotivos SA (Pernambuco state, Brazil); and the exercise of a call option held by Fiat on 5% of the share<br />

capital of Ferrari, in relation to which a financial payable of an equivalent amount was recognized.<br />

� Proceeds from the sale of non-current assets totaled €57 million and related to tangible and intangible assets.<br />

� The €594 million increase in receivables from financing activities related to FGA's financial services companies<br />

outside Europe.<br />

Cash used in investing activities for Discontinued Operations totaled approximately €0.5 billion and primarily related to<br />

the approximately €0.9 billion in investments (including equity investments), less approximately €0.4 billion in cash<br />

generated through the decrease in receivables from financing activities.<br />

Cash from financing activities totaled approximately €0.9 billion. Continuing Operations used approximately €1.2<br />

billion in cash: €1 billion for redemption of a bond at maturity and dividend payments of €239 million were only partly<br />

offset by cash from new borrowings.<br />

Discontinued Operations, on the other hand, generated approximately €2.1 billion. Cash inflows related to a USD 1.5<br />

billion bond issued by Case New Holland Inc., an increase in asset-backed financing and a net increase in other<br />

financing, which were only partially offset by early repayment of a USD 500 million bond, by CNH, that was originally<br />

scheduled for repayment on 1 March 2014.<br />

Report on Operations Financial Review – Fiat Group<br />

46