annual report - FIAT SpA

annual report - FIAT SpA

annual report - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

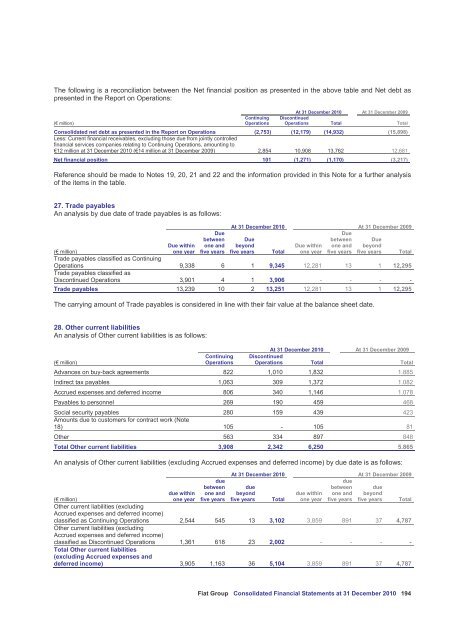

The following is a reconciliation between the Net financial position as presented in the above table and Net debt as<br />

presented in the Report on Operations:<br />

(€ million)<br />

Continuing<br />

Operations<br />

At 31 December 2010<br />

Discontinued<br />

At 31 December 2009<br />

Operations Total Total<br />

Consolidated net debt as presented in the Report on Operations (2,753) (12,179) (14,932) (15,898)<br />

Less: Current financial receivables, excluding those due from jointly controlled<br />

financial services companies relating to Continuing Operations, amounting to<br />

€12 million at 31 December 2010 (€14 million at 31 December 2009) 2,854 10,908 13,762 12,681<br />

Net financial position 101 (1,271) (1,170) (3,217)<br />

Reference should be made to Notes 19, 20, 21 and 22 and the information provided in this Note for a further analysis<br />

of the items in the table.<br />

27. Trade payables<br />

An analysis by due date of trade payables is as follows:<br />

(€ million)<br />

Due within<br />

one year<br />

Due<br />

between<br />

one and<br />

five years<br />

At 31 December 2010<br />

Due<br />

beyond<br />

five years Total<br />

Due within<br />

one year<br />

Due<br />

between<br />

one and<br />

five years<br />

At 31 December 2009<br />

Due<br />

beyond<br />

five years Total<br />

Trade payables classified as Continuing<br />

Operations 9,338 6 1 9,345 12,281 13 1 12,295<br />

Trade payables classified as<br />

Discontinued Operations 3,901 4 1 3,906 - - - -<br />

Trade payables 13,239 10 2 13,251 12,281 13 1 12,295<br />

The carrying amount of Trade payables is considered in line with their fair value at the balance sheet date.<br />

28. Other current liabilities<br />

An analysis of Other current liabilities is as follows:<br />

At 31 December 2010 At 31 December 2009<br />

(€ million)<br />

Continuing<br />

Operations<br />

Discontinued<br />

Operations Total Total<br />

Advances on buy-back agreements 822 1,010 1,832 1.885<br />

Indirect tax payables 1,063 309 1,372 1.082<br />

Accrued expenses and deferred income 806 340 1,146 1.078<br />

Payables to personnel 269 190 459 468<br />

Social security payables<br />

Amounts due to customers for contract work (Note<br />

280 159 439 423<br />

18) 105 - 105 81<br />

Other 563 334 897 848<br />

Total Other current liabilities 3,908 2,342 6,250 5.865<br />

An analysis of Other current liabilities (excluding Accrued expenses and deferred income) by due date is as follows:<br />

(€ million)<br />

due within<br />

one year<br />

due<br />

between<br />

one and<br />

five years<br />

At 31 December 2010 At 31 December 2009<br />

due<br />

beyond<br />

five years Total<br />

due within<br />

one year<br />

due<br />

between<br />

one and<br />

five years<br />

due<br />

beyond<br />

five years Total<br />

Other current liabilities (excluding<br />

Accrued expenses and deferred income)<br />

classified as Continuing Operations 2,544 545 13 3,102 3,859 891 37 4,787<br />

Other current liabilities (excluding<br />

Accrued expenses and deferred income)<br />

classified as Discontinued Operations 1,361 618 23 2,002 - - - -<br />

Total Other current liabilities<br />

(excluding Accrued expenses and<br />

deferred income) 3,905 1,163 36 5,104 3,859 891 37 4,787<br />

Fiat Group Consolidated Financial Statements at 31 December 2010 194