annual report - FIAT SpA

annual report - FIAT SpA

annual report - FIAT SpA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

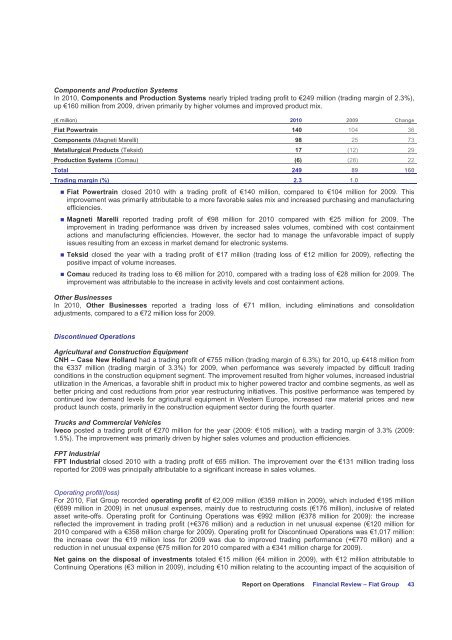

Components and Production Systems<br />

In 2010, Components and Production Systems nearly tripled trading profit to €249 million (trading margin of 2.3%),<br />

up €160 million from 2009, driven primarily by higher volumes and improved product mix.<br />

(€ million) 2010 2009 Change<br />

Fiat Powertrain 140 104 36<br />

Components (Magneti Marelli) 98 25 73<br />

Metallurgical Products (Teksid) 17 (12) 29<br />

Production Systems (Comau) (6) (28) 22<br />

Total 249 89 160<br />

Trading margin (%) 2.3 1.0<br />

� Fiat Powertrain closed 2010 with a trading profit of €140 million, compared to €104 million for 2009. This<br />

improvement was primarily attributable to a more favorable sales mix and increased purchasing and manufacturing<br />

efficiencies.<br />

� Magneti Marelli <strong>report</strong>ed trading profit of €98 million for 2010 compared with €25 million for 2009. The<br />

improvement in trading performance was driven by increased sales volumes, combined with cost containment<br />

actions and manufacturing efficiencies. However, the sector had to manage the unfavorable impact of supply<br />

issues resulting from an excess in market demand for electronic systems.<br />

� Teksid closed the year with a trading profit of €17 million (trading loss of €12 million for 2009), reflecting the<br />

positive impact of volume increases.<br />

� Comau reduced its trading loss to €6 million for 2010, compared with a trading loss of €28 million for 2009. The<br />

improvement was attributable to the increase in activity levels and cost containment actions.<br />

Other Businesses<br />

In 2010, Other Businesses <strong>report</strong>ed a trading loss of €71 million, including eliminations and consolidation<br />

adjustments, compared to a €72 million loss for 2009.<br />

Discontinued Operations<br />

Agricultural and Construction Equipment<br />

CNH – Case New Holland had a trading profit of €755 million (trading margin of 6.3%) for 2010, up €418 million from<br />

the €337 million (trading margin of 3.3%) for 2009, when performance was severely impacted by difficult trading<br />

conditions in the construction equipment segment. The improvement resulted from higher volumes, increased industrial<br />

utilization in the Americas, a favorable shift in product mix to higher powered tractor and combine segments, as well as<br />

better pricing and cost reductions from prior year restructuring initiatives. This positive performance was tempered by<br />

continued low demand levels for agricultural equipment in Western Europe, increased raw material prices and new<br />

product launch costs, primarily in the construction equipment sector during the fourth quarter.<br />

Trucks and Commercial Vehicles<br />

Iveco posted a trading profit of €270 million for the year (2009: €105 million), with a trading margin of 3.3% (2009:<br />

1.5%). The improvement was primarily driven by higher sales volumes and production efficiencies.<br />

FPT Industrial<br />

FPT Industrial closed 2010 with a trading profit of €65 million. The improvement over the €131 million trading loss<br />

<strong>report</strong>ed for 2009 was principally attributable to a significant increase in sales volumes.<br />

Operating profit/(loss)<br />

For 2010, Fiat Group recorded operating profit of €2,009 million (€359 million in 2009), which included €195 million<br />

(€699 million in 2009) in net unusual expenses, mainly due to restructuring costs (€176 million), inclusive of related<br />

asset write-offs. Operating profit for Continuing Operations was €992 million (€378 million for 2009): the increase<br />

reflected the improvement in trading profit (+€376 million) and a reduction in net unusual expense (€120 million for<br />

2010 compared with a €358 million charge for 2009). Operating profit for Discontinued Operations was €1,017 million:<br />

the increase over the €19 million loss for 2009 was due to improved trading performance (+€770 million) and a<br />

reduction in net unusual expense (€75 million for 2010 compared with a €341 million charge for 2009).<br />

Net gains on the disposal of investments totaled €15 million (€4 million in 2009), with €12 million attributable to<br />

Continuing Operations (€3 million in 2009), including €10 million relating to the accounting impact of the acquisition of<br />

Report on Operations Financial Review – Fiat Group<br />

43