s2dQo5

s2dQo5

s2dQo5

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

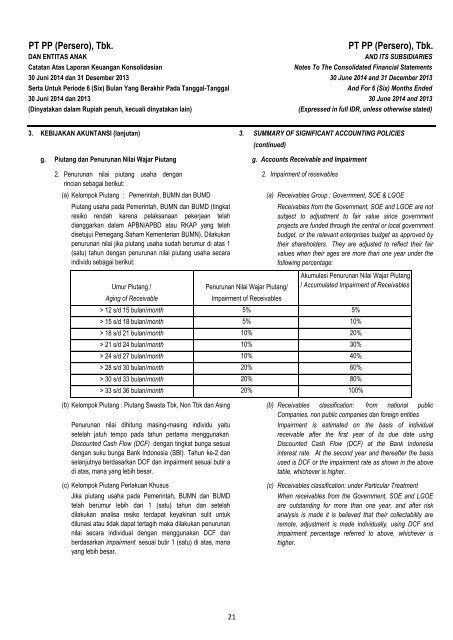

PT PP (Persero), Tbk.DAN ENTITAS ANAKCatatan Atas Laporan Keuangan KonsolidasianPT PP (Persero), Tbk.AND ITS SUBSIDIARIESNOTES TO Notes THE CONSOLIDATED To The Consolidated FINANCIAL Financial STATEMENTSStatements30 Juni 2014 dan 31 Desember 2013 30 June 2014 and 31 December 2013Serta Untuk Periode 6 (Six) Bulan Yang Berakhir Pada Tanggal-TanggalAnd For FOR 6 THE (Six) YEARS Months ENDED Ended30 Juni 2014 dan 2013 31 DECEMBER 30 June 2013 2014 AND and 2013 2012(Dinyatakan dalam Rupiah penuh, kecuali dinyatakan lain)(Expressed in full IDR, unless otherwise stated)3. KEBIJAKAN AKUNTANSI (lanjutan) 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES(continued)g. Piutang dan Penurunan Nilai Wajar Piutang g. Accounts Receivable and Impairment2. Penurunan nilai piutang usaha dengan2. Impairment of receivablesrincian sebagai berikut:(a) Kelompok Piutang : Pemerintah, BUMN dan BUMDPiutang usaha pada Pemerintah, BUMN dan BUMD (tingkatresiko rendah karena pelaksanaan pekerjaan telahdianggarkan dalam APBN/APBD atau RKAP yang telahdisetujui Pemegang Saham Kementerian BUMN). Dilakukanpenurunan nilai jika piutang usaha sudah berumur di atas 1(satu) tahun dengan penurunan nilai piutang usaha secaraindividu sebagai berikut:Umur Piutang /Aging of Receivable> 18 s/d 21 bulan/month10%> 21 s/d 24 bulan/month 10%> 28 s/d 30 bulan/month> 30 s/d 33 bulan/month(a)Penurunan Nilai Wajar Piutang/> 12 s/d 15 bulan/month 5%Receivables Group : Government, SOE & LGOEReceivables from the Government, SOE and LGOE are notsubject to adjustment to fair value since governmentprojects are funded through the central or local governmentbudget, or the relevant enterprises budget as approved bytheir shareholders. They are adjusted to reflect their fairvalues when their ages are more than one year under thefollowing percentage:> 15 s/d 18 bulan/month 5% 10%> 24 s/d 27 bulan/monthImpairment of Receivables10%> 33 s/d 36 bulan/month 20%Akumulasi Penurunan Nilai Wajar Piutang/ Accumulated Impairment of Receivables5%20%30%40%20% 60%20% 80%100%(b) Kelompok Piutang : Piutang Swasta Tbk, Non Tbk dan AsingPenurunan nilai dihitung masing-masing individu yaitusetelah jatuh tempo pada tahun pertama menggunakanDiscounted Cash Flow (DCF) dengan tingkat bunga sesuaidengan suku bunga Bank Indonesia (SBI). Tahun ke-2 danselanjutnya berdasarkan DCF dan impairment sesuai butir adi atas, mana yang lebih besar.(c) Kelompok Piutang Perlakuan KhususJika piutang usaha pada Pemerintah, BUMN dan BUMDtelah berumur lebih dari 1 (satu) tahun dan setelahdilakukan analisa resiko terdapat keyakinan sulit untukdilunasi atau tidak dapat tertagih maka dilakukan penurunannilai secara individual dengan menggunakan DCF danberdasarkan impairment sesuai butir 1 (satu) di atas, manayang lebih besar.(b)(c)Receivables classification: from national publicCompanies, non public companies dan foreign entitiesImpairment is estimated on the basis of individualreceivable after the first year of its due date usingDiscounted Cash Flow (DCF) at the Bank Indonesiainterest rate. At the second year and thereafter the basisused is DCF or the impairment rate as shown in the abovetable, whichever is higher.Receivables classification: under Particular TreatmentWhen receivables from the Government, SOE and LGOEare outstanding for more than one year, and after riskanalysis is made it is believed that their collectability areremote, adjustment is made individually, using DCF andimpairment percentage referred to above, whichever ishigher.21