s2dQo5

s2dQo5

s2dQo5

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

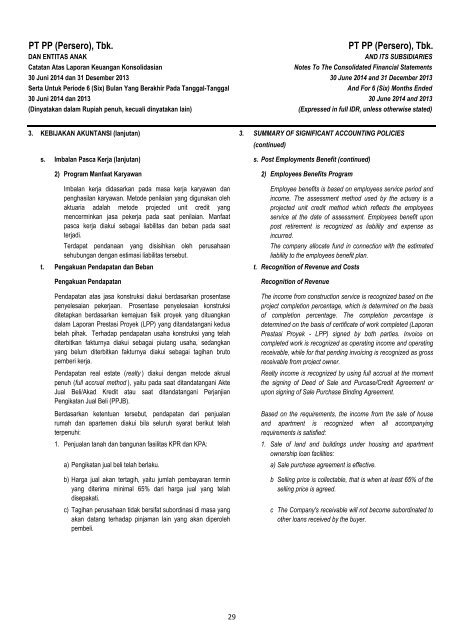

PT PP (Persero), Tbk.DAN ENTITAS ANAKCatatan Atas Laporan Keuangan KonsolidasianPT PP (Persero), Tbk.AND ITS SUBSIDIARIESNOTES TO Notes THE CONSOLIDATED To The Consolidated FINANCIAL Financial STATEMENTSStatements30 Juni 2014 dan 31 Desember 2013 30 June 2014 and 31 December 2013Serta Untuk Periode 6 (Six) Bulan Yang Berakhir Pada Tanggal-TanggalAnd For FOR 6 THE (Six) YEARS Months ENDED Ended30 Juni 2014 dan 2013 31 DECEMBER 30 June 2013 2014 AND and 2013 2012(Dinyatakan dalam Rupiah penuh, kecuali dinyatakan lain)(Expressed in full IDR, unless otherwise stated)3. KEBIJAKAN AKUNTANSI (lanjutan) 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES(continued)s. Imbalan Pasca Kerja (lanjutan) s. Post Employments Benefit (continued)2) Program Manfaat Karyawan 2) Employees Benefits ProgramImbalan kerja didasarkan pada masa kerja karyawan danpenghasilan karyawan. Metode penilaian yang digunakan olehaktuaria adalah metode projected unit credit yangmencerminkan jasa pekerja pada saat penilaian. Manfaatpasca kerja diakui sebagai liabilitas dan beban pada saatterjadi.Terdapat pendanaan yang disisihkan oleh perusahaansehubungan dengan estimasi liabilitas tersebut.Employee benefits is based on employees service period andincome. The assessment method used by the actuary is aprojected unit credit method which reflects the employeesservice at the date of assessment. Employees benefit uponpost retirement is recognized as liability and expense asincurred.The company allocate fund in connection with the estimatedliability to the employees benefit plan.t. Pengakuan Pendapatan dan Beban t. Recognition of Revenue and CostsPengakuan PendapatanRecognition of RevenuePendapatan atas jasa konstruksi diakui berdasarkan prosentasepenyelesaian pekerjaan. Prosentase penyelesaian konstruksiditetapkan berdasarkan kemajuan fisik proyek yang dituangkandalam Laporan Prestasi Proyek (LPP) yang ditandatangani keduabelah pihak. Terhadap pendapatan usaha konstruksi yang telahditerbitkan fakturnya diakui sebagai piutang usaha, sedangkanyang belum diterbitkan fakturnya diakui sebagai tagihan brutopemberi kerja.Pendapatan real estate (realty ) diakui dengan metode akrualpenuh (full accrual method ), yaitu pada saat ditandatangani AkteJual Beli/Akad Kredit atau saat ditandatangani PerjanjianPengikatan Jual Beli (PPJB).Berdasarkan ketentuan tersebut, pendapatan dari penjualanrumah dan apartemen diakui bila seluruh syarat berikut telahterpenuhi:1. Penjualan tanah dan bangunan fasilitas KPR dan KPA:1.a) Pengikatan jual beli telah berlaku. a) Sale purchase agreement is effective.b) Harga jual akan tertagih, yaitu jumlah pembayaran terminbyang diterima minimal 65% dari harga jual yang telah)disepakati.c) Tagihan perusahaan tidak bersifat subordinasi di masa yangcakan datang terhadap pinjaman lain yang akan diperoleh)pembeli.The income from construction service is recognized based on theproject completion percentage, which is determined on the basisof completion percentage. The completion percentage isdetermined on the basis of certificate of work completed (LaporanPrestasi Proyek - LPP) signed by both parties. Invoice oncompleted work is recognized as operating income and operatingreceivable, while for that pending invoicing is recognized as grossreceivable from project owner.Realty income is recognized by using full accrual at the momentthe signing of Deed of Sale and Purcase/Credit Agreement orupon signing of Sale Purchase Binding Agreement.Based on the requirements, the income from the sale of houseand apartment is recognized when all accompanyingrequirements is satisfied:Sale of land and buildings under housing and apartmentownership loan facilities:Selling price is collectable, that is when at least 65% of theselling price is agreed.The Company's receivable will not become subordinated toother loans received by the buyer.29