ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30. Employee share option and share purchase plans<br />

Starting February 2005, the Group launched a yearly Executive Equity Award Program (EEAP) for the Board<br />

of Directors of <strong>Sonova</strong> Holding AG, for the Management Board as well as for the management and senior<br />

employees of other Group Companies. In February 2005, 2006 and 2007 the Group off ered in addition a<br />

Share Purchase Plan (SPP) for the Group’s employees.<br />

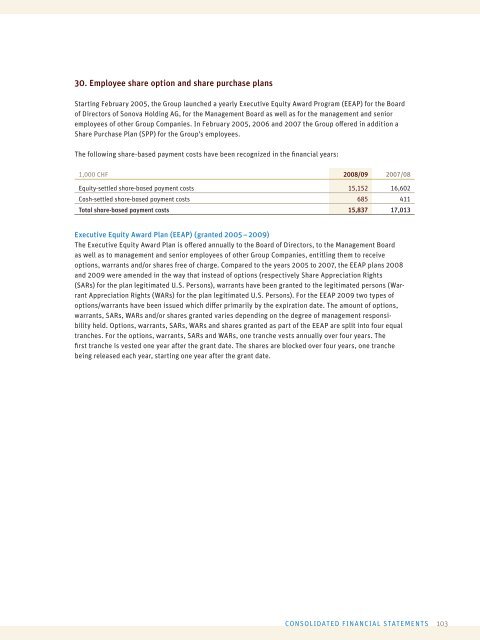

The following share-based payment costs have been recognized in the fi nancial years:<br />

1,000 CHF <strong>2008</strong>/<strong>09</strong> 2007/08<br />

Equity-settled share-based payment costs 15,152 16,602<br />

Cash-settled share-based payment costs 685 411<br />

Total share-based payment costs 15,837 17,013<br />

Executive Equity Award Plan (EEAP) (granted 2005 – 20<strong>09</strong>)<br />

The Executive Equity Award Plan is off ered annually to the Board of Directors, to the Management Board<br />

as well as to management and senior employees of other Group Companies, entitling them to receive<br />

options, warrants and/or shares free of charge. Compared to the years 2005 to 2007, the EEAP plans <strong>2008</strong><br />

and 20<strong>09</strong> were amended in the way that instead of options (respectively Share Appreciation Rights<br />

(SARs) for the plan legitimated U.S. Persons), warrants have been granted to the legitimated persons (Warrant<br />

Appreciation Rights (WARs) for the plan legitimated U.S. Persons). For the EEAP 20<strong>09</strong> two types of<br />

options/warrants have been issued which diff er primarily by the expiration date. The amount of options,<br />

warrants, SARs, WARs and/or shares granted varies depending on the degree of management responsibility<br />

held. Options, warrants, SARs, WARs and shares granted as part of the EEAP are split into four equal<br />

tranches. For the options, warrants, SARs and WARs, one tranche vests annually over four years. The<br />

fi rst tranche is vested one year after the grant date. The shares are blocked over four years, one tranche<br />

being released each year, starting one year after the grant date.<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

103