ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

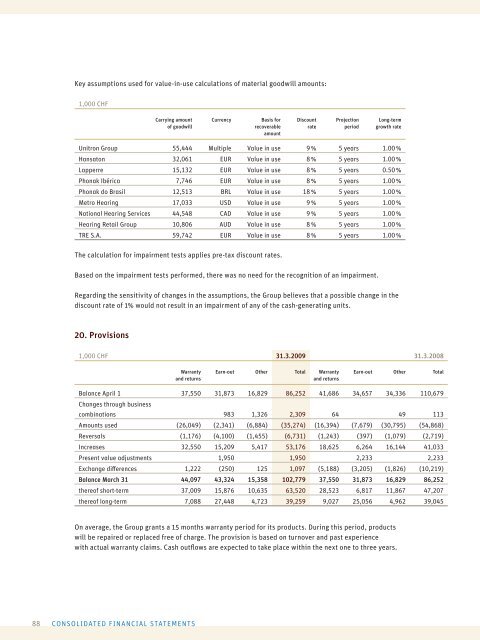

Key assumptions used for value-in-use calculations of material goodwill amounts:<br />

1,000 CHF<br />

Carrying amount<br />

of goodwill<br />

88 CONSOLIDATED FINANCIAL STATEMENTS<br />

Currency Basis for<br />

recoverable<br />

amount<br />

Discount<br />

rate<br />

Projection<br />

period<br />

Long-term<br />

growth rate<br />

Unitron Group 55,444 Multiple Value in use 9 % 5 years 1.00 %<br />

Hansaton 32,061 EUR Value in use 8 % 5 years 1.00 %<br />

Lapperre 15,132 EUR Value in use 8 % 5 years 0.50 %<br />

Phonak Ibérica 7,746 EUR Value in use 8 % 5 years 1.00 %<br />

Phonak do Brasil 12,513 BRL Value in use 18 % 5 years 1.00 %<br />

Metro Hearing 17,033 USD Value in use 9 % 5 years 1.00 %<br />

National Hearing Services 44,548 CAD Value in use 9 % 5 years 1.00 %<br />

Hearing Retail Group 10,806 AUD Value in use 8 % 5 years 1.00 %<br />

TRE S.A. 59,742 EUR Value in use 8 % 5 years 1.00 %<br />

The calculation for impairment tests applies pre-tax discount rates.<br />

Based on the impairment tests performed, there was no need for the recognition of an impairment.<br />

Regarding the sensitivity of changes in the assumptions, the Group believes that a possible change in the<br />

discount rate of 1% would not result in an impairment of any of the cash-generating units.<br />

20. Provisions<br />

1,000 CHF 31.3.20<strong>09</strong> 31.3.<strong>2008</strong><br />

Warranty<br />

and returns<br />

Earn-out Other Total Warranty<br />

and returns<br />

Earn-out Other Total<br />

Balance April 1<br />

Changes through business<br />

37,550 31,873 16,829 86,252 41,686 34,657 34,336 110,679<br />

combinations 983 1,326 2,3<strong>09</strong> 64 49 113<br />

Amounts used (26,049) (2,341) (6,884) (35,274) (16,394) (7,679) (30,795) (54,868)<br />

Reversals (1,176) (4,100) (1,455) (6,731) (1,243) (397) (1,079) (2,719)<br />

Increases 32,550 15,2<strong>09</strong> 5,417 53,176 18,625 6,264 16,144 41,033<br />

Present value adjustments 1,950 1,950 2,233 2,233<br />

Exchange diff erences 1,222 (250) 125 1,<strong>09</strong>7 (5,188) (3,205) (1,826) (10,219)<br />

Balance March 31 44,<strong>09</strong>7 43,324 15,358 102,779 37,550 31,873 16,829 86,252<br />

thereof short-term 37,0<strong>09</strong> 15,876 10,635 63,520 28,523 6,817 11,867 47,207<br />

thereof long-term 7,088 27,448 4,723 39,259 9,027 25,056 4,962 39,045<br />

On average, the Group grants a 15 months warranty period for its products. During this period, products<br />

will be repaired or replaced free of charge. The provision is based on turnover and past experience<br />

with actual warranty claims. Cash outfl ows are expected to take place within the next one to three years.