ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

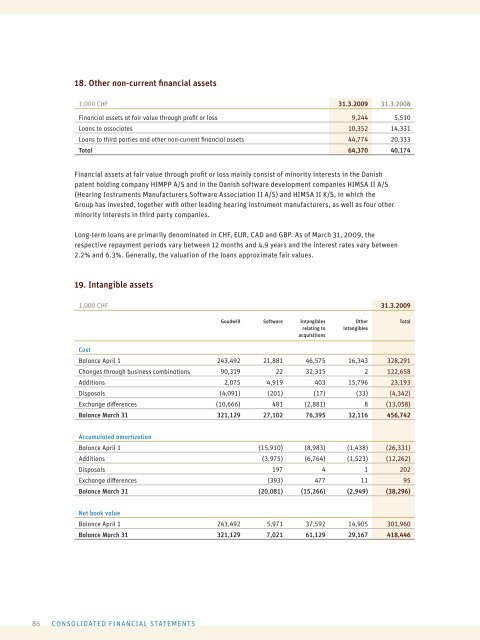

18. Other non-current fi nancial assets<br />

1,000 CHF 31.3.20<strong>09</strong> 31.3.<strong>2008</strong><br />

Financial assets at fair value through profi t or loss 9,244 5,510<br />

Loans to associates 10,352 14,331<br />

Loans to third parties and other non-current fi nancial assets 44,774 20,333<br />

Total 64,370 40,174<br />

Financial assets at fair value through profi t or loss mainly consist of minority interests in the Danish<br />

patent holding company HIMPP A/S and in the Danish software development companies HIMSA II A/S<br />

(Hearing Instruments Manufacturers Software Association II A/S) and HIMSA II K/S, in which the<br />

Group has invested, together with other leading hearing instrument manufacturers, as well as four other<br />

minority interests in third party companies.<br />

Long-term loans are primarily denominated in CHF, EUR, CAD and GBP. As of March 31, 20<strong>09</strong>, the<br />

respective repayment periods vary between 12 months and 4.9 years and the interest rates vary between<br />

2.2% and 6.3%. Generally, the valuation of the loans approximate fair values.<br />

19. Intangible assets<br />

1,000 CHF 31.3.20<strong>09</strong><br />

Cost<br />

86 CONSOLIDATED FINANCIAL STATEMENTS<br />

Goodwill Software Intangibles<br />

relating to<br />

acquisitions<br />

Other<br />

intangibles<br />

Balance April 1 243,492 21,881 46,575 16,343 328,291<br />

Changes through business combinations 90,319 22 32,315 2 122,658<br />

Additions 2,075 4,919 403 15,796 23,193<br />

Disposals (4,<strong>09</strong>1) (201) (17) (33) (4,342)<br />

Exchange diff erences (10,666) 481 (2,881) 8 (13,058)<br />

Balance March 31 321,129 27,102 76,395 32,116 456,742<br />

Accumulated amortization<br />

Balance April 1 (15,910) (8,983) (1,438) (26,331)<br />

Additions (3,975) (6,764) (1,523) (12,262)<br />

Disposals 197 4 1 202<br />

Exchange diff erences (393) 477 11 95<br />

Balance March 31 (20,081) (15,266) (2,949) (38,296)<br />

Net book value<br />

Balance April 1 243,492 5,971 37,592 14,905 301,960<br />

Balance March 31 321,129 7,021 61,129 29,167 418,446<br />

Total