ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

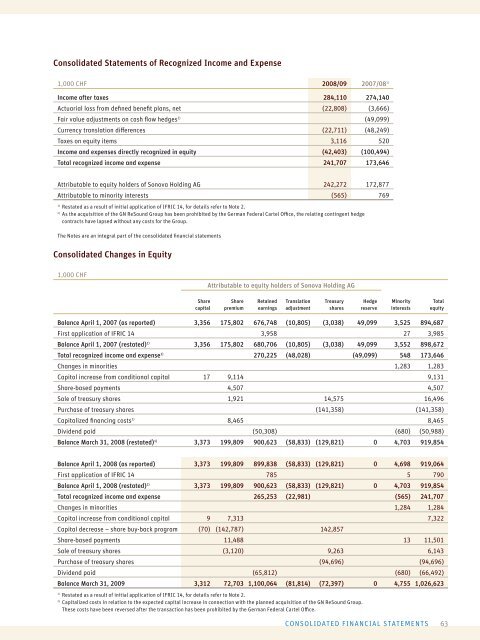

Consolidated Statements of Recognized Income and Expense<br />

1,000 CHF <strong>2008</strong>/<strong>09</strong> 2007/08 1)<br />

Income after taxes 284,110 274,140<br />

Actuarial loss from defi ned benefi t plans, net (22,808) (3,666)<br />

Fair value adjustments on cash fl ow hedges 2) (49,<strong>09</strong>9)<br />

Currency translation diff erences (22,711) (48,249)<br />

Taxes on equity items 3,116 520<br />

Income and expenses directly recognized in equity (42,403) (100,494)<br />

Total recognized income and expense 241,707 173,646<br />

Attributable to equity holders of <strong>Sonova</strong> Holding AG 242,272 172,877<br />

Attributable to minority interests (565) 769<br />

1) Restated as a result of initial application of IFRIC 14, for details refer to Note 2.<br />

2) As the acquisition of the GN ReSound Group has been prohibited by the German Federal Cartel Offi ce, the relating contingent hedge<br />

contracts have lapsed without any costs for the Group.<br />

The Notes are an integral part of the consolidated fi nancial statements<br />

Consolidated Changes in Equity<br />

1,000 CHF<br />

Share<br />

capital<br />

Attributable to equity holders of <strong>Sonova</strong> Holding AG<br />

Share<br />

premium<br />

Retained<br />

earnings<br />

Translation<br />

adjustment<br />

Treasury<br />

shares<br />

Hedge<br />

reserve<br />

Minority<br />

interests<br />

Balance April 1, 2007 (as reported) 3,356 175,802 676,748 (10,805) (3,038) 49,<strong>09</strong>9 3,525 894,687<br />

First application of IFRIC 14 3,958 27 3,985<br />

Balance April 1, 2007 (restated) 1) 3,356 175,802 680,706 (10,805) (3,038) 49,<strong>09</strong>9 3,552 898,672<br />

Total recognized income and expense1) 270,225 (48,028) (49,<strong>09</strong>9) 548 173,646<br />

Changes in minorities 1,283 1,283<br />

Capital increase from conditional capital 17 9,114 9,131<br />

Share-based payments 4,507 4,507<br />

Sale of treasury shares 1,921 14,575 16,496<br />

Purchase of treasury shares (141,358) (141,358)<br />

Capitalized fi nancing costs2) 8,465 8,465<br />

Dividend paid (50,308) (680) (50,988)<br />

Balance March 31, <strong>2008</strong> (restated) 1) 3,373 199,8<strong>09</strong> 900,623 (58,833) (129,821) 0 4,703 919,854<br />

Balance April 1, <strong>2008</strong> (as reported) 3,373 199,8<strong>09</strong> 899,838 (58,833) (129,821) 0 4,698 919,064<br />

First application of IFRIC 14 785 5 790<br />

Balance April 1, <strong>2008</strong> (restated) 1) 3,373 199,8<strong>09</strong> 900,623 (58,833) (129,821) 0 4,703 919,854<br />

Total recognized income and expense 265,253 (22,981) (565) 241,707<br />

Changes in minorities 1,284 1,284<br />

Capital increase from conditional capital 9 7,313 7,322<br />

Capital decrease – share buy-back program (70) (142,787) 142,857<br />

Share-based payments 11,488 13 11,501<br />

Sale of treasury shares (3,120) 9,263 6,143<br />

Purchase of treasury shares (94,696) (94,696)<br />

Dividend paid (65,812) (680) (66,492)<br />

Balance March 31, 20<strong>09</strong> 3,312 72,703 1,100,064 (81,814) (72,397) 0 4,755 1,026,623<br />

1) Restated as a result of initial application of IFRIC 14, for details refer to Note 2.<br />

2) Capitalized costs in relation to the expected capital increase in connection with the planned acquisition of the GN ReSound Group.<br />

These costs have been reversed after the transaction has been prohibited by the German Federal Cartel Offi ce.<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Total<br />

equity<br />

63