ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

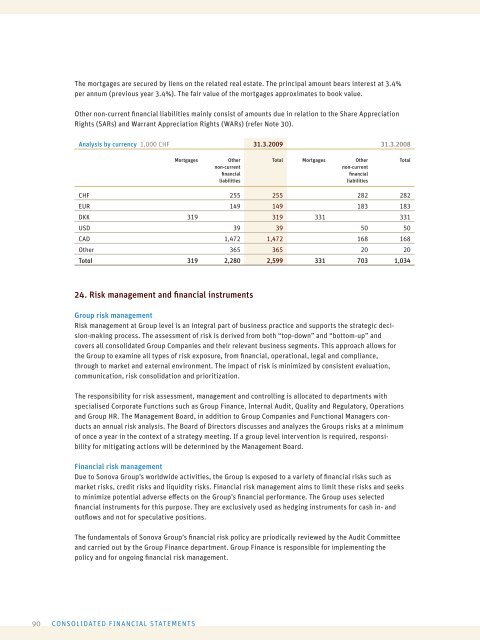

The mortgages are secured by liens on the related real estate. The principal amount bears interest at 3.4%<br />

per annum (previous year 3.4%). The fair value of the mortgages approximates to book value.<br />

Other non-current fi nancial liabilities mainly consist of amounts due in relation to the Share Appreciation<br />

Rights (SARs) and Warrant Appreciation Rights (WARs) (refer Note 30).<br />

Analysis by currency 1,000 CHF 31.3.20<strong>09</strong> 31.3.<strong>2008</strong><br />

90 CONSOLIDATED FINANCIAL STATEMENTS<br />

Mortgages Other<br />

non-current<br />

fi nancial<br />

liabilities<br />

Total Mortgages Other<br />

non-current<br />

fi nancial<br />

liabilities<br />

CHF 255 255 282 282<br />

EUR 149 149 183 183<br />

DKK 319 319 331 331<br />

USD 39 39 50 50<br />

CAD 1,472 1,472 168 168<br />

Other 365 365 20 20<br />

Total 319 2,280 2,599 331 703 1,034<br />

24. Risk management and fi nancial instruments<br />

Group risk management<br />

Risk management at Group level is an integral part of business practice and supports the strategic decision-making<br />

process. The assessment of risk is derived from both “top-down” and “bottom-up” and<br />

covers all consolidated Group Companies and their relevant business segments. This approach allows for<br />

the Group to examine all types of risk exposure, from fi nancial, operational, legal and compliance,<br />

through to market and external environment. The impact of risk is minimized by consistent evaluation,<br />

communication, risk consolidation and prioritization.<br />

The responsibility for risk assessment, management and controlling is allocated to departments with<br />

specialised Corporate Functions such as Group Finance, Internal Audit, Quality and Regulatory, Operations<br />

and Group HR. The Management Board, in addition to Group Companies and Functional Managers conducts<br />

an annual risk analysis. The Board of Directors discusses and analyzes the Groups risks at a min imum<br />

of once a year in the context of a strategy meeting. If a group level intervention is required, respon sibility<br />

for mitigating actions will be determined by the Management Board.<br />

Financial risk management<br />

Due to <strong>Sonova</strong> Group’s worldwide activities, the Group is exposed to a variety of fi nancial risks such as<br />

market risks, credit risks and liquidity risks. Financial risk management aims to limit these risks and seeks<br />

to minimize potential adverse eff ects on the Group’s fi nancial performance. The Group uses selected<br />

fi nancial instruments for this purpose. They are exclusively used as hedging instruments for cash in- and<br />

outfl ows and not for speculative positions.<br />

The fundamentals of <strong>Sonova</strong> Group’s fi nancial risk policy are priodically reviewed by the Audit Committee<br />

and carried out by the Group Finance department. Group Finance is responsible for implementing the<br />

policy and for ongoing fi nancial risk management.<br />

Total