ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

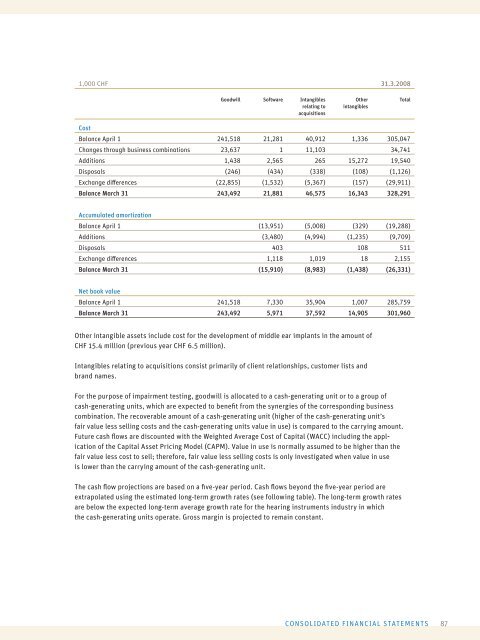

1,000 CHF 31.3.<strong>2008</strong><br />

Cost<br />

Goodwill Software Intangibles<br />

relating to<br />

acquisitions<br />

Other<br />

intangibles<br />

Balance April 1 241,518 21,281 40,912 1,336 305,047<br />

Changes through business combinations 23,637 1 11,103 34,741<br />

Additions 1,438 2,565 265 15,272 19,540<br />

Disposals (246) (434) (338) (108) (1,126)<br />

Exchange diff erences (22,855) (1,532) (5,367) (157) (29,911)<br />

Balance March 31 243,492 21,881 46,575 16,343 328,291<br />

Accumulated amortization<br />

Balance April 1 (13,951) (5,008) (329) (19,288)<br />

Additions (3,480) (4,994) (1,235) (9,7<strong>09</strong>)<br />

Disposals 403 108 511<br />

Exchange diff erences 1,118 1,019 18 2,155<br />

Balance March 31 (15,910) (8,983) (1,438) (26,331)<br />

Net book value<br />

Balance April 1 241,518 7,330 35,904 1,007 285,759<br />

Balance March 31 243,492 5,971 37,592 14,905 301,960<br />

Other intangible assets include cost for the development of middle ear implants in the amount of<br />

CHF 15.4 million (previous year CHF 6.5 million).<br />

Intangibles relating to acquisitions consist primarily of client relationships, customer lists and<br />

brand names.<br />

For the purpose of impairment testing, goodwill is allocated to a cash-generating unit or to a group of<br />

cash-generating units, which are expected to benefi t from the synergies of the corresponding business<br />

combination. The recoverable amount of a cash-generating unit (higher of the cash-generating unit’s<br />

fair value less selling costs and the cash- generating units value in use) is compared to the carrying amount.<br />

Future cash fl ows are discounted with the Weighted Average Cost of Capital (WACC) including the application<br />

of the Capital Asset Pricing Model (CAPM). Value in use is normally assumed to be higher than the<br />

fair value less cost to sell; therefore, fair value less selling costs is only investigated when value in use<br />

is lower than the carrying amount of the cash-generating unit.<br />

The cash fl ow projections are based on a fi ve-year period. Cash fl ows beyond the fi ve-year period are<br />

extrapolated using the estimated long-term growth rates (see following table). The long-term growth rates<br />

are below the expected long-term average growth rate for the hearing instruments industry in which<br />

the cash-gen erating units operate. Gross margin is projected to remain constant.<br />

Total<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

87