ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

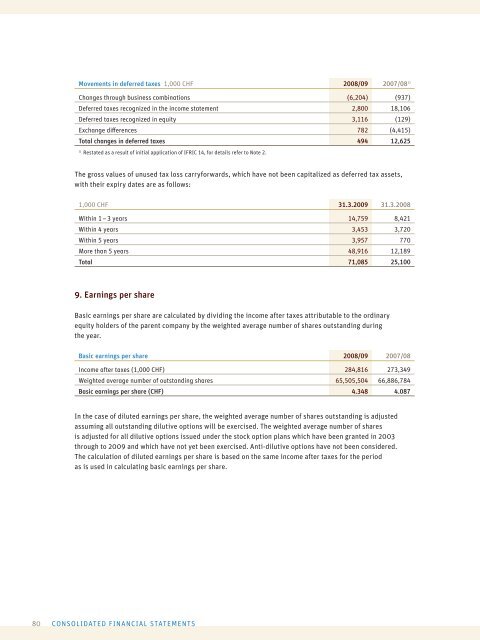

Movements in deferred taxes 1,000 CHF <strong>2008</strong>/<strong>09</strong> 2007/08 1)<br />

Changes through business combinations (6,204) (937)<br />

Deferred taxes recognized in the income statement 2,800 18,106<br />

Deferred taxes recognized in equity 3,116 (129)<br />

Exchange diff erences 782 (4,415)<br />

Total changes in deferred taxes 494 12,625<br />

1) Restated as a result of initial application of IFRIC 14, for details refer to Note 2.<br />

The gross values of unused tax loss carryforwards, which have not been capitalized as deferred tax assets,<br />

with their expiry dates are as follows:<br />

1,000 CHF 31.3.20<strong>09</strong> 31.3.<strong>2008</strong><br />

Within 1 – 3 years 14,759 8,421<br />

Within 4 years 3,453 3,720<br />

Within 5 years 3,957 770<br />

More than 5 years 48,916 12,189<br />

Total 71,085 25,100<br />

9. Earnings per share<br />

Basic earnings per share are calculated by dividing the income after taxes attributable to the ordinary<br />

equity holders of the parent company by the weighted average number of shares outstanding during<br />

the year.<br />

Basic earnings per share <strong>2008</strong>/<strong>09</strong> 2007/08<br />

Income after taxes (1,000 CHF) 284,816 273,349<br />

Weighted average number of outstanding shares 65,505,504 66,886,784<br />

Basic earnings per share (CHF) 4.348 4.087<br />

In the case of diluted earnings per share, the weighted average number of shares outstanding is adjusted<br />

assuming all outstanding dilutive options will be exercised. The weighted average number of shares<br />

is adjusted for all dilutive options issued under the stock option plans which have been granted in 2003<br />

through to 20<strong>09</strong> and which have not yet been exercised. Anti-dilutive options have not been considered.<br />

The calculation of diluted earnings per share is based on the same income after taxes for the period<br />

as is used in calculating basic earnings per share.<br />

80 CONSOLIDATED FINANCIAL STATEMENTS