ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Options/Warrants – Executive Equity Award Plan<br />

The exercise price of the options/warrants is generally equal to the market price of the <strong>Sonova</strong> share at the<br />

SIX Swiss Exchange at grant date. The fair value of the options/warrants granted is estimated at grant<br />

date and recorded as an expense over the corresponding vesting period. Assumptions are made regarding<br />

the forfeiture rate which is adjusted during the vesting period to ensure that in the end only a charge<br />

for vested amounts occurred. While the options may be exercised between the end of the vesting period<br />

and the expiration date of the options the tradable warrants may be sold between the end of the vesting<br />

period and the expiration date of the warrants. If options are exercised, shares are issued from the conditional<br />

share capital. In the case of warrants, shares are issued from the conditional share capital in relation<br />

25:1.<br />

Warrant Appreciation Rights (WARs)/Share Appreciation Rights (SARs) – Executive Equity Award Plan<br />

The exercise price of the WARs/SARs is generally equal to the market price of the <strong>Sonova</strong> share at the SIX<br />

Swiss Exchange at grant date. Upon exercise of a WAR/SAR, a participant shall be paid, in cash, an<br />

amount equal to the products of the number of shares for which the participant exercised WARs/SARs, multiplied<br />

by the excess, if any, of the per-share market price at the date of exercise over the per-share exercise<br />

price (determined at the date of grant of WARs/SARs). The initial fair value of the WARs/SARs is in line<br />

with the valuation of the warrants/options of the respective period and recorded as an expense over the<br />

vesting period. Until the liability is settled, it is revalued at each reporting date recognizing changes in fair<br />

value in the income statement. The WARs/SARs may be sold between the end of the vesting period and<br />

the expiration date of the WARs/SARs.<br />

The carrying amount of the liability relating to the WARs at March 31, 20<strong>09</strong> is CHF 0.4 million (previous<br />

year CHF 0.4 million) and the remaining life is 4.5 years. The carrying amount of the liability relating<br />

to the SARs at March 31, 20<strong>09</strong> is CHF 0.2 million (previous year CHF 0.3 million) and the remaining life is<br />

three years.<br />

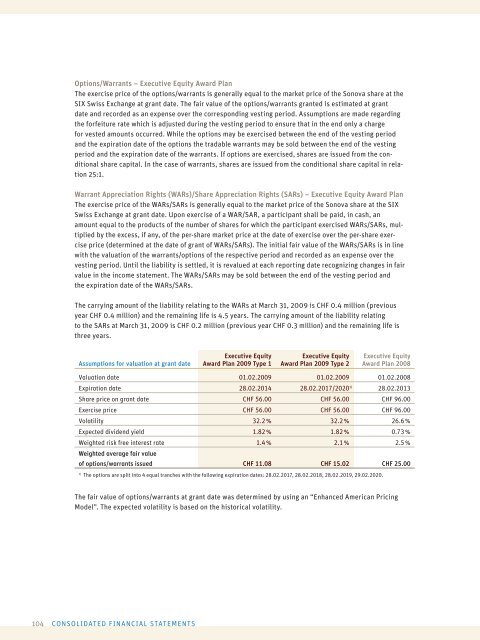

Assumptions for valuation at grant date<br />

104 CONSOLIDATED FINANCIAL STATEMENTS<br />

Executive Equity<br />

Award Plan 20<strong>09</strong> Type 1<br />

Executive Equity<br />

Award Plan 20<strong>09</strong> Type 2<br />

Executive Equity<br />

Award Plan <strong>2008</strong><br />

Valuation date 01.02.20<strong>09</strong> 01.02.20<strong>09</strong> 01.02.<strong>2008</strong><br />

Expiration date 28.02.2014 28.02.2017/20201) 28.02.2013<br />

Share price on grant date CHF 56.00 CHF 56.00 CHF 96.00<br />

Exercise price CHF 56.00 CHF 56.00 CHF 96.00<br />

Volatility 32.2 % 32.2 % 26.6 %<br />

Expected dividend yield 1.82 % 1.82 % 0.73 %<br />

Weighted risk free interest rate<br />

Weighted average fair value<br />

1.4 % 2.1 % 2.5 %<br />

of options/warrants issued CHF 11.08 CHF 15.02 CHF 25.00<br />

1) The options are split into 4 equal tranches with the following expiration dates: 28.02.2017, 28.02.2018, 28.02.2019, 29.02.2020.<br />

The fair value of options/warrants at grant date was determined by using an “Enhanced American Pricing<br />

Model”. The expected volatility is based on the historical volatility.