ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

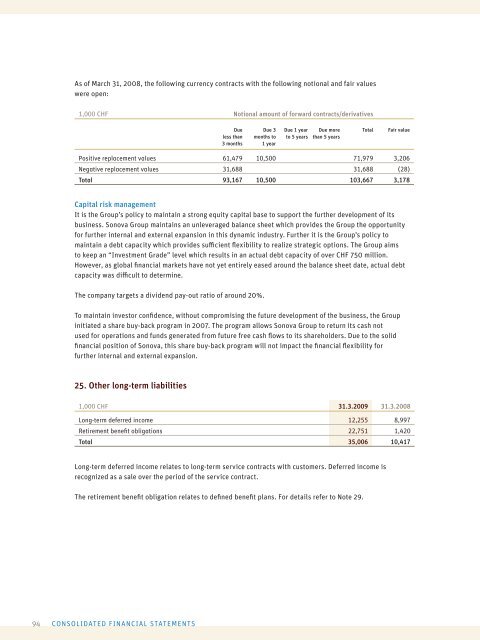

As of March 31, <strong>2008</strong>, the following currency contracts with the following notional and fair values<br />

were open:<br />

1,000 CHF Notional amount of forward contracts/derivatives<br />

94 CONSOLIDATED FINANCIAL STATEMENTS<br />

Due<br />

less than<br />

3 months<br />

Due 3<br />

months to<br />

1 year<br />

Due 1 year<br />

to 5 years<br />

Due more<br />

than 5 years<br />

Total Fair value<br />

Positive replacement values 61,479 10,500 71,979 3,206<br />

Negative replacement values 31,688 31,688 (28)<br />

Total 93,167 10,500 103,667 3,178<br />

Capital risk management<br />

It is the Group’s policy to maintain a strong equity capital base to support the further development of its<br />

business. <strong>Sonova</strong> Group maintains an unleveraged balance sheet which provides the Group the opportunity<br />

for further internal and external expansion in this dynamic industry. Further it is the Group’s policy to<br />

maintain a debt capacity which provides suffi cient fl exibility to realize strategic options. The Group aims<br />

to keep an “Investment Grade” level which results in an actual debt capacity of over CHF 750 million.<br />

However, as global fi nancial markets have not yet entirely eased around the balance sheet date, actual debt<br />

capacity was diffi cult to determine.<br />

The company targets a dividend pay-out ratio of around 20%.<br />

To maintain investor confi dence, without compromising the future development of the business, the Group<br />

initiated a share buy-back program in 2007. The program allows <strong>Sonova</strong> Group to return its cash not<br />

used for operations and funds generated from future free cash fl ows to its shareholders. Due to the solid<br />

fi nancial position of <strong>Sonova</strong>, this share buy-back program will not impact the fi nancial fl exibility for<br />

further internal and external expansion.<br />

25. Other long-term liabilities<br />

1,000 CHF 31.3.20<strong>09</strong> 31.3.<strong>2008</strong><br />

Long-term deferred income 12,255 8,997<br />

Retirement benefi t obligations 22,751 1,420<br />

Total 35,006 10,417<br />

Long-term deferred income relates to long-term service contracts with customers. Deferred income is<br />

recognized as a sale over the period of the service contract.<br />

The retirement benefi t obligation relates to defi ned benefi t plans. For details refer to Note 29.