ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

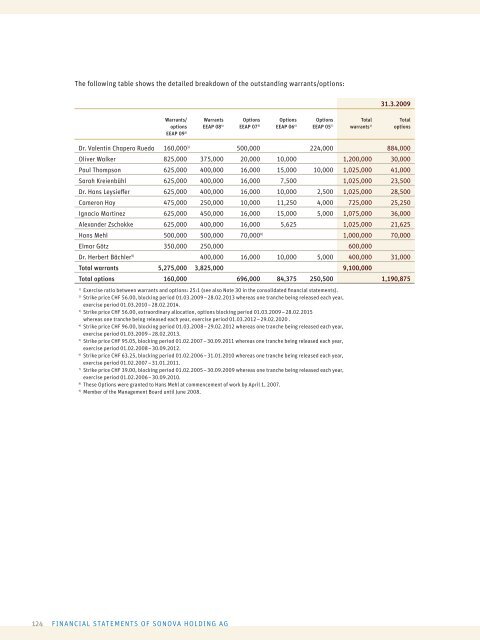

The following table shows the detailed breakdown of the outstanding warrants/options:<br />

Warrants/<br />

options<br />

EEAP <strong>09</strong> 2)<br />

Warrants<br />

EEAP 08 4)<br />

Options<br />

EEAP 07 5)<br />

Options<br />

EEAP 06 6)<br />

Options<br />

EEAP 05 7)<br />

Total<br />

warrants 1)<br />

31.3.20<strong>09</strong><br />

Total<br />

options<br />

Dr. Valentin Chapero Rueda 160,000 3) 500,000 224,000 884,000<br />

Oliver Walker 825,000 375,000 20,000 10,000 1,200,000 30,000<br />

Paul Thompson 625,000 400,000 16,000 15,000 10,000 1,025,000 41,000<br />

Sarah Kreienbühl 625,000 400,000 16,000 7,500 1,025,000 23,500<br />

Dr. Hans Leysieff er 625,000 400,000 16,000 10,000 2,500 1,025,000 28,500<br />

Cameron Hay 475,000 250,000 10,000 11,250 4,000 725,000 25,250<br />

Ignacio Martinez 625,000 450,000 16,000 15,000 5,000 1,075,000 36,000<br />

Alexander Zschokke 625,000 400,000 16,000 5,625 1,025,000 21,625<br />

Hans Mehl 500,000 500,000 70,000 8) 1,000,000 70,000<br />

Elmar Götz 350,000 250,000 600,000<br />

Dr. Herbert Bächler 9) 400,000 16,000 10,000 5,000 400,000 31,000<br />

Total warrants 5,275,000 3,825,000 9,100,000<br />

Total options 160,000 696,000 84,375 250,500 1,190,875<br />

1) Exercise ratio between warrants and options: 25:1 (see also Note 30 in the consolidated fi nancial statements).<br />

2) Strike price CHF 56.00, blocking period 01.03.20<strong>09</strong> – 28.02.2013 whereas one tranche being released each year,<br />

exercise period 01.03.2010 – 28.02.2014.<br />

3) Strike price CHF 56.00, extraordinary allocation, options blocking period 01.03.20<strong>09</strong> – 28.02.2015<br />

whereas one tranche being released each year, exercise period 01.03.2012 – 29.02.2020 .<br />

4) Strike price CHF 96.00, blocking period 01.03.<strong>2008</strong> – 29.02.2012 whereas one tranche being released each year,<br />

exercise period 01.03.20<strong>09</strong> – 28.02.2013.<br />

5) Strike price CHF 95.05, blocking period 01.02.2007 – 30.<strong>09</strong>.2011 whereas one tranche being released each year,<br />

exercise period 01.02.<strong>2008</strong> – 30.<strong>09</strong>.2012.<br />

6) Strike price CHF 63.25, blocking period 01.02.2006 – 31.01.2010 whereas one tranche being released each year,<br />

exercise period 01.02.2007 – 31.01.2011.<br />

7) Strike price CHF 39.00, blocking period 01.02.2005 – 30.<strong>09</strong>.20<strong>09</strong> whereas one tranche being released each year,<br />

exercise period 01.02.2006 – 30.<strong>09</strong>.2010.<br />

8) These Options were granted to Hans Mehl at commencement of work by April 1, 2007.<br />

9) Member of the Management Board until June <strong>2008</strong>.<br />

124 FINANCIAL STATEMENTS OF SONOVA HOLDING AG