ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

ANNUAL REPORT 2008/09 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

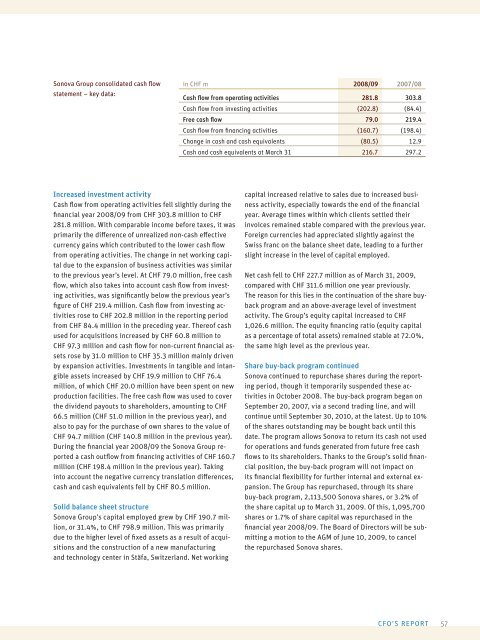

<strong>Sonova</strong> Group consolidated cash fl ow<br />

statement – key data:<br />

Increased investment activity<br />

Cash fl ow from operating activities fell slightly during the<br />

fi nancial year <strong>2008</strong>/<strong>09</strong> from CHF 303.8 million to CHF<br />

281.8 million. With comparable income before taxes, it was<br />

primarily the diff erence of unrealized non-cash eff ective<br />

currency gains which contributed to the lower cash fl ow<br />

from operating activities. The change in net working capital<br />

due to the expansion of business activities was similar<br />

to the previous year’s level. At CHF 79.0 million, free cash<br />

fl ow, which also takes into account cash fl ow from investing<br />

activities, was signifi cantly below the previous year’s<br />

fi gure of CHF 219.4 million. Cash fl ow from investing activities<br />

rose to CHF 202.8 million in the reporting period<br />

from CHF 84.4 million in the preceding year. Thereof cash<br />

used for acquisitions increased by CHF 60.8 million to<br />

CHF 97.3 million and cash fl ow for non-current fi nancial assets<br />

rose by 31.0 million to CHF 35.3 million mainly driven<br />

by expansion activities. Investments in tangible and intangible<br />

assets increased by CHF 19.9 million to CHF 76.4<br />

million, of which CHF 20.0 million have been spent on new<br />

production facilities. The free cash fl ow was used to cover<br />

the dividend payouts to shareholders, amounting to CHF<br />

66.5 million (CHF 51.0 million in the previous year), and<br />

also to pay for the purchase of own shares to the value of<br />

CHF 94.7 million (CHF 140.8 million in the previous year).<br />

During the fi nancial year <strong>2008</strong>/<strong>09</strong> the <strong>Sonova</strong> Group reported<br />

a cash outfl ow from fi nancing activities of CHF 160.7<br />

million (CHF 198.4 million in the previous year). Taking<br />

into account the negative currency translation diff erences,<br />

cash and cash equivalents fell by CHF 80.5 million.<br />

Solid balance sheet structure<br />

<strong>Sonova</strong> Group’s capital employed grew by CHF 190.7 million,<br />

or 31.4%, to CHF 798.9 million. This was primarily<br />

due to the higher level of fi xed assets as a result of acquisitions<br />

and the construction of a new manufacturing<br />

and technology center in Stäfa, Switzerland. Net working<br />

in CHF m <strong>2008</strong>/<strong>09</strong> 2007/08<br />

Cash fl ow from operating activities 281.8 303.8<br />

Cash fl ow from investing activities (202.8) (84.4)<br />

Free cash fl ow 79.0 219.4<br />

Cash fl ow from fi nancing activities (160.7) (198.4)<br />

Change in cash and cash equivalents (80.5) 12.9<br />

Cash and cash equivalents at March 31 216.7 297.2<br />

capital increased relative to sales due to increased business<br />

activity, especially towards the end of the fi nancial<br />

year. Average times within which clients settled their<br />

invoices remained stable compared with the previous year.<br />

Foreign currencies had appreciated slightly against the<br />

Swiss franc on the balance sheet date, leading to a further<br />

slight increase in the level of capital employed.<br />

Net cash fell to CHF 227.7 million as of March 31, 20<strong>09</strong>,<br />

compared with CHF 311.6 million one year previously.<br />

The reason for this lies in the continuation of the share buyback<br />

program and an above-average level of investment<br />

activity. The Group’s equity capital increased to CHF<br />

1,026.6 million. The equity fi nancing ratio (equity capital<br />

as a percentage of total assets) remained stable at 72.0%,<br />

the same high level as the previous year.<br />

Share buy-back program continued<br />

<strong>Sonova</strong> continued to repurchase shares during the reporting<br />

period, though it temporarily suspended these activities<br />

in October <strong>2008</strong>. The buy-back program began on<br />

September 20, 2007, via a second trading line, and will<br />

continue until September 30, 2010, at the latest. Up to 10%<br />

of the shares outstanding may be bought back until this<br />

date. The program allows <strong>Sonova</strong> to return its cash not used<br />

for operations and funds generated from future free cash<br />

fl ows to its shareholders. Thanks to the Group’s solid fi nancial<br />

position, the buy-back program will not impact on<br />

its fi nancial fl exibility for further internal and external expansion.<br />

The Group has repurchased, through its share<br />

buy-back program, 2,113,500 <strong>Sonova</strong> shares, or 3.2% of<br />

the share capital up to March 31, 20<strong>09</strong>. Of this, 1,<strong>09</strong>5,700<br />

shares or 1.7% of share capital was repurchased in the<br />

fi nancial year <strong>2008</strong>/<strong>09</strong>. The Board of Directors will be submitting<br />

a motion to the AGM of June 10, 20<strong>09</strong>, to cancel<br />

the repurchased <strong>Sonova</strong> shares.<br />

CFO’S <strong>REPORT</strong><br />

57