Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Significant works cont<strong>in</strong>ued <strong>in</strong> 2008 to ensure <strong>in</strong>stitutional<br />

development of the bank<strong>in</strong>g system. Pursuant to the Presidential<br />

Decree of March 1, 2005 “On additional measures to further<br />

expand the reforms <strong>in</strong> the f<strong>in</strong>ancial and bank<strong>in</strong>g system of the<br />

Republic of <strong>Azerbaijan</strong>”, activities were cont<strong>in</strong>ued to privatize the<br />

Jo<strong>in</strong>t-Stock Commercial Bank “International Bank of <strong>Azerbaijan</strong>”<br />

and Jo<strong>in</strong>t-Stock Company “Kapital Bank”. JSC “Kapital Bank” was<br />

completely privatized <strong>in</strong> 2008.<br />

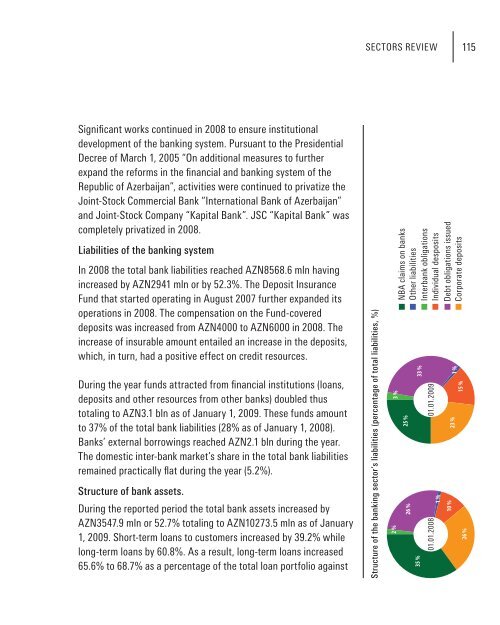

Liabilities of the bank<strong>in</strong>g system<br />

In 2008 the total bank liabilities reached AZN8568.6 mln hav<strong>in</strong>g<br />

<strong>in</strong>creased by AZN2941 mln or by 52.3%. The Deposit Insurance<br />

Fund that started operat<strong>in</strong>g <strong>in</strong> August 2007 further expanded its<br />

operations <strong>in</strong> 2008. The compensation on the Fund-covered<br />

deposits was <strong>in</strong>creased from AZN4000 to AZN6000 <strong>in</strong> 2008. The<br />

<strong>in</strong>crease of <strong>in</strong>surable amount entailed an <strong>in</strong>crease <strong>in</strong> the deposits,<br />

which, <strong>in</strong> turn, had a positive effect on credit resources.<br />

Dur<strong>in</strong>g the year funds attracted from f<strong>in</strong>ancial <strong>in</strong>stitutions (loans,<br />

deposits and other resources from other banks) doubled thus<br />

total<strong>in</strong>g to AZN3.1 bln as of January 1, <strong>2009</strong>. These funds amount<br />

to 37% of the total bank liabilities (28% as of January 1, 2008).<br />

Banks’ external borrow<strong>in</strong>gs reached AZN2.1 bln dur<strong>in</strong>g the year.<br />

The domestic <strong>in</strong>ter-bank market’s share <strong>in</strong> the total bank liabilities<br />

rema<strong>in</strong>ed practically flat dur<strong>in</strong>g the year (5.2%).<br />

Structure of bank assets.<br />

Dur<strong>in</strong>g the reported period the total bank assets <strong>in</strong>creased by<br />

AZN3547.9 mln or 52.7% total<strong>in</strong>g to AZN10273.5 mln as of January<br />

1, <strong>2009</strong>. Short-term loans to customers <strong>in</strong>creased by 39.2% while<br />

long-term loans by 60.8%. As a result, long-term loans <strong>in</strong>creased<br />

65.6% to 68.7% as a percentage of the total loan portfolio aga<strong>in</strong>st<br />

SECTORS REVIEW<br />

115