Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

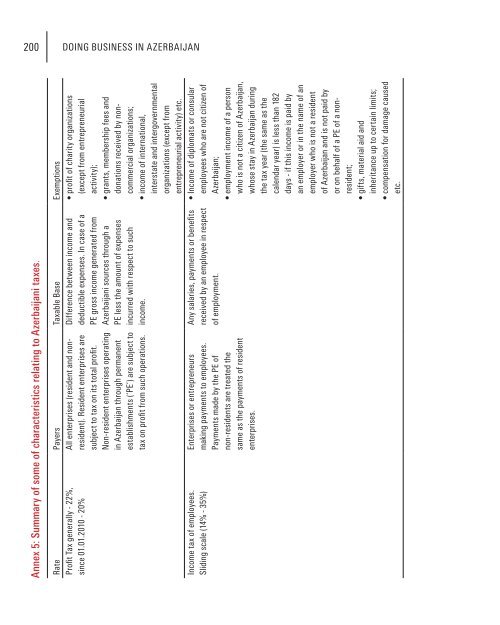

200 DOING BUSINESS IN AZERBAIJAN<br />

Annex 5: Summary of some of characteristics relat<strong>in</strong>g to <strong>Azerbaijan</strong>i taxes.<br />

Rate Payers Taxable Base Exemptions<br />

Profit Tax generally - 22%, All enterprises (resident and non- Difference between <strong>in</strong>come and • profit of charity organizations<br />

s<strong>in</strong>ce 01.01.2010 - 20%<br />

resident). Resident enterprises are deductible expenses. In case of a (except from entrepreneurial<br />

subject to tax on its total profit. PE gross <strong>in</strong>come generated from activity);<br />

Non-resident enterprises operat<strong>in</strong>g <strong>Azerbaijan</strong>i sources through a • grants, membership fees and<br />

<strong>in</strong> <strong>Azerbaijan</strong> through permanent PE less the amount of expenses donations received by non-<br />

establishments (‘PE’) are subject to <strong>in</strong>curred with respect to such commercial organizations;<br />

tax on profit from such operations. <strong>in</strong>come.<br />

• <strong>in</strong>come of <strong>in</strong>ternational,<br />

<strong>in</strong>terstate and <strong>in</strong>tergovernmental<br />

organizations (except from<br />

entrepreneurial activity) etc.<br />

Income tax of employees. Enterprises or entrepreneurs Any salaries, payments or benefits • Income of diplomats or consular<br />

Slid<strong>in</strong>g scale (14% - 35%) mak<strong>in</strong>g payments to employees. received by an employee <strong>in</strong> respect employees who are not citizen of<br />

Payments made by the PE of of employment.<br />

<strong>Azerbaijan</strong>;<br />

non-residents are treated the<br />

• employment <strong>in</strong>come of a person<br />

same as the payments of resident<br />

who is not a citizen of <strong>Azerbaijan</strong>,<br />

enterprises.<br />

whose stay <strong>in</strong> <strong>Azerbaijan</strong> dur<strong>in</strong>g<br />

the tax year (the same as the<br />

calendar year) is less than 182<br />

days - if this <strong>in</strong>come is paid by<br />

an employer or <strong>in</strong> the name of an<br />

employer who is not a resident<br />

of <strong>Azerbaijan</strong> and is not paid by<br />

or on behalf of a PE of a nonresident;<br />

• gifts, material aid and<br />

<strong>in</strong>heritance up to certa<strong>in</strong> limits;<br />

• compensation for damage caused<br />

etc.