Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

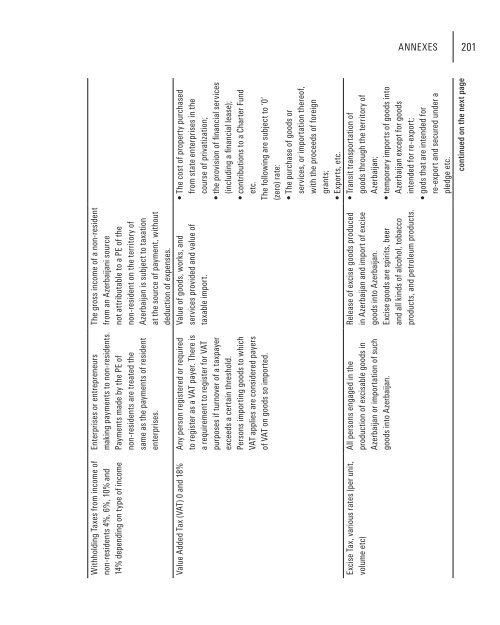

The gross <strong>in</strong>come of a non-resident<br />

from an <strong>Azerbaijan</strong>i source<br />

not attributable to a PE of the<br />

non-resident on the territory of<br />

<strong>Azerbaijan</strong> is subject to taxation<br />

at the source of payment, without<br />

deduction of expenses.<br />

Value of goods, works, and<br />

services provided and value of<br />

taxable import.<br />

Enterprises or entrepreneurs<br />

mak<strong>in</strong>g payments to non-residents.<br />

Payments made by the PE of<br />

non-residents are treated the<br />

same as the payments of resident<br />

enterprises.<br />

Withhold<strong>in</strong>g Taxes from <strong>in</strong>come of<br />

non-residents 4%, 6%, 10% and<br />

14% depend<strong>in</strong>g on type of <strong>in</strong>come<br />

• The cost of property purchased<br />

from state enterprises <strong>in</strong> the<br />

course of privatization;<br />

• the provision of f<strong>in</strong>ancial services<br />

(<strong>in</strong>clud<strong>in</strong>g a f<strong>in</strong>ancial lease);<br />

• contributions to a Charter Fund<br />

etc.<br />

The follow<strong>in</strong>g are subject to ‘0’<br />

(zero) rate:<br />

• The purchase of goods or<br />

services, or importation thereof,<br />

with the proceeds of foreign<br />

grants;<br />

• <strong>Export</strong>s, etc.<br />

• Transit transportation of<br />

goods through the territory of<br />

<strong>Azerbaijan</strong>;<br />

• temporary imports of goods <strong>in</strong>to<br />

<strong>Azerbaijan</strong> except for goods<br />

<strong>in</strong>tended for re-export;<br />

• gods that are <strong>in</strong>tended for<br />

re-export and secured under a<br />

pledge etc.<br />

cont<strong>in</strong>ued on the next page<br />

Value Added Tax (VAT) 0 and 18% Any person registered or required<br />

to register as a VAT payer. There is<br />

a requirement to register for VAT<br />

purposes if turnover of a taxpayer<br />

exceeds a certa<strong>in</strong> threshold.<br />

Persons import<strong>in</strong>g goods to which<br />

VAT applies are considered payers<br />

of VAT on goods so imported.<br />

Release of excise goods produced<br />

<strong>in</strong> <strong>Azerbaijan</strong> and import of excise<br />

goods <strong>in</strong>to <strong>Azerbaijan</strong>.<br />

Excise goods are spirits, beer<br />

and all k<strong>in</strong>ds of alcohol, tobacco<br />

products, and petroleum products.<br />

All persons engaged <strong>in</strong> the<br />

production of excisable goods <strong>in</strong><br />

<strong>Azerbaijan</strong> or importation of such<br />

goods <strong>in</strong>to <strong>Azerbaijan</strong>.<br />

Excise Tax, various rates (per unit,<br />

volume etc)<br />

ANNEXES<br />

201