Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Doing Business in Azerbaijan 2009 - Azerbaijan Export ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

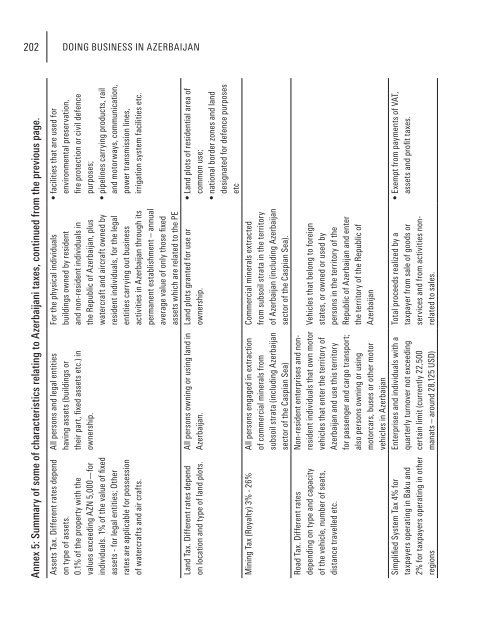

202 DOING BUSINESS IN AZERBAIJAN<br />

Annex 5: Summary of some of characteristics relat<strong>in</strong>g to <strong>Azerbaijan</strong>i taxes, cont<strong>in</strong>ued from the previous page.<br />

• facilities that are used for<br />

environmental preservation,<br />

fire protection or civil defence<br />

purposes;<br />

• pipel<strong>in</strong>es carry<strong>in</strong>g products, rail<br />

and motorways, communication,<br />

power transmission l<strong>in</strong>es,<br />

irrigation system facilities etc.<br />

For the physical <strong>in</strong>dividuals<br />

build<strong>in</strong>gs owned by resident<br />

and non-resident <strong>in</strong>dividuals <strong>in</strong><br />

the Republic of <strong>Azerbaijan</strong>, plus<br />

watercraft and aircraft owned by<br />

resident <strong>in</strong>dividuals, for the legal<br />

entities carry<strong>in</strong>g out bus<strong>in</strong>ess<br />

activities <strong>in</strong> <strong>Azerbaijan</strong> through its<br />

permanent establishment – annual<br />

average value of only those fixed<br />

assets which are related to the PE<br />

All persons and legal entities<br />

hav<strong>in</strong>g assets (build<strong>in</strong>gs or<br />

their part, fixed assets etc.) <strong>in</strong><br />

ownership.<br />

Assets Tax. Different rates depend<br />

on type of assets.<br />

0.1% of the property with the<br />

values exceed<strong>in</strong>g AZN 5,000—for<br />

<strong>in</strong>dividuals. 1% of the value of fixed<br />

assets - for legal entities; Other<br />

rates are applicable for possession<br />

of watercrafts and air crafts.<br />

• Land plots of residential area of<br />

common use;<br />

• national border zones and land<br />

designated for defence purposes<br />

etc<br />

Land plots granted for use or<br />

ownership.<br />

All persons own<strong>in</strong>g or us<strong>in</strong>g land <strong>in</strong><br />

<strong>Azerbaijan</strong>.<br />

Land Tax. Different rates depend<br />

on location and type of land plots.<br />

Commercial m<strong>in</strong>erals extracted<br />

from subsoil strata <strong>in</strong> the territory<br />

of <strong>Azerbaijan</strong> (<strong>in</strong>clud<strong>in</strong>g <strong>Azerbaijan</strong><br />

sector of the Caspian Sea).<br />

M<strong>in</strong><strong>in</strong>g Tax (Royalty) 3% - 26% All persons engaged <strong>in</strong> extraction<br />

of commercial m<strong>in</strong>erals from<br />

subsoil strata (<strong>in</strong>clud<strong>in</strong>g <strong>Azerbaijan</strong><br />

sector of the Caspian Sea)<br />

Vehicles that belong to foreign<br />

states, or owned or used by<br />

persons <strong>in</strong> the territory of the<br />

Republic of <strong>Azerbaijan</strong> and enter<br />

the territory of the Republic of<br />

<strong>Azerbaijan</strong><br />

Non-resident enterprises and nonresident<br />

<strong>in</strong>dividuals that own motor<br />

vehicles that enter the territory of<br />

<strong>Azerbaijan</strong> and use this territory<br />

for passenger and cargo transport;<br />

also persons own<strong>in</strong>g or us<strong>in</strong>g<br />

motorcars, buses or other motor<br />

vehicles <strong>in</strong> <strong>Azerbaijan</strong><br />

Enterprises and <strong>in</strong>dividuals with a<br />

quarterly turnover not exceed<strong>in</strong>g<br />

certa<strong>in</strong> limit (currently 22,500<br />

manats – around 28,125 USD)<br />

Road Tax. Different rates<br />

depend<strong>in</strong>g on type and capacity<br />

of the vehicle, number of seats,<br />

distance travelled etc.<br />

• Exempt from payments of VAT,<br />

assets and profit taxes.<br />

Total proceeds realized by a<br />

taxpayer from sale of goods or<br />

services and from activities nonrelated<br />

to sales.<br />

Simplified System Tax 4% for<br />

taxpayers operat<strong>in</strong>g <strong>in</strong> Baku and<br />

2% for taxpayers operat<strong>in</strong>g <strong>in</strong> other<br />

regions