GRISUMMIT - Global Real Estate Institute

GRISUMMIT - Global Real Estate Institute

GRISUMMIT - Global Real Estate Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RREEF <strong>Real</strong> <strong>Estate</strong> acquires and manages investments in commercial and residential<br />

property, and real estate securities on behalf of its institutional and private clients worldwide.<br />

Its product offering is global and comprehensive, including core, value-enhanced and high<br />

yield property investments as well as investments in publicly traded real estate securities.<br />

RREEF <strong>Real</strong> <strong>Estate</strong> has more than 55.5 billion in assets under management worldwide as of<br />

31 December 2007.<br />

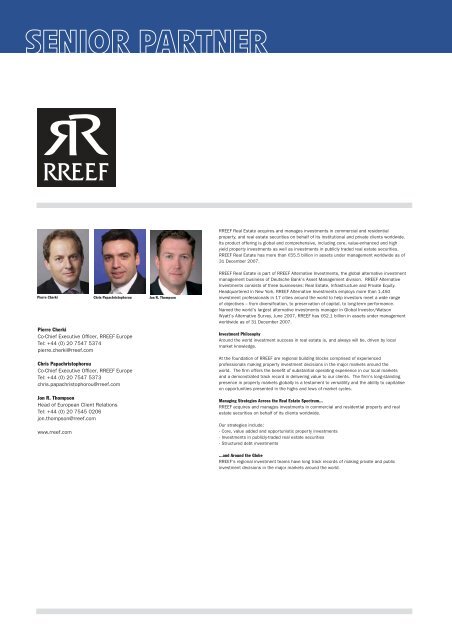

Pierre Cherki<br />

Pierre Cherki<br />

Co-Chief Executive Officer, RREEF Europe<br />

Tel: +44 (0) 20 7547 5374<br />

pierre.cherki@rreef.com<br />

Chris Papachristophorou<br />

Co-Chief Executive Officer, RREEF Europe<br />

Tel: +44 (0) 20 7547 5373<br />

chris.papachristophorou@rreef.com<br />

Jon R. Thompson<br />

Head of European Client Relations<br />

Tel: +44 (0) 20 7545 0206<br />

jon.thompson@rreef.com<br />

www.rreef.com<br />

Chris Papachristophorou<br />

Jon R. Thompson<br />

RREEF <strong>Real</strong> <strong>Estate</strong> is part of RREEF Alternative Investments, the global alternative investment<br />

management business of Deutsche Bank’s Asset Management division. RREEF Alternative<br />

Investments consists of three businesses: <strong>Real</strong> <strong>Estate</strong>, Infrastructure and Private Equity.<br />

Headquartered in New York, RREEF Alternative Investments employs more than 1,450<br />

investment professionals in 17 cities around the world to help investors meet a wide range<br />

of objectives – from diversification, to preservation of capital, to long-term performance.<br />

Named the world’s largest alternative investments manager in <strong>Global</strong> Investor/Watson<br />

Wyatt’s Alternative Survey, June 2007, RREEF has 62.1 billion in assets under management<br />

worldwide as of 31 December 2007.<br />

Investment Philosophy<br />

Around the world investment success in real estate is, and always will be, driven by local<br />

market knowledge.<br />

At the foundation of RREEF are regional building blocks comprised of experienced<br />

professionals making property investment decisions in the major markets around the<br />

world. The firm offers the benefit of substantial operating experience in our local markets<br />

and a demonstrated track record in delivering value to our clients. The firm’s long-standing<br />

presence in property markets globally is a testament to versatility and the ability to capitalise<br />

on opportunities presented in the highs and lows of market cycles.<br />

Managing Strategies Across the <strong>Real</strong> <strong>Estate</strong> Spectrum...<br />

RREEF acquires and manages investments in commercial and residential property and real<br />

estate securities on behalf of its clients worldwide.<br />

Our strategies include:<br />

· Core, value added and opportunistic property investments<br />

· Investments in publicly-traded real estate securities<br />

· Structured debt investments<br />

...and Around the Globe<br />

RREEF’s regional investment teams have long track records of making private and public<br />

investment decisions in the major markets around the world.