GRISUMMIT - Global Real Estate Institute

GRISUMMIT - Global Real Estate Institute

GRISUMMIT - Global Real Estate Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

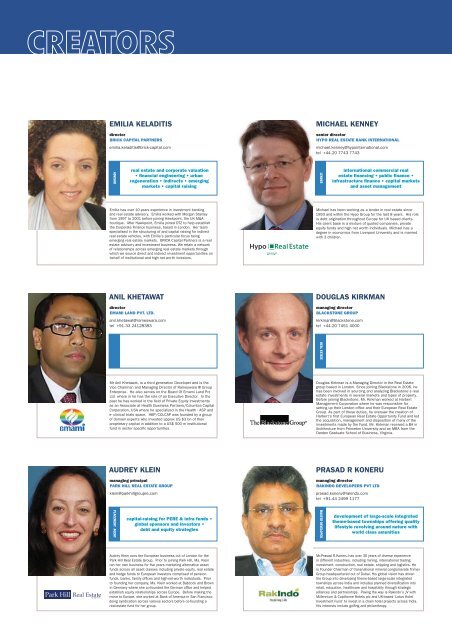

EMILIA KELADITIS<br />

director<br />

BRICK CAPITAL PARTNERS<br />

emilia.keladitis@brick-capital.com<br />

MICHAEL KENNEY<br />

senior director<br />

HYPO REAL ESTATE BANK INTERNATIONAL<br />

michael.kenney@hypointernational.com<br />

tel +44.20 7743 7743<br />

ADVISOR<br />

real estate and corporate valuation<br />

• financial engineering • urban<br />

regeneration • indirects • emerging<br />

markets • capital raising<br />

LENDER<br />

international commercial real<br />

estate financing • public finance •<br />

infrastructure finance • capital markets<br />

and asset management<br />

Emilia has over 10 years experience in investment banking<br />

and real estate advisory. Emilia worked with Morgan Stanley<br />

from 1997 to 2001 before joining Hawkpoint, the UK M&A<br />

boutique. After Hawkpoint, Emilia joined DTZ to help establish<br />

the Corporate Finance business, based in London. Her team<br />

specialised in the structuring of and capital raising for indirect<br />

real estate vehicles, with Emilia’s particular focus being<br />

emerging real estate markets. BRICK Capital Partners is a real<br />

estate advisory and investment business. We retain a network<br />

of relationships across emerging real estate markets through<br />

which we source direct and indirect investment opportunities on<br />

behalf of institutional and high net worth investors.<br />

Michael has been working as a lender in real estate since<br />

1993 and within the Hypo Group for the last 8 years. His role<br />

is debt origination throughout Europe for UK based clients.<br />

His client base is a mixture of quoted companies, private<br />

equity funds and high net worth individuals. Michael has a<br />

degree in economics from Liverpool University and is married<br />

with 3 children.<br />

ANIL KHETAWAT<br />

director<br />

EMAMI LAND PVT. LTD.<br />

anil.khetawat@rameswara.com<br />

tel +91.33 24128383<br />

DOUGLAS KIRKMAN<br />

managing director<br />

BLACKSTONE GROUP<br />

kirkman@blackstone.com<br />

tel +44.20 7451 4000<br />

REAL ESTATE<br />

Mr Anil Khetawat, is a third generation Developer and is the<br />

Vice Chairman and Managing Director of Rameswara ® Group<br />

Enterprise. He also serves on the Board Of Emami Land Pvt<br />

Ltd where in he has the role of an Executive Director. In the<br />

past he has worked in the field of Private Equity Investments<br />

as an Associate at Health Business Partners/Columbia Capital<br />

Corporation, USA where he specialized in the Health - ASP and<br />

e- clinical trials space. HBP/COLCAP was founded by a group<br />

of domain experts who invested approx US $3 bn of their<br />

proprietary capital in addition to a US$ 500 m institutional<br />

fund in sector specific opportunities.<br />

Douglas Kirkman is a Managing Director in the <strong>Real</strong> <strong>Estate</strong><br />

group based in London. Since joining Blackstone in 2006, he<br />

has been involved in sourcing and analyzing Blackstone’s real<br />

estate investments in several markets and types of property.<br />

Before joining Blackstone, Mr. Kirkman worked at Harbert<br />

Management Corporation where he was responsible for<br />

setting up their London office and their European <strong>Real</strong> <strong>Estate</strong><br />

Group. As part of these duties, he oversaw the creation of<br />

Harbert’s first European <strong>Real</strong> <strong>Estate</strong> Opportunity Fund and led<br />

the acquisition, management and disposition of many of the<br />

investments made by the Fund. Mr. Kirkman received a BA in<br />

Architecture from Princeton University and an MBA from the<br />

Darden Graduate School of Business, Virginia.<br />

AUDREY KLEIN<br />

managing principal<br />

PARK HILL REAL ESTATE GROUP<br />

klein@parkhillgroupre.com<br />

PRASAD R KONERU<br />

managing director<br />

RAKINDO DEVELOPERS PVT LTD<br />

prasad.koneru@rakindo.com<br />

tel +91.44 2499 1177<br />

PLACEMENT AGENT<br />

capital-raising for PERE & infra funds •<br />

global sponsors and investors •<br />

debt and equity strategies<br />

MASTER DEVELOPER<br />

development of large-scale integrated<br />

theme-based townships offering quality<br />

lifestyle revolving around nature with<br />

world class amenities<br />

Audrey Klein runs the European business out of London for the<br />

Park Hill <strong>Real</strong> <strong>Estate</strong> Group. Prior to joining Park Hill, Ms. Klein<br />

ran her own business for five years marketing alternative asset<br />

funds across all asset classes including private equity, real estate<br />

and hedge funds to European investors comprised of pension<br />

funds, banks, family offices and high-net-worth individuals. Prior<br />

to founding her company, Ms. Klein worked at Babcock and Brown<br />

in Germany where she co-founded the German office and helped<br />

establish equity relationships across Europe. Before making the<br />

move to Europe, she worked at Bank of America in San Francisco<br />

doing syndication across various sectors before co-founding a<br />

real-estate fund for her group.<br />

Mr.Prasad R.Koneru has over 30 years of diverse experience<br />

in different industries, including mining, international trading,<br />

investment, construction, real estate, shipping and logistics. He<br />

is Founder Chairman of transnational mineral conglomerate Trimex<br />

Group headquartered out of Dubai. His global vision has driven<br />

the Group into developing theme-based large-scale integrated<br />

townships across India and includes planned diversification into<br />

retail, education, healthcare and hospitality through strategic<br />

alliances and partnerships. Paving the way is Rakindo’s JV with<br />

Millennium & Copthorne Hotels plc and UK-based ‘Lotus Hotel<br />

Investment Fund’ to invest in a chain hotel projects across India.<br />

His interests include golfing and philanthropy.