Three Essays on Executive Compensation - KOPS - Universität ...

Three Essays on Executive Compensation - KOPS - Universität ...

Three Essays on Executive Compensation - KOPS - Universität ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

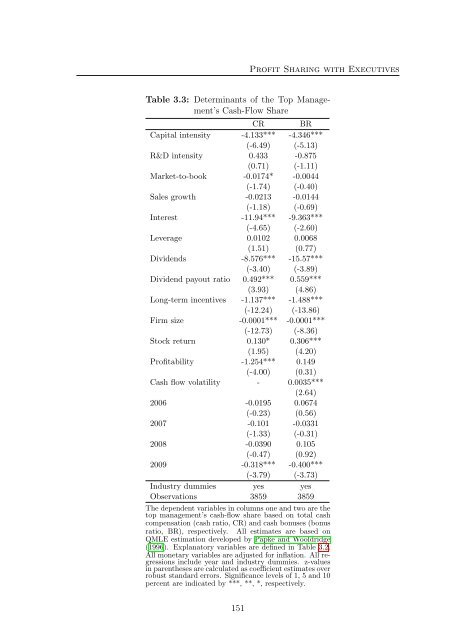

Profit Sharing with <strong>Executive</strong>s<br />

Table 3.3: Determinants of the Top Management’s<br />

Cash-Flow Share<br />

CR BR<br />

Capital intensity -4.133*** -4.346***<br />

(-6.49) (-5.13)<br />

R&D intensity 0.433 -0.875<br />

(0.71) (-1.11)<br />

Market-to-book -0.0174* -0.0044<br />

(-1.74) (-0.40)<br />

Sales growth -0.0213 -0.0144<br />

(-1.18) (-0.69)<br />

Interest -11.94*** -9.363***<br />

(-4.65) (-2.60)<br />

Leverage 0.0102 0.0068<br />

(1.51) (0.77)<br />

Dividends -8.576*** -15.57***<br />

(-3.40) (-3.89)<br />

Dividend payout ratio 0.492*** 0.559***<br />

(3.93) (4.86)<br />

L<strong>on</strong>g-term incentives -1.137*** -1.488***<br />

(-12.24) (-13.86)<br />

Firm size -0.0001*** -0.0001***<br />

(-12.73) (-8.36)<br />

Stock return 0.130* 0.306***<br />

(1.95) (4.20)<br />

Profitability -1.254*** 0.149<br />

(-4.00) (0.31)<br />

Cash flow volatility - 0.0035***<br />

(2.64)<br />

2006 -0.0195 0.0674<br />

(-0.23) (0.56)<br />

2007 -0.101 -0.0331<br />

(-1.33) (-0.31)<br />

2008 -0.0390 0.105<br />

(-0.47) (0.92)<br />

2009 -0.318*** -0.400***<br />

(-3.79) (-3.73)<br />

Industry dummies yes yes<br />

Observati<strong>on</strong>s 3859 3859<br />

The dependent variables in columns <strong>on</strong>e and two are the<br />

top management’s cash-flow share based <strong>on</strong> total cash<br />

compensati<strong>on</strong> (cash ratio, CR) and cash b<strong>on</strong>uses (b<strong>on</strong>us<br />

ratio, BR), respectively. All estimates are based <strong>on</strong><br />

QMLE estimati<strong>on</strong> developed by Papke and Wooldridge<br />

(1996). Explanatory variables are defined in Table 3.2.<br />

All m<strong>on</strong>etary variables are adjusted for inflati<strong>on</strong>. All regressi<strong>on</strong>s<br />

include year and industry dummies. z-values<br />

in parentheses are calculated as coefficient estimates over<br />

robust standard errors. Significance levels of 1, 5 and 10<br />

percent are indicated by ***, **, *, respectively.<br />

151