Oil and Gas at Your Door? (2005 Edition) - Earthworks

Oil and Gas at Your Door? (2005 Edition) - Earthworks

Oil and Gas at Your Door? (2005 Edition) - Earthworks

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IMPACTS ASSOCIATED WITH OIL AND GAS<br />

Impacts Associ<strong>at</strong>ed with <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Oper<strong>at</strong>ions<br />

Some impacts from oil <strong>and</strong> gas development may be positive for surface owners. The enjoyment<br />

of benefits depends upon a couple of factors:<br />

1. Do you own the mineral rights?<br />

2. Is some of the infrastructure associ<strong>at</strong>ed with oil or gas development useful to you?<br />

The primary benefit of oil <strong>and</strong> gas development to mineral owners is financial. If you own the<br />

mineral rights you will receive royalties on any oil or gas th<strong>at</strong> are removed from your property.<br />

The extent of your financial gain, however, depends upon the productivity of the well, <strong>and</strong> wh<strong>at</strong><br />

sort of royalty provisions you are able to negoti<strong>at</strong>e in your leasing agreement. Secondary benefits<br />

may be derived from any compens<strong>at</strong>ion received for surface damages, as well as perceived<br />

benefits from improvements such as roads <strong>and</strong> fences.<br />

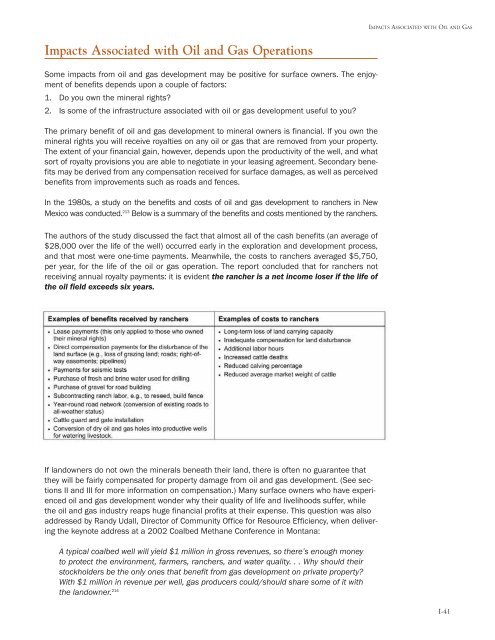

In the 1980s, a study on the benefits <strong>and</strong> costs of oil <strong>and</strong> gas development to ranchers in New<br />

Mexico was conducted. 213 Below is a summary of the benefits <strong>and</strong> costs mentioned by the ranchers.<br />

The authors of the study discussed the fact th<strong>at</strong> almost all of the cash benefits (an average of<br />

$28,000 over the life of the well) occurred early in the explor<strong>at</strong>ion <strong>and</strong> development process,<br />

<strong>and</strong> th<strong>at</strong> most were one-time payments. Meanwhile, the costs to ranchers averaged $5,750,<br />

per year, for the life of the oil or gas oper<strong>at</strong>ion. The report concluded th<strong>at</strong> for ranchers not<br />

receiving annual royalty payments: it is evident the rancher is a net income loser if the life of<br />

the oil field exceeds six years.<br />

If l<strong>and</strong>owners do not own the minerals bene<strong>at</strong>h their l<strong>and</strong>, there is often no guarantee th<strong>at</strong><br />

they will be fairly compens<strong>at</strong>ed for property damage from oil <strong>and</strong> gas development. (See sections<br />

II <strong>and</strong> III for more inform<strong>at</strong>ion on compens<strong>at</strong>ion.) Many surface owners who have experienced<br />

oil <strong>and</strong> gas development wonder why their quality of life <strong>and</strong> livelihoods suffer, while<br />

the oil <strong>and</strong> gas industry reaps huge financial profits <strong>at</strong> their expense. This question was also<br />

addressed by R<strong>and</strong>y Udall, Director of Community Office for Resource Efficiency, when delivering<br />

the keynote address <strong>at</strong> a 2002 Coalbed Methane Conference in Montana:<br />

A typical coalbed well will yield $1 million in gross revenues, so there’s enough money<br />

to protect the environment, farmers, ranchers, <strong>and</strong> w<strong>at</strong>er quality. . . Why should their<br />

stockholders be the only ones th<strong>at</strong> benefit from gas development on priv<strong>at</strong>e property?<br />

With $1 million in revenue per well, gas producers could/should share some of it with<br />

the l<strong>and</strong>owner. 214 I-41