Minutes of Evidence p.1401-1509 - Parliament of Victoria

Minutes of Evidence p.1401-1509 - Parliament of Victoria

Minutes of Evidence p.1401-1509 - Parliament of Victoria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

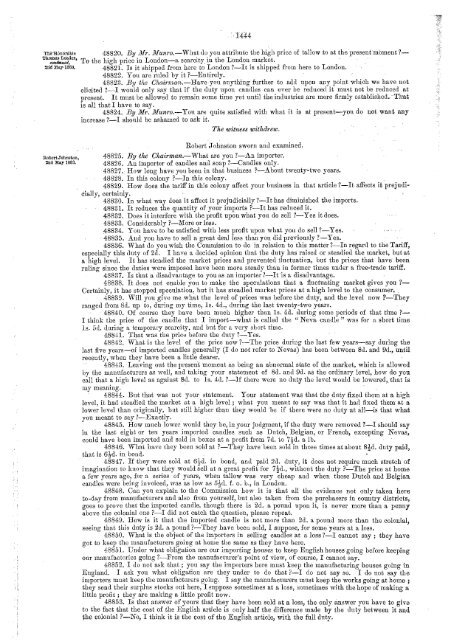

··1444<br />

'rlle'Honorli:bte 48820. By .Ll'ir. 1rlunro.-What do you attribute the high price <strong>of</strong> tallow to at the present moment?-<br />

Tho,!a;,.~er, To the high price in London-a, scarcity. in the London market. ·· · .·<br />

2rldMa,r·l88a. 48821. Is it shipped from here to London ?-It is shipped from here to London.<br />

48822. You are rulell by it ?-Entirely. · .·<br />

48823. By the Chairman.-Have you anything further to add upon any point which we have not<br />

elicited ?~I would only say that if the duty upon candles can ever be reduced it must not be reduced at<br />

present. It must be allowed to remain some time yet until the industries are more firmly established. That<br />

is all that I have to say.<br />

48824. By Mr. frlunro.-You are quite satisfied with what it is at present-you do not want any<br />

increase ?-I should be ashamed to ask it.<br />

The tvitness withdrew.<br />

RobertJobnston,<br />

2nd Mayl883.<br />

Robert Johnston sworn aml examined.<br />

48825. By the Chairman.-\Vhat are you ?-An importer.<br />

48826. An importer <strong>of</strong> candles and soap ?:-Candles only.<br />

48827. How long have you been in that business ?-About twenty-two year~.<br />

48828. In this colony ?-In this colony. .<br />

48829. How does the taritr in this colony affect your business in that article ?-It affects it prejudi-<br />

Cially, certainly. ·<br />

48830. In what way does it affect it prejudicially ?-It has diminished the imports.<br />

48831. It reduces the quantity <strong>of</strong> your imports ?-It has reduced it.<br />

48832. Does it interfere with the pr<strong>of</strong>it upon what yen do sell ?-Yes it does.<br />

48833. Considerably ?-:More or less.<br />

48834. You have to be satisfied with less pr<strong>of</strong>it upon what you do sell?-Yes.<br />

48835. And you have to sell a great deal less than you did previously ?-Yes.<br />

48836. What do you wish the Commission to do in relation to this matter ?-In regard to the Tariff,<br />

especially this duty <strong>of</strong> 2d. I have a decided opinion that the duty has raised or steadied the market, but at<br />

a· high level. It has steatliecl the market prices and preventccliluctuation, but the prices that have been<br />

ruling since the duties were imposed have been more steady than in former times under a free-trade tariff.<br />

48837. Is that a disadvantage to you as an importer ?-It.is a disadvantage.<br />

48838. It does not enable you to make the speculations that a fluctuating market gives you ?<br />

Certainly, it has stopped speculation, but it has steadied market prices at a high level to the consumer' .<br />

-±8839. Will you give me what the level <strong>of</strong> prices was before the duty, and the level now !-They<br />

ran""ecl from 8d. up to, during my time, ls. 4cl., during the last twenty-two years. · ··<br />

" 48840. Of conrse they have been much higher than ls. 4cl. ;luring some periods <strong>of</strong> that time ?<br />

I think the price <strong>of</strong> the candle that I import-what, is called the "Neva candle'' was for a short time<br />

ls. 5cl. during a tempomry scl1rcity, and but fbr a very short time.<br />

48841. That was the price before the duty ?-Yes.<br />

48842. What is the level <strong>of</strong> the price now ?-The price during the last few years-say during the<br />

last five years-<strong>of</strong> imported candles generally (I do not refer to Nevas) has been between 8cl. and 9d., until<br />

recently, when they have been a little dearer. ·<br />

· 48843. Leaving out the present moment as being an abnormal state <strong>of</strong> the market, which is allowed<br />

by the manufacturers as well, and taking your statement <strong>of</strong> 8d. and 9d. as the ordinary level, how do you<br />

call that a high level as against Bel. to Is. 4d. ?-1£ there were no duty the level would be lowered, that is<br />

my meaning.<br />

48844. But that was not yom statement. Your statement was that the dnty fixe(l them at a high<br />

level, it had steadied the market at a high level ; what you meant to say was that it had fixed them at a<br />

lower level than originally, but still higher than they would ·be if there were no duty at all-is that what<br />

von meant to say ?-Exactly.<br />

· 48845. How much lower would they be, in your judgment, if the duty were removed ?-I should say<br />

in the last eight or ten years imported candles such as Dntch, Belgian, or French, excepting Nevas,<br />

could have been imported and sold in boxes at a pr<strong>of</strong>it from 7c1. to 7~d. a lb.<br />

48846. What have they been sold at ?-They have been sold in those times at about 8~d. duty paid,<br />

that is 6~d. in bond. . ,<br />

48847. If they were sold at 6~cl. in bond, and paid 2d. duty, it does not require much stretch <strong>of</strong><br />

imagimtion to know that they would sell at a great pr<strong>of</strong>it for 7·~d., without the duty ?-The price at home<br />

a few years ago, for a series <strong>of</strong> years, when tallow was very cheap and when these Dutch and Belgian<br />

candles were being invoiced, was as low as 5!d. f. o. b., in London.<br />

48848. Can you explain to the Commission how it is that all the evidence not only taken here<br />

to-clay from manufacturers and also from yourself, but also taken from the purchasers in country districts,<br />

goes to prove that the imported candle, though there is 2cl. a pmmd upon it, is never more than a penny<br />

above the colonial one ?-I did not catch the question, please repeat.<br />

48849. How is it that the imported candle is not more than 2d. a pound more than the colonial,<br />

seeing thflt this duty is 2cl. a pound ?-They have been sold, I suppose, for som0years at a loss.<br />

48850. What is the object <strong>of</strong> the importers in selling cru:tdles at a loss ?-I cannot say ; they have<br />

got to keep the manufacturers going at home the same as they have here.<br />

48851. Under what obligation a-rc our importing honses to keep English houses going before keeping<br />

onr manufactories going ?-From the manufacturer's point <strong>of</strong> view, <strong>of</strong> course, I cannot say.<br />

48852. I do not ask that ; you say the importers here must keep the manufacturing houses going in<br />

England. I ask you what obligation are they under to do that ?-I do not say so. I do not say the<br />

importers must keep the manufactnrers going. I say the mannfactmers must keep the works going at home ;<br />

they send their surplus stocks out here, I suppose sometimes at a loss, sometimes with the hope <strong>of</strong> making a<br />

little pr<strong>of</strong>it ; they are making a little pr<strong>of</strong>it now.<br />

48853. Is that answer <strong>of</strong> yours that they have been sold at a loss, the only answer you have to give<br />

to the fact that the cost <strong>of</strong> the English article is only half the difference made by the duty between it and<br />

~he colonial ?-No, I think it is the cost <strong>of</strong> the English article, with the full duty.