Minutes of Evidence p.1401-1509 - Parliament of Victoria

Minutes of Evidence p.1401-1509 - Parliament of Victoria

Minutes of Evidence p.1401-1509 - Parliament of Victoria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

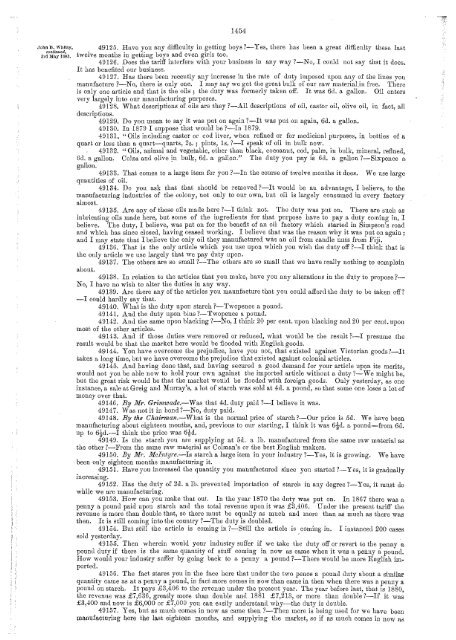

John B. Whitty,<br />

IXJntinued.<br />

3rd Mc.y 1888.<br />

14M<br />

49125. Have you any difficulty in getting boys ?-'-Yes, there bt8 been a great clifficlllty these last<br />

twelve months in getting boys and even gil"ls too.<br />

4D126. Does the tariff interfere with your business in any way ?-No, I conld not say that it does.<br />

It has benefited our business.<br />

49127. Has there been recently any increase in the rate <strong>of</strong> duty imposed upon any <strong>of</strong> the lines you<br />

manufacture ?-No, there is only one. I may say we get the great bulk <strong>of</strong> our raw material.iu free. There<br />

is only one article and that is the oils ; the duty was formerly taken <strong>of</strong>f. It was 6d. a gallon. Oil enters<br />

very largely into our manufacturing purposes.<br />

49128. What descriptions <strong>of</strong> oils are they ?-All descriptions <strong>of</strong> oil, castor oil, olive oil, in fact, all<br />

descriptions.<br />

49129. Do you mean to say it was put on again ?-It was put on again, 6d. a gallon.<br />

49130. In 1879 I suppose that would be ?~In 1879.<br />

49131, "Oils including castor or cod hver, when refined or for medicinal purposes, in bottles <strong>of</strong> a<br />

quart or le,;s than a quart-quarts, 2s. ; pints, Is. ?-I speak <strong>of</strong> oil in bulk now.<br />

. 49132. "Oils, animal and vegetable, other than black, cocoanut, cod, palm, in bulk, mineral, re:llned,<br />

Gd. a gallon. Colza and olive !n bulk, 6d. a gallon." The duty you pay is 6c1. a gallon ?-Sixpence a<br />

gallon.<br />

49133. 'l'hat comes to a large item for you ?-In the course <strong>of</strong> twelve months it does. We use large<br />

quantities <strong>of</strong> oil.<br />

49134. Do ymt ask that that. should be removed ?-It would be an advantage, I believe, to the<br />

manufacturing industries <strong>of</strong> the colony, not only to our own, but oil is largely consumed in every factory<br />

almost.<br />

49135. Are any <strong>of</strong> those oils made here ?-I think not. The duty was put on. There are such as<br />

lubricating oils made here, but some <strong>of</strong> the ingredients for that purpose have to pay a duty coming in, I<br />

believe. The duty, I believe, was put on for the benefit <strong>of</strong> an oil factory which started in Simpson's road<br />

and which has since closed, having ceased working. I believe that was the reason why it was put on again;<br />

and I may state that I believe the only oil they manufacturetl wits an oil from candle nuts from Fiji.<br />

4913G. That is the only article which you use upon which you wish the duty <strong>of</strong>f ?-I think that is<br />

the only article we use largely that we pay duty upon.<br />

49137, The others are so small ?-The others are so small that we have really nothing to complain<br />

about.<br />

49138. In relation to the articles that you make, have you any alterations in the duty to propose?<br />

No, I have no wish to alter the duties in any way.<br />

49139. Are there any <strong>of</strong> the articles you manufacture that you could afford the duty to be taken <strong>of</strong>f?<br />

-I could hardly say that.<br />

49140. What is the duty upon starch ?-Twopence a pound.<br />

49141. And the duty upon blue ?-Twopence a pound.<br />

49142. And the same upon blacking ?-No, I think 20 per cent. upon blacking and 20 per cent.npon<br />

most <strong>of</strong> the other articles.<br />

49143. And if those duties were removed or reduced, what would be the result ?-I presume the<br />

result would he that the market here would he flooded with English goods.<br />

49144. You have overcome the prejudice, have you not, that existed against <strong>Victoria</strong>n goods ?-It<br />

takes a long time, but we have overcome the prejudice that existed against colonial articles.<br />

49145. And having done that, and having secured a good demand for your article upon its merits,<br />

would not you be able now to hold your own against the imported article without a duty '1-We might be,<br />

but the great risk would be that the market would be flooded with foreign goods. Only yesterday, as one<br />

instance, a sale at Greig and JYiurray's, a lot <strong>of</strong> starch was sold at 4cl. a pound, so that some one loses a lot <strong>of</strong><br />

money over that.<br />

49146. By .lJfr. Grirnwade.-Was that 4d. duty paid ?~I believe it was.<br />

49147. Was not it in bond?-No, duty paid.<br />

49148. By the Chairman.-What is the normal price <strong>of</strong> starch ?-Our price is 5d. We have been<br />

manufacturing about eighteen months, ancl, previous to om starting, I think it was 6-!cl. a pound-from 6d.<br />

up to 6itl.-I think the price was 6~cl.<br />

49149. Is the starch you are supplying at 5d. a lb. manufactured from the same raw material as<br />

the other ?-From the same raw material as Colman's or the best English makers.<br />

49150. By Mr. Mclntyre.-Is starch a large item in your industry ·?-Yes, it is growing. We have<br />

been only eighteen months manufacturing it.<br />

49151. Have you increased the quantity you manufactured since you started ?-Yes, it is graclually<br />

increasing.<br />

49152. Has the duty <strong>of</strong> 2d. a lb. preventecl importation <strong>of</strong> starch in any degree ?-Yes, it must do<br />

while we are manufacturing.<br />

49153. How can you make that out. In the year 1870 the duty was put on. In 18G7 there was a<br />

penny a pound paid upon starch and the total revenue upon it was £3,40G. U mler the present tariff the<br />

revenue is more than double that, so there must be equa.lly as much and more than as much as there was<br />

then. It is still coming into the country ?-The duty is doubled.<br />

49154. But still the article is coming in ?-Still the article is coming in. I instanced 200 cases<br />

sold yesterday. ' .<br />

49155. Then wherein would your industry suffer if we take the duty <strong>of</strong>f or revert to the penny a<br />

pouml duty if there is the same quantity <strong>of</strong> stuff coming in now as came when it was a penny a pound.<br />

How would your industry suffer by going back to a penny a pound ?-There would be more English hnported.<br />

4915G. The fact stares you in the face here that under the two pence a pound duty about a similar<br />

quantity came as at a penny a pound, in fact more comes in now than came in then when there was a penny a<br />

pound on starch. It pays .£3,406 to the revenue undeT the peesent year. The year before last, that is 1880,<br />

the revenue was £7,636, greatly more than double and 1881 £7,213, or more than double ?~If it was<br />

£3,400 and now is £6,000 or £7,000 you can easily understancl why~the duty is double.<br />

49157. Yes, but as much comes in now as came then ?-Then more is being used for we have been<br />

manl:!fa,cturing 4ere the l!l.st eighteen months, and supplying the market 1<br />

so if a:s much co:mes in now fi.S