TABLE OF CONTENTS

TABLE OF CONTENTS

TABLE OF CONTENTS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

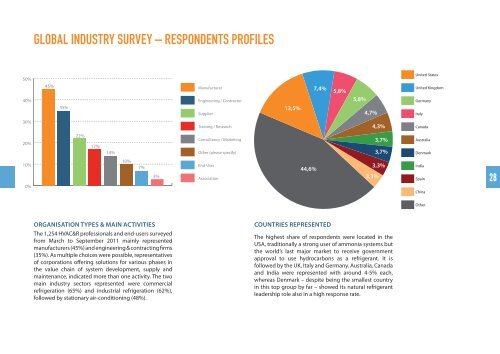

Global Industry Survey – Respondents Profiles<br />

50%<br />

40%<br />

45%<br />

35%<br />

13,5%<br />

7,4%<br />

5,8%<br />

5,8%<br />

4,7%<br />

30%<br />

4,3%<br />

20%<br />

22%<br />

17%<br />

14%<br />

3,7%<br />

3,7%<br />

10%<br />

0%<br />

10%<br />

7%<br />

3%<br />

44,6%<br />

3,3%<br />

3,1%<br />

28<br />

Organisation Types & Main Activities<br />

The 1,254 HVAC&R professionals and end-users surveyed<br />

from March to September 2011 mainly represented<br />

manufacturers (45%) and engineering & contracting firms<br />

(35%). As multiple choices were possible, representatives<br />

of corporations offering solutions for various phases in<br />

the value chain of system development, supply and<br />

maintenance, indicated more than one activity. The two<br />

main industry sectors represented were commercial<br />

refrigeration (65%) and industrial refrigeration (62%),<br />

followed by stationary air-conditioning (48%).<br />

Countries represented<br />

The highest share of respondents were located in the<br />

USA, traditionally a strong user of ammonia systems but<br />

the world’s last major market to receive government<br />

approval to use hydrocarbons as a refrigerant. It is<br />

followed by the UK, Italy and Germany. Australia, Canada<br />

and India were represented with around 4-5% each,<br />

whereas Denmark – despite being the smallest country<br />

in this top group by far – showed its natural refrigerant<br />

leadership role also in a high response rate.