Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Customer financing<br />

Customer financing is a well-established<br />

field of operations in most of <strong>Scania</strong>’s main<br />

markets.<br />

These activities contribute to the company’s<br />

overall earnings and growth, while<br />

strengthening the competitiveness of <strong>Scania</strong>.<br />

To meet the needs of customers in new<br />

markets and increase <strong>Scania</strong>’s business<br />

opportunities, a number of new finance companies<br />

were established during the year.<br />

Customer financing is an important element of <strong>Scania</strong>’s<br />

complete product range. The company endeavours to<br />

work locally in its Customer Finance operations. Proximity<br />

to the customer and local know-how makes the pro-<br />

Continued positive trend<br />

The income of <strong>Scania</strong>’s Customer Finance operations<br />

rose by 11 percent to SEK 308 m. (278). This was<br />

equivalent to an operating income of 1.22 (1.19) percent<br />

of the year’s average portfolio. Overhead, expressed in<br />

relation to the average portfolio, rose from 0.97 percent<br />

in 2001 to 1.05 percent in <strong>2002</strong>.<br />

Total financing volume rose to SEK 25,303 m.<br />

(25,091). During the year, 11,742 (12,109) new trucks,<br />

407 (458) new buses and 2,953 (2,498) used <strong>Scania</strong><br />

vehicles were financed. The number of contracts in the<br />

portfolio at year-end totalled 59,472 (54,028). Of the<br />

total portfolio, 33 percent was operating leases. The<br />

remaining 67 percent consisted of loan financing and<br />

financial leases.<br />

cessing of applications faster and improves the quality<br />

of credit evaluation.<br />

<strong>Scania</strong>’s strategy is to establish its own finance<br />

companies in markets with sufficient sales volume. In<br />

other markets, distributors are supported by financing<br />

solutions from the subsidiary <strong>Scania</strong> Credit AB.<br />

Europe<br />

<strong>Scania</strong>’s Customer Finance operations in Europe now<br />

consist of thirteen <strong>Scania</strong>-owned finance companies.<br />

In some western European countries, portfolio<br />

growth halted due to lower sales volume.<br />

However, growth occurred in the Italian company<br />

and in Spain, due to a large element of bus financing.<br />

Operations in central and eastern Europe, which<br />

take place through the company <strong>Scania</strong> Credit, continued<br />

to show good growth.<br />

In one of these markets, Russia, a finance company<br />

was established to be able to offer Russian customers<br />

domestic financing as an alternative to the cross-border<br />

financing offered via <strong>Scania</strong> Credit.<br />

Asia<br />

Financing operations in South Korea have taken place<br />

since the beginning of <strong>2002</strong> through a <strong>Scania</strong>-owned<br />

finance company. During the year, the company refined<br />

its financing range. Processes were trimmed and staff<br />

received further training in order to meet the high<br />

standards required in this market.<br />

Latin America<br />

In the Latin American market, <strong>Scania</strong> offers financing in<br />

collaboration with outside lenders. In the uncertain eco-<br />

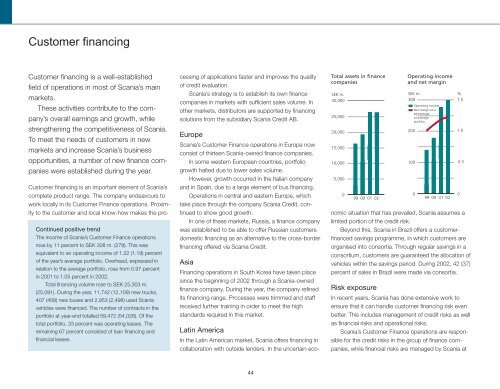

Total assets in finance<br />

companies<br />

SEK m.<br />

30,000<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

0<br />

99 00 01 02<br />

Operating income<br />

and net margin<br />

SEK m.<br />

300<br />

nomic situation that has prevailed, <strong>Scania</strong> assumes a<br />

limited portion of the credit risk.<br />

Beyond this, <strong>Scania</strong> in Brazil offers a customerfinanced<br />

savings programme, in which customers are<br />

organised into consortia. Through regular savings in a<br />

consortium, customers are guaranteed the allocation of<br />

vehicles within the savings period. During <strong>2002</strong>, 42 (37)<br />

percent of sales in Brazil were made via consortia.<br />

Risk exposure<br />

In recent years, <strong>Scania</strong> has done extensive work to<br />

ensure that it can handle customer financing risk even<br />

better. This includes management of credit risks as well<br />

as financial risks and operational risks.<br />

<strong>Scania</strong>’s Customer Finance operations are responsible<br />

for the credit risks in the group of finance companies,<br />

while financial risks are managed by <strong>Scania</strong> at<br />

200<br />

100<br />

Operating income<br />

Net margin as a<br />

percentage<br />

of average<br />

porfolio<br />

0<br />

99 00 01 02<br />

%<br />

1.5<br />

1.0<br />

0.5<br />

0<br />

44