Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

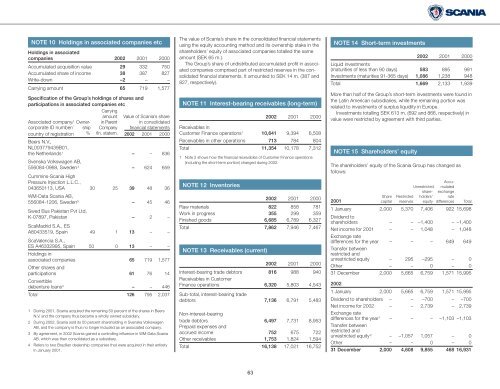

NOTE 10 Holdings in associated companies etc<br />

Holdings in associated<br />

companies <strong>2002</strong> 2001 2000<br />

Accumulated acquisition value 29 332 750<br />

Accumulated share of income 38 387 827<br />

Write-down –2 – –<br />

Carrying amount 65 719 1,577<br />

Specification of the Group’s holdings of shares and<br />

participations in associated companies etc<br />

Carrying<br />

amount Value of <strong>Scania</strong>’s share<br />

Associated company/ Owner- in Parent in consolidated<br />

corporate ID number/ ship Company financial statements<br />

country of registration % fin. statem. <strong>2002</strong> 2001 2000<br />

Beers N.V.,<br />

NL003779439B01,<br />

the Netherlands 1 – – 836<br />

Svenska Volkswagen AB,<br />

556084-0968, Sweden 2 – 624 659<br />

Cummins-<strong>Scania</strong> High<br />

Pressure Injection L.L.C.,<br />

043650113, USA 30 25 39 48 36<br />

WM-Data <strong>Scania</strong> AB,<br />

556084-1206, Sweden 3 – 45 46<br />

Swed Bus Pakistan Pvt Ltd,<br />

K-07897, Pakistan – 2 –<br />

ScaMadrid S.A., ES<br />

A80433519, Spain 49 1 13 – –<br />

ScaValencia S.A.,<br />

ES A46332995, Spain 50 0 13 – –<br />

Holdings in<br />

associated companies 65 719 1,577<br />

Other shares and<br />

participations 61 76 14<br />

Convertible<br />

debenture loans 4 – – 446<br />

Total 126 795 2,037<br />

1 During 2001, <strong>Scania</strong> acquired the remaining 50 percent of the shares in Beers<br />

N.V. and the company thus became a wholly owned subsidiary.<br />

2 During <strong>2002</strong>, <strong>Scania</strong> sold its 50 percent shareholding in Svenska Volkswagen<br />

AB, and the company is thus no longer included as an associated company.<br />

3 By agreement, in <strong>2002</strong> <strong>Scania</strong> gained a controlling influence in WM-Data <strong>Scania</strong><br />

AB, which was then consolidated as a subsidiary.<br />

4 Refers to two Brazilian dealership companies that were acquired in their entirety<br />

in January 2001.<br />

The value of <strong>Scania</strong>’s share in the consolidated financial statements<br />

using the equity accounting method and its ownership stake in the<br />

shareholders’ equity of associated companies totalled the same<br />

amount (SEK 65 m.).<br />

The Group’s share of undistributed accumulated profit in associated<br />

companies comprised part of restricted reserves in the consolidated<br />

financial statements. It amounted to SEK 14 m. (387 and<br />

827, respectively).<br />

NOTE 11 Interest-bearing receivables (long-term)<br />

<strong>2002</strong> 2001 2000<br />

Receivables in<br />

Customer Finance operations 1 10,641 9,394 6,508<br />

Receivables in other operations 713 784 804<br />

Total 11,354 10,178 7,312<br />

1 Note 2 shows how the financial receivables of Customer Finance operations<br />

(including the short-term portion) changed during <strong>2002</strong>.<br />

NOTE 12 Inventories<br />

<strong>2002</strong> 2001 2000<br />

Raw materials 822 858 781<br />

Work in progress 355 299 359<br />

Finished goods 6,685 6,789 6,327<br />

Total 7,862 7,946 7,467<br />

NOTE 13 Receivables (current)<br />

<strong>2002</strong> 2001 2000<br />

Interest-bearing trade debtors 816 988 940<br />

Receivables in Customer<br />

Finance operations 6,320 5,803 4,543<br />

Sub-total, interest-bearing trade<br />

debtors 7,136 6,791 5,483<br />

Non-interest-bearing<br />

trade debtors 6,497 7,731 8,953<br />

Prepaid expenses and<br />

accrued income 752 675 722<br />

Other receivables 1,753 1,824 1,594<br />

Total 16,138 17,021 16,752<br />

NOTE 14 Short-term investments<br />

<strong>2002</strong> 2001 2000<br />

Liquid investments<br />

(maturities of less than 90 days) 583 895 991<br />

Investments (maturities 91-365 days) 1,086 1,238 948<br />

Total 1,669 2,133 1,939<br />

More than half of the Group’s short-term investments were found in<br />

the Latin American subsidiaries, while the remaining portion was<br />

related to investments of surplus liquidity in Europe.<br />

Investments totalling SEK 613 m. (692 and 866, respectively) in<br />

value were restricted by agreement with third parties.<br />

NOTE 15 Shareholders’ equity<br />

The shareholders’ equity of the <strong>Scania</strong> Group has changed as<br />

follows:<br />

Accu-<br />

Unrestricted mulated<br />

share- exchange<br />

Share Restricted holders’ rate<br />

2001 capital reserves equity differences Total<br />

1 January 2,000 5,370 7,406 922 15,698<br />

Dividend to<br />

shareholders – – –1,400 – –1,400<br />

Net income for 2001 – – 1,048 – 1,048<br />

Exchange rate<br />

differences for the year – – – 649 649<br />

Transfer between<br />

restricted and<br />

unrestricted equity – 295 –295 – 0<br />

Other – – 0 – 0<br />

31 December 2,000 5,665 6,759 1,571 15,995<br />

<strong>2002</strong><br />

1 January 2,000 5,665 6,759 1,571 15,995<br />

Dividend to shareholders – – –700 – –700<br />

Net income for <strong>2002</strong> – – 2,739 – 2,739<br />

Exchange rate<br />

differences for the year 1 – – – –1,103 –1,103<br />

Transfer between<br />

restricted and<br />

unrestricted equity 2 – –1,057 1,057 – 0<br />

Other – – 0 – 0<br />

31 December 2,000 4,608 9,855 468 16,931<br />

63