Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

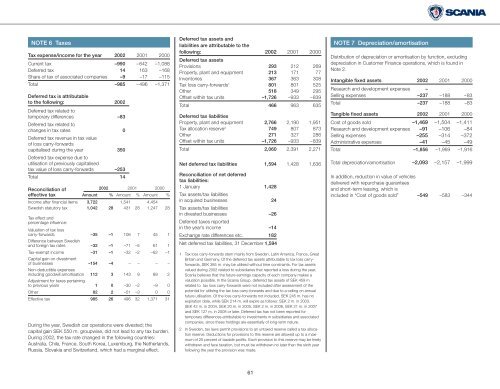

NOTE 6 Taxes<br />

Tax expense/income for the year <strong>2002</strong> 2001 2000<br />

Current tax –990 –642 –1,088<br />

Deferred tax 14 163 –168<br />

Share of tax of associated companies –9 –17 –115<br />

Total –985 –496 –1,371<br />

Deferred tax is attributable<br />

to the following: <strong>2002</strong><br />

Deferred tax related to<br />

temporary differences –83<br />

Deferred tax related to<br />

changes in tax rates 0<br />

Deferred tax revenue in tax value<br />

of loss carry-forwards<br />

capitalised during the year 350<br />

Deferred tax expense due to<br />

utilisation of previously capitalised<br />

tax value of loss carry-forwards –253<br />

Total 14<br />

Reconciliation of <strong>2002</strong> 2001 2000<br />

effective tax Amount % Amount % Amount %<br />

Income after financial items 3,722 1,541 4,454<br />

Swedish statutory tax 1,042 28 431 28 1,247 28<br />

Tax effect and<br />

percentage influence:<br />

Valuation of tax loss<br />

carry-forwards –35 –1 106 7 45 1<br />

Difference between Swedish<br />

and foreign tax rates –32 –1 –71 –5 61 1<br />

Tax-exempt income –31 –1 –32 –2 –62 –1<br />

Capital gain on divestment<br />

of businesses –154 –4 – – – –<br />

Non-deductible expenses<br />

including goodwill amortisation 112 3 143 9 89 2<br />

Adjustment for taxes pertaining<br />

to previous years 1 0 –30 –2 –9 0<br />

Other 82 2 –51 –3 0 0<br />

Effective tax 985 26 496 32 1,371 31<br />

During the year, Swedish car operations were divested; the<br />

capital gain SEK 550 m. groupwise, did not lead to any tax burden.<br />

During <strong>2002</strong>, the tax rate changed in the following countries:<br />

Australia, Chile, France, South Korea, Luxemburg, the Netherlands,<br />

Russia, Slovakia and Switzerland, which had a marginal effect.<br />

Deferred tax assets and<br />

liabilities are attributable to the<br />

following: <strong>2002</strong> 2001 2000<br />

Deferred tax assets<br />

Provisions 293 212 269<br />

Property, plant and equipment 213 171 77<br />

Inventories 367 363 308<br />

Tax loss carry-forwards 1 801 801 525<br />

Other 518 349 295<br />

Offset within tax units –1,726 –933 –839<br />

Total 466 963 635<br />

Deferred tax liabilities<br />

Property, plant and equipment 2,766 2,190 1,951<br />

Tax allocation reserve 2 749 807 873<br />

Other 271 327 286<br />

Offset within tax units –1,726 –933 –839<br />

Total 2,060 2,391 2,271<br />

Net deferred tax liabilities 1,594 1,428 1,636<br />

Reconciliation of net deferred<br />

tax liabilities:<br />

1 January 1,428<br />

Tax assets/tax liabilities<br />

in acquired businesses 24<br />

Tax assets/tax liabilities<br />

in divested businesses –26<br />

Deferred taxes <strong>report</strong>ed<br />

in the year’s income –14<br />

Exchange rate differences etc. 182<br />

Net deferred tax liabilities, 31 December 1,594<br />

1 Tax loss carry-forwards stem mainly from Sweden, Latin America, France, Great<br />

Britain and Germany. Of the deferred tax assets attributable to tax loss carryforwards,<br />

SEK 385 m. may be utilised without time constraints. For tax assets<br />

valued during <strong>2002</strong> related to subsidiaries that <strong>report</strong>ed a loss during the year,<br />

<strong>Scania</strong> believes that the future earnings capacity of each company makes a<br />

valuation possible. In the <strong>Scania</strong> Group, deferred tax assets of SEK 459 m<br />

related to tax loss carry-forwards were not included after assessment of the<br />

potential for utilising the tax loss carry-forwards and due to a ceiling on <strong>annual</strong><br />

future utilisation. Of the loss carry-forwards not included, SEK 245 m. has no<br />

expiration date, while SEK 214 m. will expire as follows: SEK 2 m. in 2003.<br />

SEK 42 m. in 2004, SEK 20 m. in 2005, SEK 2 m. in 2006, SEK 21 m. in 2007<br />

and SEK 127 m. in 2008 or later. Deferred tax has not been <strong>report</strong>ed for<br />

temporary differences attributable to investments in subsidiaries and associated<br />

companies, since these holdings are essentially of long-term nature.<br />

2 In Sweden, tax laws permit provisions to an untaxed reserve called a tax allocation<br />

reserve. Deductions for provisions to this reserve are allowed up to a maximum<br />

of 25 percent of taxable profits. Each provision to this reserve may be freely<br />

withdrawn and face taxation, but must be withdrawn no later than the sixth year<br />

following the year the provision was made.<br />

NOTE 7 Depreciation/amortisation<br />

Distribution of depreciation or amortisation by function, excluding<br />

depreciation in Customer Finance operations, which is found in<br />

Note 2.<br />

Intangible fixed assets <strong>2002</strong> 2001 2000<br />

Research and development expenses –<br />

Selling expenses –237 –188 –83<br />

Total –237 –188 –83<br />

Tangible fixed assets <strong>2002</strong> 2001 2000<br />

Cost of goods sold –1,469 –1,504 –1,411<br />

Research and development expenses –91 –106 –84<br />

Selling expenses –255 –314 –372<br />

Administrative expenses –41 –45 –49<br />

Total –1,856 –1,969 –1,916<br />

Total depreciation/amortisation –2,093 –2,157 –1,999<br />

In addition, reduction in value of vehicles<br />

delivered with repurchase guarantees<br />

and short-term leasing, which is<br />

included in “Cost of goods sold” –549 –583 –344<br />

61