Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SCANIA SHARE DATA<br />

<strong>Scania</strong> share data<br />

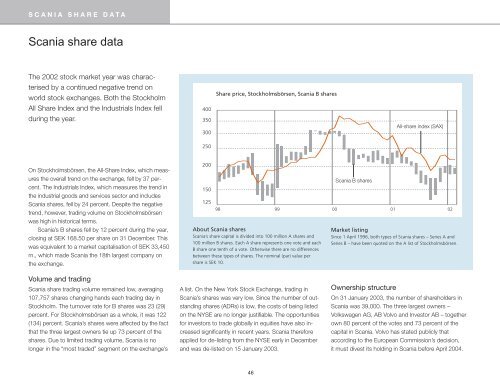

The <strong>2002</strong> stock market year was characterised<br />

by a continued negative trend on<br />

world stock exchanges. Both the Stockholm<br />

All Share Index and the Industrials Index fell<br />

during the year.<br />

400<br />

350<br />

300<br />

Share price, Stockholmsbörsen, <strong>Scania</strong> B shares<br />

All-share index (SAX)<br />

250<br />

On Stockholmsbörsen, the All-Share Index, which measures<br />

the overall trend on the exchange, fell by 37 percent.<br />

The Industrials Index, which measures the trend in<br />

the industrial goods and services sector and includes<br />

<strong>Scania</strong> shares, fell by 24 percent. Despite the negative<br />

trend, however, trading volume on Stockholmsbörsen<br />

was high in historical terms.<br />

<strong>Scania</strong>’s B shares fell by 12 percent during the year,<br />

closing at SEK 168.50 per share on 31 December. This<br />

was equivalent to a market capitalisation of SEK 33,450<br />

m., which made <strong>Scania</strong> the 18th largest company on<br />

the exchange.<br />

200<br />

150<br />

125<br />

About <strong>Scania</strong> shares<br />

<strong>Scania</strong>’s share capital is divided into 100 million A shares and<br />

100 million B shares. Each A share represents one vote and each<br />

B share one tenth of a vote. Otherwise there are no differences<br />

between these types of shares. The nominal (par) value per<br />

share is SEK 10.<br />

<strong>Scania</strong> B shares<br />

98 99 00 01 02<br />

Market listing<br />

Since 1 April 1996, both types of <strong>Scania</strong> shares – Series A and<br />

Series B – have been quoted on the A list of Stockholmsbörsen.<br />

Volume and trading<br />

<strong>Scania</strong> share trading volume remained low, averaging<br />

107,757 shares changing hands each trading day in<br />

Stockholm. The turnover rate for B shares was 23 (29)<br />

percent. For Stockholmsbörsen as a whole, it was 122<br />

(134) percent. <strong>Scania</strong>’s shares were affected by the fact<br />

that the three largest owners tie up 73 percent of the<br />

shares. Due to limited trading volume, <strong>Scania</strong> is no<br />

longer in the “most traded” segment on the exchange’s<br />

A list. On the New York Stock Exchange, trading in<br />

<strong>Scania</strong>’s shares was very low. Since the number of outstanding<br />

shares (ADRs) is low, the costs of being listed<br />

on the NYSE are no longer justifiable. The opportunities<br />

for investors to trade globally in equities have also increased<br />

significantly in recent years. <strong>Scania</strong> therefore<br />

applied for de-listing from the NYSE early in December<br />

and was de-listed on 15 January 2003.<br />

Ownership structure<br />

On 31 January 2003, the number of shareholders in<br />

<strong>Scania</strong> was 39,000. The three largest owners –<br />

Volkswagen AG, AB Volvo and Investor AB – together<br />

own 80 percent of the votes and 73 percent of the<br />

capital in <strong>Scania</strong>. Volvo has stated publicly that<br />

according to the European Commission’s decision,<br />

it must divest its holding in <strong>Scania</strong> before April 2004.<br />

46