Scania annual report 2002

Scania annual report 2002

Scania annual report 2002

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

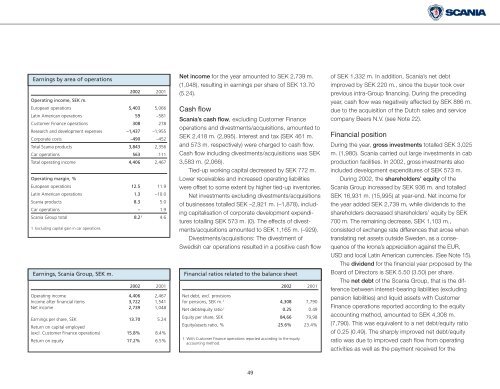

Earnings by area of operations<br />

<strong>2002</strong> 2001<br />

Operating income, SEK m.<br />

European operations 5,403 5,066<br />

Latin American operations 59 –581<br />

Customer Finance operations 308 278<br />

Research and development expenses –1,437 –1,955<br />

Corporate costs –490 –452<br />

Total <strong>Scania</strong> products 3,843 2,356<br />

Car operations 563 111<br />

Total operating income 4,406 2,467<br />

Operating margin, %<br />

European operations 12.5 11.9<br />

Latin American operations 1.3 –10.0<br />

<strong>Scania</strong> products 8.3 5.0<br />

Car operations – 1.9<br />

<strong>Scania</strong> Group total 8.2 1 4.6<br />

1 Excluding capital gain in car operations.<br />

Earnings, <strong>Scania</strong> Group, SEK m.<br />

<strong>2002</strong> 2001<br />

Operating income 4,406 2,467<br />

Income after financial items 3,722 1,541<br />

Net income 2,739 1,048<br />

Earnings per share, SEK 13.70 5.24<br />

Return on capital employed<br />

(excl. Customer Finance operations) 15.8% 8.4%<br />

Return on equity 17.2% 6.5%<br />

Net income for the year amounted to SEK 2,739 m.<br />

(1,048), resulting in earnings per share of SEK 13.70<br />

(5.24).<br />

Cash flow<br />

<strong>Scania</strong>’s cash flow, excluding Customer Finance<br />

operations and divestments/acquisitions, amounted to<br />

SEK 2,418 m. (2,995). Interest and tax (SEK 461 m.<br />

and 573 m. respectively) were charged to cash flow.<br />

Cash flow including divestments/acquisitions was SEK<br />

3,583 m. (2,066).<br />

Tied-up working capital decreased by SEK 772 m.<br />

Lower receivables and increased operating liabilities<br />

were offset to some extent by higher tied-up inventories.<br />

Net investments excluding divestments/acquisitions<br />

of businesses totalled SEK –2,921 m. (–1,878), including<br />

capitalisation of corporate development expenditures<br />

totalling SEK 573 m. (0). The effects of divestments/acquisitions<br />

amounted to SEK 1,165 m. (–929).<br />

Divestments/acquisitions: The divestment of<br />

Swedish car operations resulted in a positive cash flow<br />

Financial ratios related to the balance sheet<br />

<strong>2002</strong> 2001<br />

Net debt, excl. provisions<br />

for pensions, SEK m. 1 4,308 7,790<br />

Net debt/equity ratio 1 0.25 0.49<br />

Equity per share, SEK 84,66 79,98<br />

Equity/assets ratio, % 25.6% 23.4%<br />

1 With Customer Finance operations <strong>report</strong>ed according to the equity<br />

accounting method.<br />

of SEK 1,332 m. In addition, <strong>Scania</strong>’s net debt<br />

improved by SEK 220 m., since the buyer took over<br />

previous intra-Group financing. During the preceding<br />

year, cash flow was negatively affected by SEK 886 m.<br />

due to the acquisition of the Dutch sales and service<br />

company Beers N.V. (see Note 22).<br />

Financial position<br />

During the year, gross investments totalled SEK 3,025<br />

m. (1,980). <strong>Scania</strong> carried out large investments in cab<br />

production facilities. In <strong>2002</strong>, gross investments also<br />

included development expenditures of SEK 573 m.<br />

During <strong>2002</strong>, the shareholders’ equity of the<br />

<strong>Scania</strong> Group increased by SEK 936 m. and totalled<br />

SEK 16,931 m. (15,995) at year-end. Net income for<br />

the year added SEK 2,739 m, while dividends to the<br />

shareholders decreased shareholders’ equity by SEK<br />

700 m. The remaining decrease, SEK 1,103 m.,<br />

consisted of exchange rate differences that arose when<br />

translating net assets outside Sweden, as a consequence<br />

of the krona’s appreciation against the EUR,<br />

USD and local Latin American currencies. (See Note 15).<br />

The dividend for the financial year proposed by the<br />

Board of Directors is SEK 5.50 (3.50) per share.<br />

The net debt of the <strong>Scania</strong> Group, that is the difference<br />

between interest-bearing liabilities (excluding<br />

pension liabilities) and liquid assets with Customer<br />

Finance operations <strong>report</strong>ed according to the equity<br />

accounting method, amounted to SEK 4,308 m.<br />

(7,790). This was equivalent to a net debt/equity ratio<br />

of 0.25 (0.49). The sharply improved net debt/equity<br />

ratio was due to improved cash flow from operating<br />

activities as well as the payment received for the<br />

49